BOE Slashes Rates As London Avoids Lockdown

London Avoids Lockdown

It was a strange day in the City yesterday as many were expecting the PM to announce a 15 day shutdown in London. Media reports had been pointing towards such an announcement all week, citing source comments from within government.

However, during the PM’s daily briefings, such a lockdown was not announced and the PM simply advised the UK public to continue “social distancing”. There has been growing criticism of the way in the which the outbreak has been handled, especially in London which accounts for nearly half of all UK COVID-19 cases. The UK PM advised the UK that the situation can be “turned around” in 12 weeks. However, with pubs, restaurants and many transport links in and out of the capital still open, the spread of the virus looks set to worsen.

In other highly infected areas, lockdowns have already been announced such as in China, Italy, Spain, France and more recently the US where major cities have been locked down. However, the UK has yet to formally announce any such measures despite the WHO slamming the government’s response as “irresponsible” and “complacent”.

BOE Cuts Rates & Announces QE

While the PM failed to address the situation in a convincing way, the Bank of England took further decisive action this week. The BOE announced fresh measures this week in a bid to support the UK economy during the ongoing disruption from COVID-19. On the back of the BOE’s recent .5% rate cut, a further reduction was announced yesterday, taking rates down to record lows of 0.10%.

Along with the rate cut, the BOE also announced a £200 billion increase in bond purchases via the new Term Funding Scheme. The decision to add to the bank’s QE program, alongside a move to record low rates, highlights the growing concern for the UK economy. The BOE’s new governor Andrew Bailey explained that the adjustments were designed “to meet the needs of UK businesses and households in dealing with the associated economic disruption”.

All eyes will now be on the government in coming weeks as the threat of a lockdown in the UK. Should conditions worsen and a lockdown be announced, the situation is likely to become more complicated for the BOE. In terms of forward guidance, the new BOE chief warned that “nothing is off the table”.

Technical Views

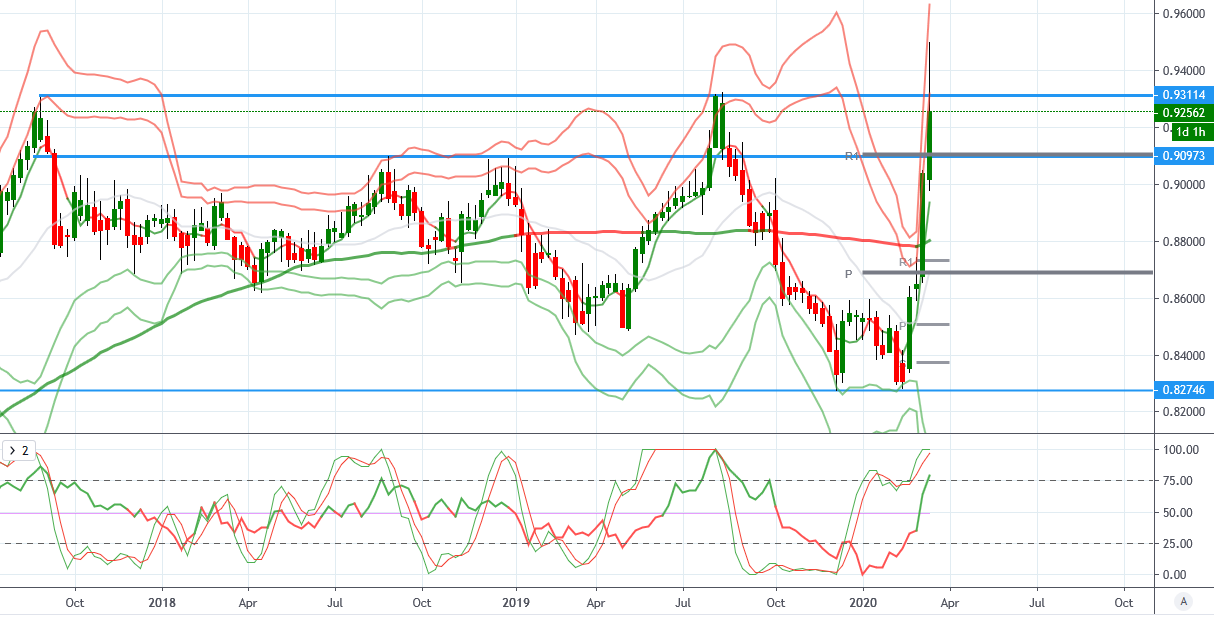

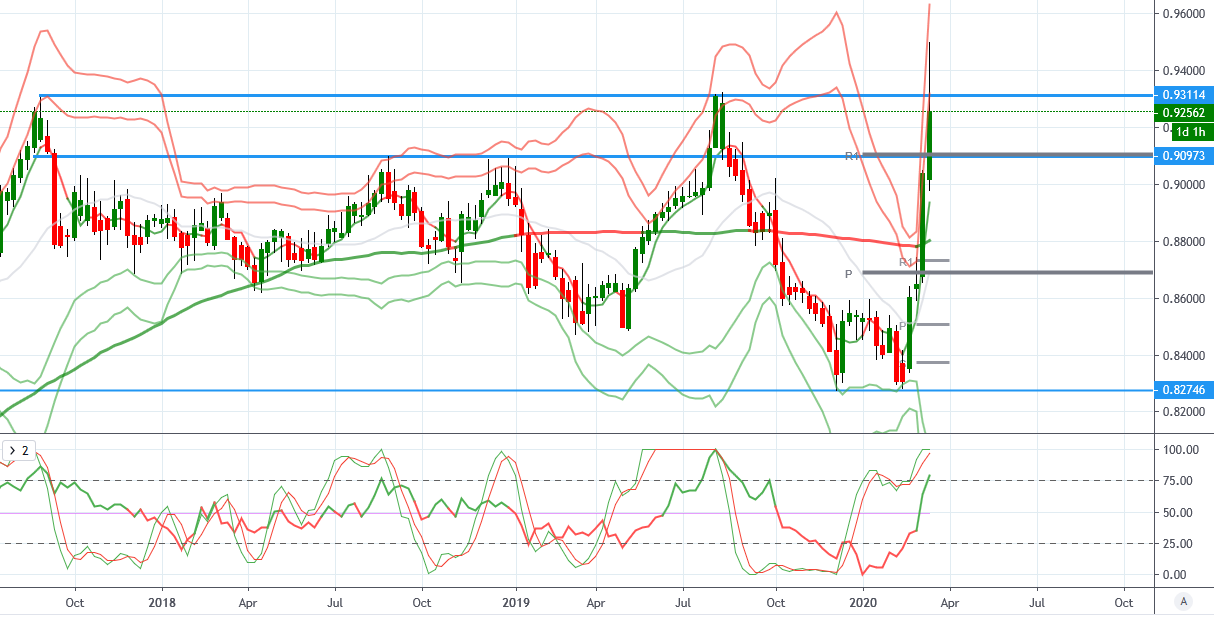

EURGBP (Bullish above .91)

From a technical viewpoint. EURGBP has tested a major, multi-year level this week with price piercing above the .9311 level before reversing to trade back below. Price is well extended, sitting firmly above the yearly R1 at .91 and, with momentum studies stretched to the topside, further recovery lower could be seen. However, the retest of the .91 level will be key and if that level holds as support, bias will remain skewed to the topside.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!