The IndeX Files 24-09-2019

Risk Markets Looking for Fresh Drivers

Global benchmark indexes remain muted following the September FOMC meeting. Policymakers, led by Fed chair Powell, announced a 25-basis point reduction in the headline cash rate, the second only rate cut in a decade. However, the voting split has seen reduced pricing for further rate cuts this year with three voting members voting against the rate cut. The market had been looking for one further cut this year though expectations have since fallen. As a result, USD has not weakened materially and benchmarks in the US, Europe, UK & Asia have struggled to continue higher.

While the Fed might be done easing, for now, the likelihood of further action from the ECB is helping keep the DAX underpinned near recent highs. A set of dismal PMI readings this week has shown all sectors moving further into negative territory in both Germany and the Eurozone as a whole. Some elements of the market were somewhat disappointed by the ECB’s recent announcement and with Draghi highlighting that there is room for rates to go lower yet, we could still see further easing over the coming months.

The UK remains driven by the fluctuating Brexit environment. Although the October 31st deadline is coming closer, the chances of UK PM Johnson being able to force a no-deal outcome appears to have weakened. This is helping keep UK asset prices supported. Traders are now waiting on the outcome of last week’s UK Supreme Court hearing which could also skew price action.

Trade war negotiations between the US and China remain a dominant driver of price action though have moved out of the spotlight somewhat this week. On the back of preliminary meetings between US and Chinese officials, the next round of talks is due to take place in October. For now, traders seem to be quietly hopeful that some actual progress can be made, which would be further bullish for equities.

Technical & Trade Views

DAX (Neutral, Bullish while 12125 supports)

From a technical and trading perspective. On a wider scale, Index continues to range between the yearly pivot between the 11490 level and the year R1 at 12689. While I am still looking for an eventual break of the R1 and a push higher, overdone momentum indicators suggest risk of a pullback. If the index suffers losses from here, I will be monitoring any retest of the 11822 support for bullish reversal candles to initiate long positions.

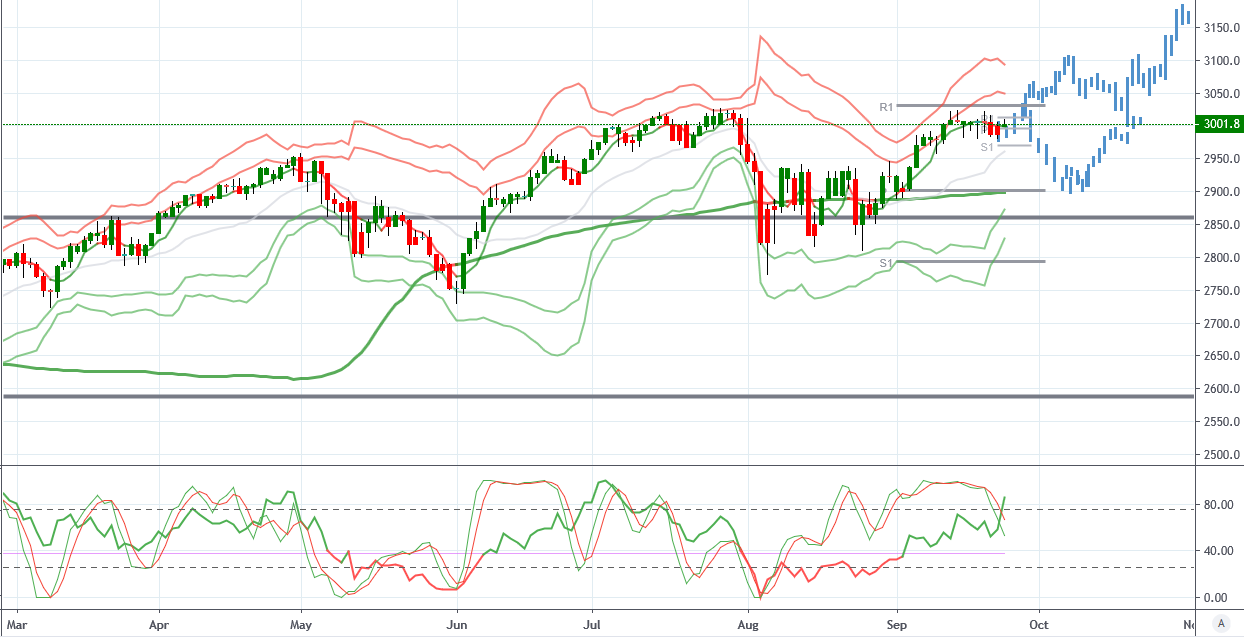

S&P (Neutral, Bullish while 2901 supports)

