Chart of the Day Bullish GBPUSD

Chart of the Day Bullish GBPUSD

Bullish GBPUSD: GBP: UK lawmakers voted 438 to 20 in favour of holding an early election on 12 December. This would be the first election held in December since 1923. Amendments to the bill, including an alternative 9 December election date and a lowering of the voting age to 16, were earlier rejected. The bill will now go to the House of Lords for further debate on Wednesday (30 October), although this is unlikely to derail the decision made by MPs in the House of Commons. Meanwhile, Donald Tusk, who is stepping down as EU Council president at the end of November, warned that the latest Brexit delay to 31 January, 2020 "may be the last one"

USD: US consumer confidence slipped in October: The Conference Board Consumer Confidence Index slipped further to 125.9 in October (Sep: 126.3 revised), missing consensus expectations that had predicted a rebound. The Present Situation Index (based on consumers’ assessment of current business and labor market conditions) rose 1.7pts while the Expectations Index (based on consumers’ short-term outlook for income, business and labor market conditions) declined 1.9pts. Nonetheless, the Conference Board said that consumer confidence was relatively flat this month and confidence level remains high and “there are no indication that consumers will curtail their holiday spending” Focus shifts to this evening's FOMC rate decision and press conference, with markets primed for another 25bps cut priced in, the main focus will be on forward guidance given during FED Chiefs Powell press conference.

