Chart of the Day CADJPY

Chart of the Day CADJPY

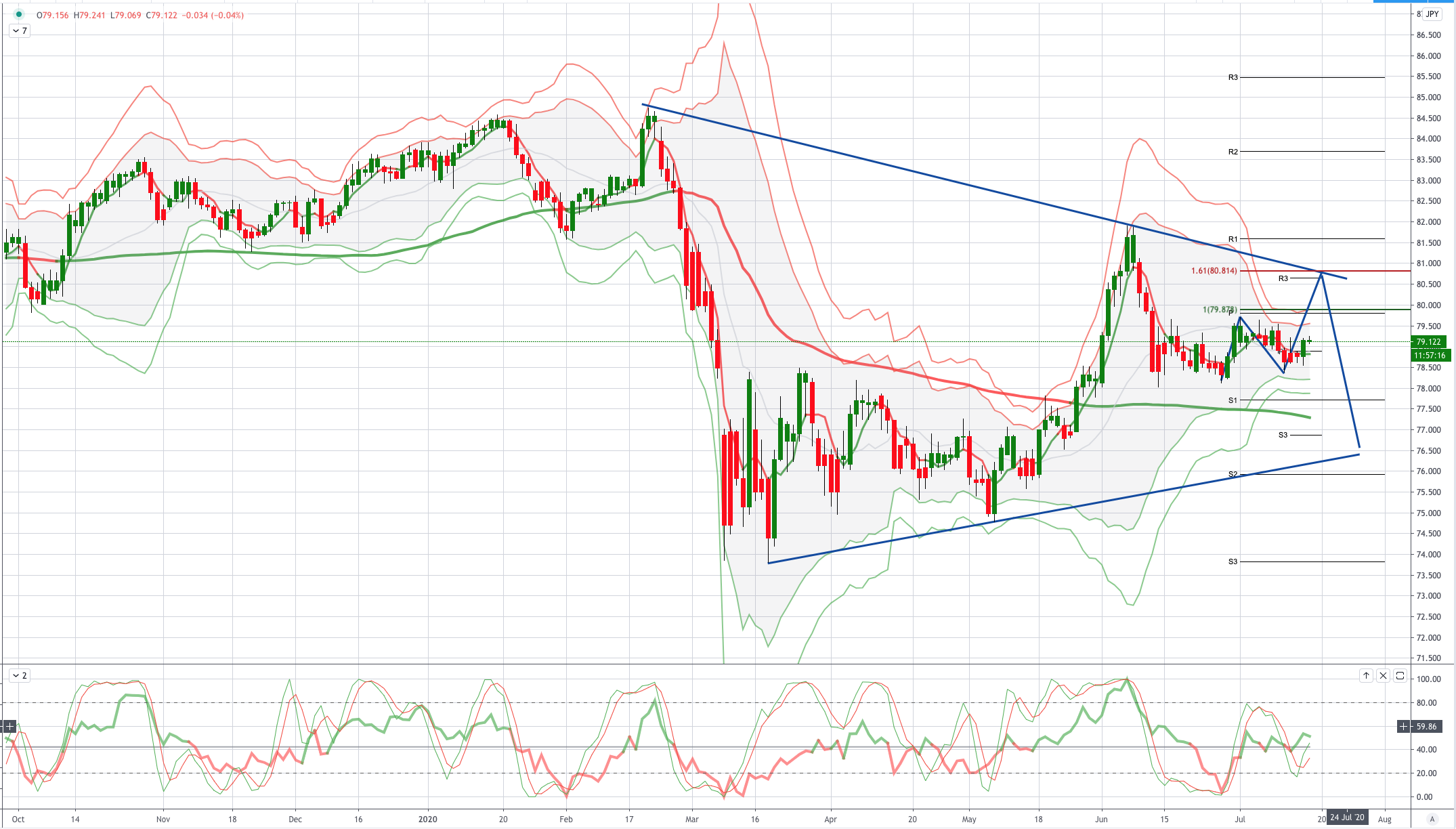

CADJPY Potential Reversal Zone - Probable Price Path

While US equities chop around recent highs, Chinese equities have been hit hard overnight, extending this week’s reversal and down ~7% from Monday’s peak. This comes despite a strong 11.5% rebound in Q2 GDP following the Q1 drop. However, while the June data showed a 4.8%y/y rise in industrial production, retail sales was down 1.8%y/y, and this might be what is worrying the equity market – probably along with continued rising geopolitical tensions against China. In Australia the unemployment rate rose to 7.4% in June (7.1% in May) but employment grew by a larger-than-expected 211k. Meanwhile, the UK unemployment rate was unchanged at 3.9% in the three months to May as the government’s support scheme helped stem off a rise. Employment fell by a smaller-than-expected 125k, jobless claims by 28k in June

CAD: The Bank of Canada held its key rate at 0.25% and signaled rates won't be raised again until 'at least 2023,' and until unemployment returns 'closer to pre-pandemic levels' and inflation 'returns substantially' to the 2% target. BoC Governor Macklem said it will be a 'long climb back' for Canada's economy, the central bank 'will look for signs the recovery is self-sustaining,' and 'rates won't move until the output gap closes.' Looking ahead, we get Canada ADP employment, and the US reads in the form of retail sales, initial jobless claims, the Philly Fed, and business inventories. We also get appearances from Fed’s Williams and Evans.

JPY: Bank of Japan's interest rate meeting was in line with expectations. Hedging demand is expected to continue around JPY performance. The Bank of Japan kept interest rates and debt buying plans unchanged, emphasizing that it can increase the purchase of assets if necessary, and it is estimated that the economy will fall by 4.7% in this fiscal year. Governor Kuroda pointed out that the epidemic has brought a heavy blow to the economy, and it will take some time to restore the original appearance, and at the same time warned that the epidemic will continue to hit the service industry.

From a technical and trading perspective, the CADJPY appears to be in a bullish consolidation pattern, the higher time frame Volume Weighted Average Price is bullish and yesterday's outside reversal pattern has now flipped the daily chart bullish. The VWAP bands are contracting suggesting the potential for an expansion move, as such bullish exposure should be rewarded on a breach of overnight highs, initially targeting the equality objective at 79.87 enroute to a test of descending trendline resistance and the 1.618 extension at 81.80. A closing breach of the daily VWAP 78.80 would invalidate the bullish thesis opening a retest of 78.00

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!