From a technical and trading perspective. Remains congested near recent highs. I will be looking to use a break and retest of the monthly R1 level to set fresh longs. On the other hand, momentum indicators raise the risk of a short term pullback in which case I will be monitoring support at the 2906 level for deeper long opportunities against the monthly pivot at 2901.

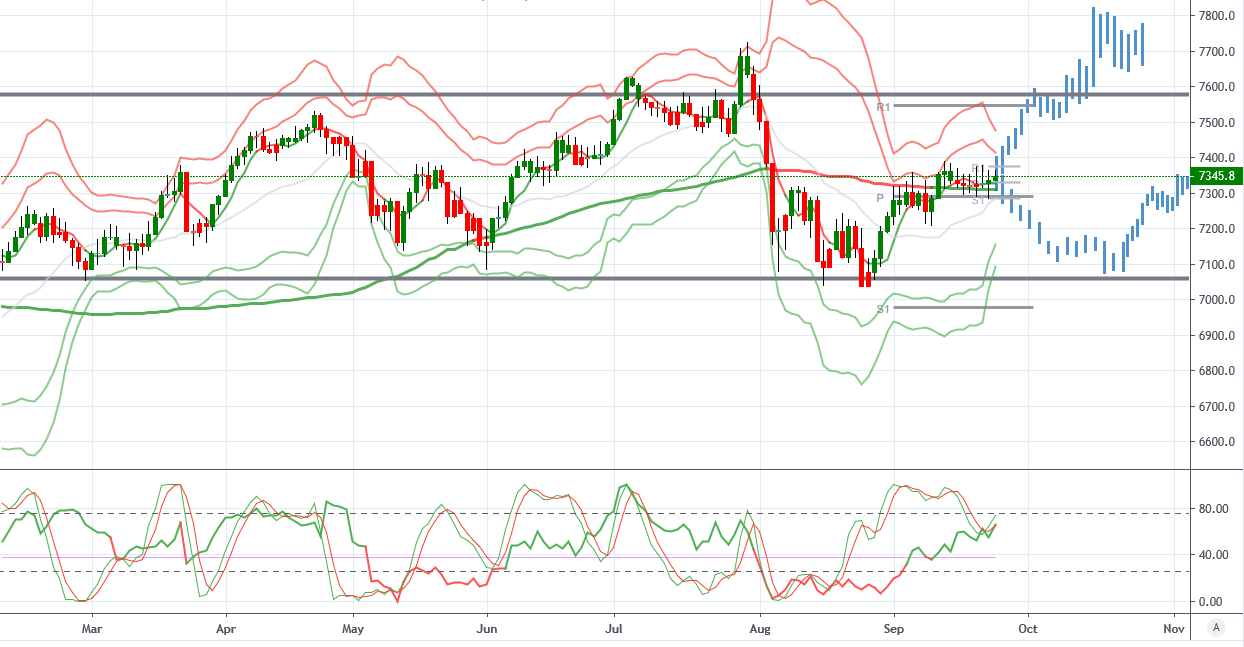

FTSE (Bullish above 7300, targeting above 7600)

From a technical and trading perspective. Congestion continues in the middle of the range between the yearly Pivot (7056) and yearly R1 (7577). VWAP continues to support a push higher to test offers into the 7577 level, for an eventual break. However, given the uncertainty in the backdrop, a pullback into the 7056 cannot be ruled out which I will be watching as a test of this base should offer long opportunities.

Nikkei (Neutral, Bullish above 21167)

From a technical and trade perspective. Offers into the medium-range bearish trend line continue to stall upside. If selling pressure creates a pullback here, I will be watching for bullish reversal candles between 21545 and 21173 for longs targeting an eventual break above the trend line. Should any pullback run deeper than 21173, we are likely to see some ranging play around the yearly pivot.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!