REAL TIME NEWS

Loading...

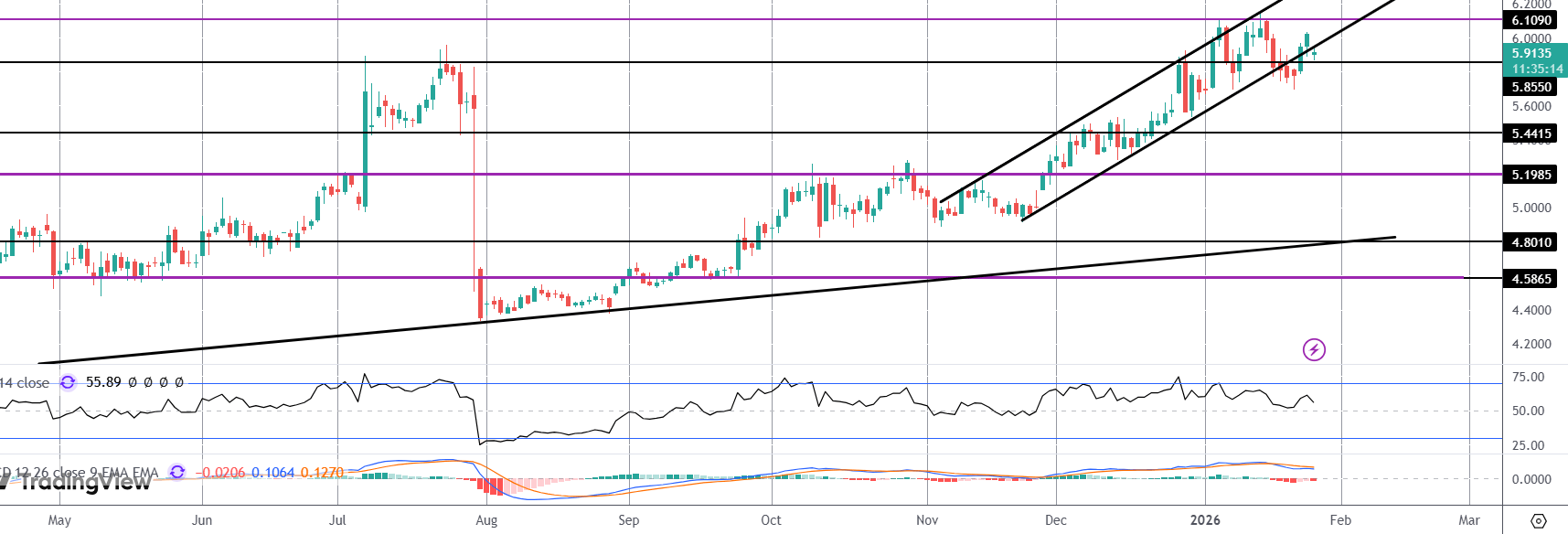

Copper Down From HighsCopper prices are on watch today after the futures market gapped lower, reversing from yesterday’s highs. The market had been pushing firmly higher, boosted by better optimism as US/EU trade war risks faded and benefiting also from a weaker US...

Copper Down From HighsCopper prices are on watch today after the futures market gapped lower, reversing from yesterday’s highs. The market had been pu

Daily Market Outlook, January 27, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Stocks extended their upward momentum for the fifth straight session, while currencies found some footing after Monday’s turbulence, as markets ...

Daily Market Outlook, January 27, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Stocks extended their upward

USD: Maintaining Short USD Bias, Monitoring Month-End RisksMarket and FX volatility is stabilising this morning following yesterday’s significant moves, marking our third-largest day on record for eFX volumes. Overall, most clients were eager to capitalise on the U...

USD: Maintaining Short USD Bias, Monitoring Month-End RisksMarket and FX volatility is stabilising this morning following yesterday’s significant move

