Bitcoin Drifts From Highs on Trade Uncertainty

Bitcoin Turning Lower

Following a breakout move to fresh all-time highs last week, Bitcoin prices have drifted lower this week with BTC futures down around 6% from those highs. Across that push to new highs Bitcoin trading saw record volume with the market recording around $3.4 billion in open interest. Institutional interest has been a major driver of this surge in volume with BTC ETFs seeing a strong 10-day streak of net-inflows amidst news that Trump Media is planning a private Bitcoin treasury with a $2.5 billion offering.

Bitcoin & BOE

While pro-Bitcoin sentiment has been on the rise over the last year in the US, we’re now seeing similar interest on the other side of the pond. Nigel Farage, leader of Reform UK has noted that the party will now accept donations in Bitcoin, echoing the moves made by Trump over his presidential campaign. Similarly, Farage has said that (if in power) he will make the Bank of England hold Bitcoin in its reserves.

US Trade Talks

For now, however it seems that Bitcoin is taking its cues from the broader risk tone as investors react with uncertainty to recent trade developments. An appeals court yesterday granted the White House a temporary suspension of the federal court ruling against Trump’s trade tariffs thwarting optimism that tariffs would be ended. This came as the same time as US treasury secretary Bessent noted that trade talks between the US and China have stalled. While this remains the case, BTC has room to drift lower as traders await a fresh breakthrough between the US and China.

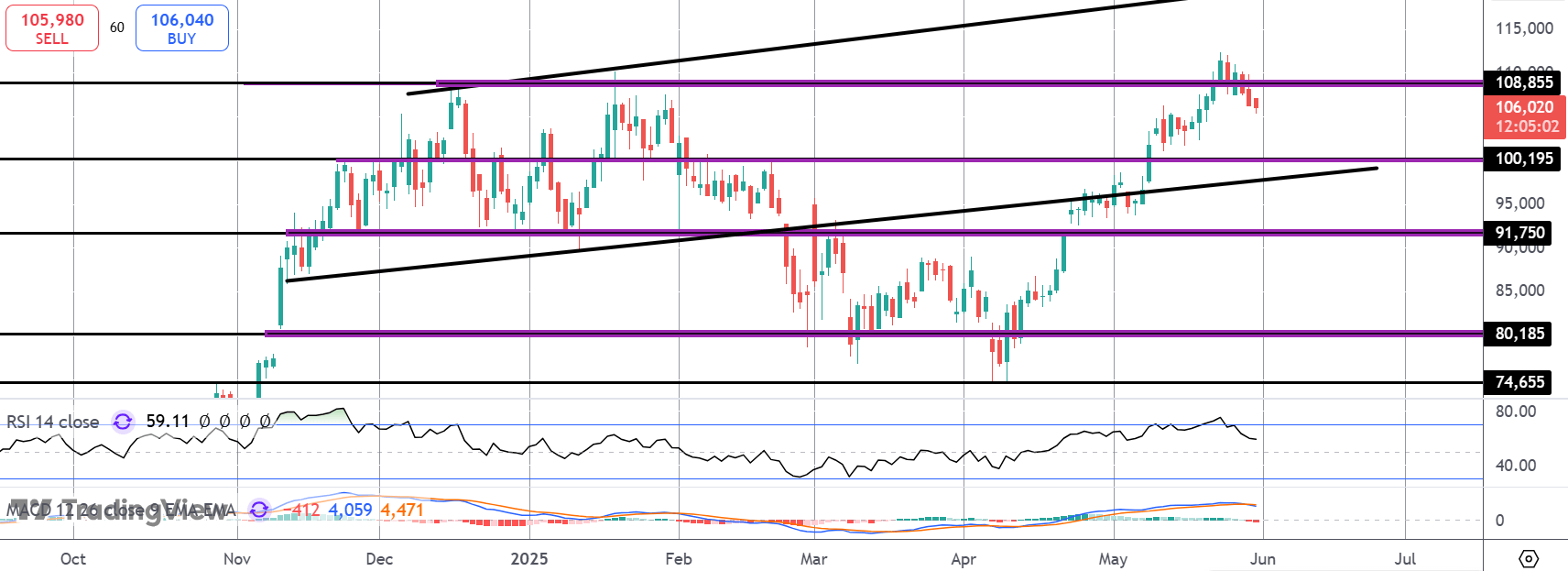

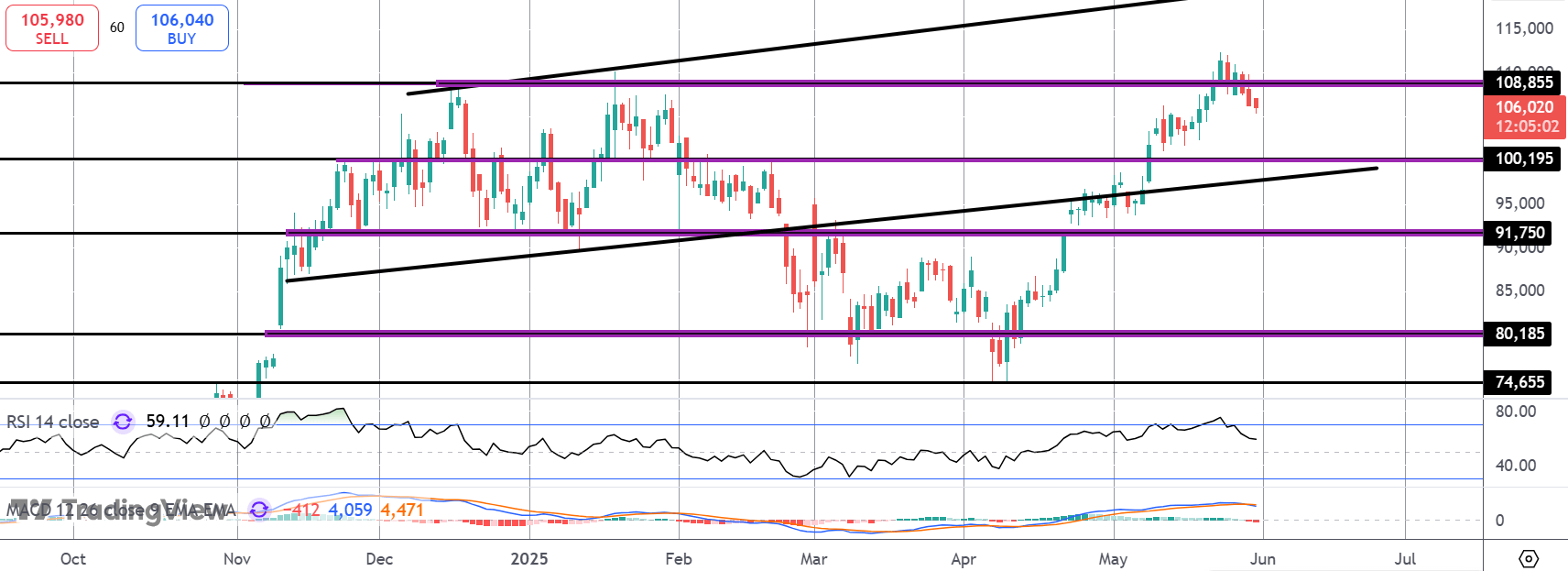

Technical Views

BTC

The latest failure at the $108,855 level risks a deeper correction lower in BTC. With momentum studies turning bearish, focus is on a test of support at the key $100k mark. Bulls need to defend this area to keep the broader bull outlook in focus or risk a test of deeper support at the $91,750 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.