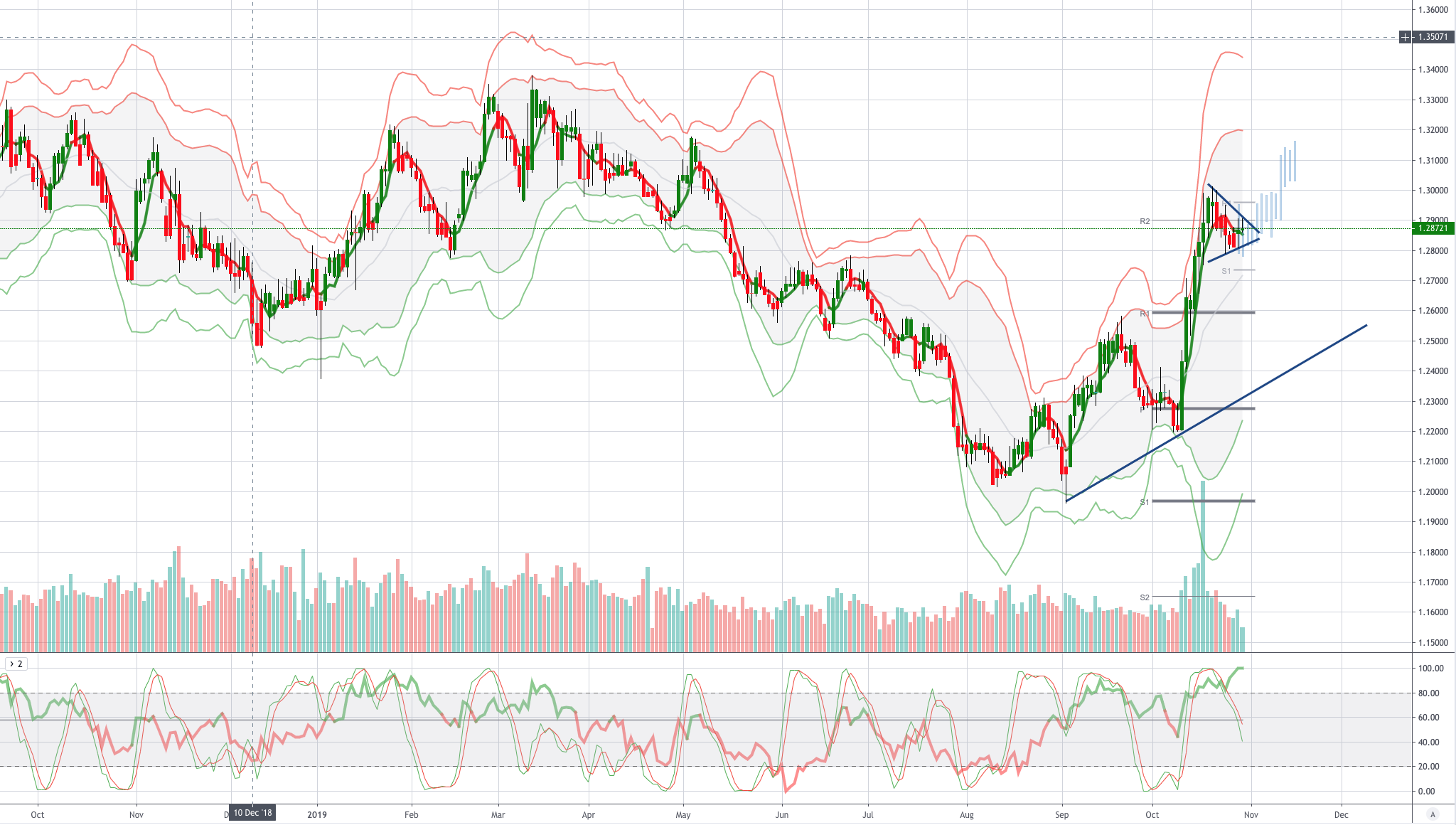

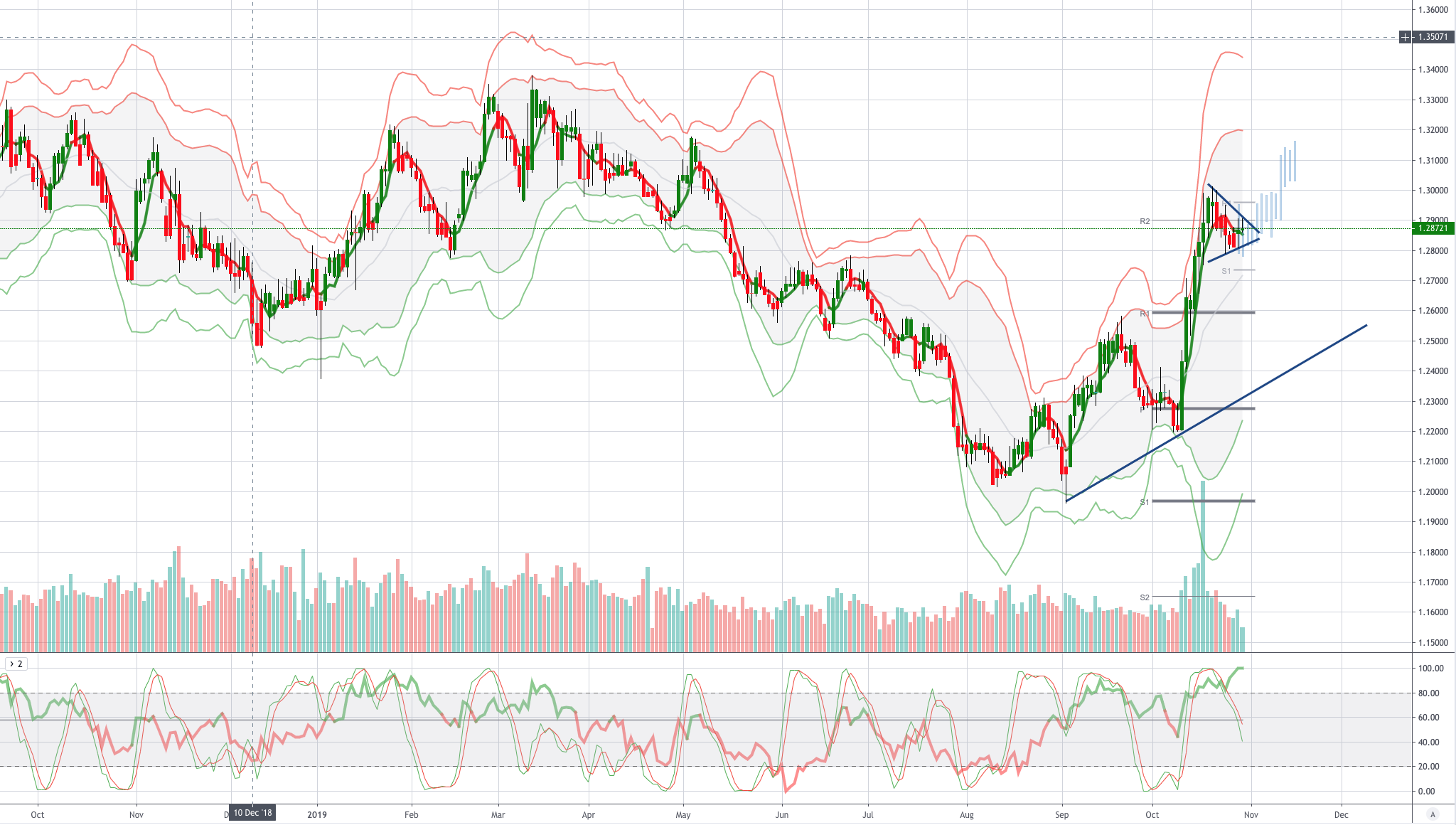

From a technical and trading perspective the GBPUSD is potentially forming a bullish symmetrical triangle and working on a time based correction versus Octobers shift higher. A sustained break of 1.29 will portend a continuation pattern with bulls sited set on stops above 1.30, as these are eroded, offers towards 1.32 will be the next major test for the GBP advance, I would anticipate that this area will likely see price correction. Only a breach of 1.28 would negate this view and open a deeper correction to test bids towards 1.26.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!