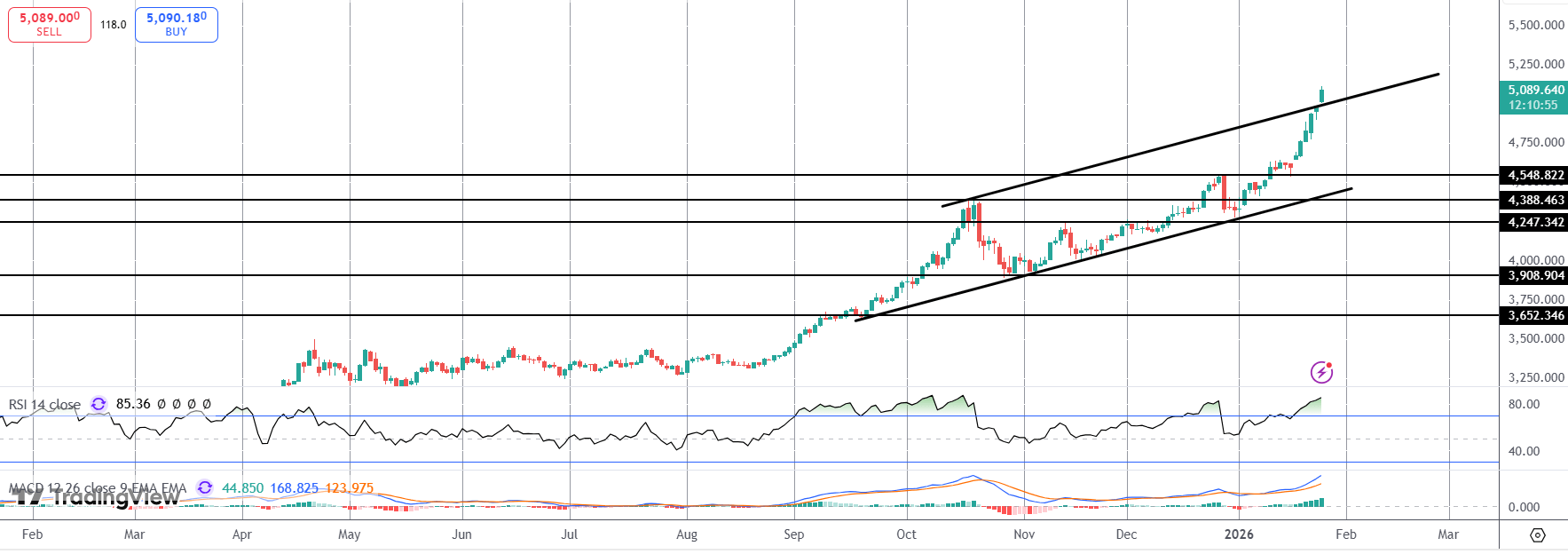

SP500 LDN TRADING UPDATE 27/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6880/70WEEKLY RANGE RES 7065 SUP 6928FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ST...

SP500 LDN TRADING UPDATE 27/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

VWAP Swing Strategy Trading Update 27/1/26In this video update, we review the latest setups and trades for the VWAP swing strategy. For access to the strategy scanner, email [email protected]://www.tradingview.com/chart/US500/V9kqL8S9-VWAP-...

VWAP Swing Strategy Trading Update 27/1/26In this video update, we review the latest setups and trades for the VWAP swing strategy. For access to the

Buy NOK, SEK, AUD, JPY. Sell EUR, GBP, USD?The US and Japanese authorities intervened in the USD/JPY market on Friday evening, triggering heightened volatility. This resulted in a sharp appreciation of the JPY and KRW, alongside another surge in gold prices, now ex...

Buy NOK, SEK, AUD, JPY. Sell EUR, GBP, USD?The US and Japanese authorities intervened in the USD/JPY market on Friday evening, triggering heightened v

USD Hanging On… For NowThe US Dollar is turning lower again today after stabilising yesterday on the back of Friday’s plunge lower. The drop on Friday, which extended into a gap lower yesterday, was fuelled by speculation of potential joint US/Japanese intervention...

USD Hanging On… For NowThe US Dollar is turning lower again today after stabilising yesterday on the back of Friday’s plunge lower. The drop on Friday

Crude Capped for NowCrude prices remain weak through early European trading on Tuesday. The market was pushing higher initially yesterday, benefiting from a weaker USD before reversing from the session highs. Over-supply concerns remain a key threat to the market w...

Crude Capped for NowCrude prices remain weak through early European trading on Tuesday. The market was pushing higher initially yesterday, benefiting

FTSE 100 FINISH LINE 26/1/26 London's stock market kicked off the week on a quiet note this Monday, as gains in metal mining stocks helped balance out losses in industrial sectors. The FTSE 100 blue-chip index and the mid-cap FTSE 250 index saw little movement...

FTSE 100 FINISH LINE 26/1/26 London's stock market kicked off the week on a quiet note this Monday, as gains in metal mining stocks helped balanc

Main driver: JPY “rate checks” and signaling risk around potential intervention (possibly coordinated Japan/US) is the dominant theme; spillover is broad USD weakness.USD bias: Staying short USD, framed as an “enduring” structural story driven by:repeated pension-f...

Main driver: JPY “rate checks” and signaling risk around potential intervention (possibly coordinated Japan/US) is the dominant theme; spillover is br

.png)