Chart of The Day NZDUSD

Chart of the Day NZDUSD

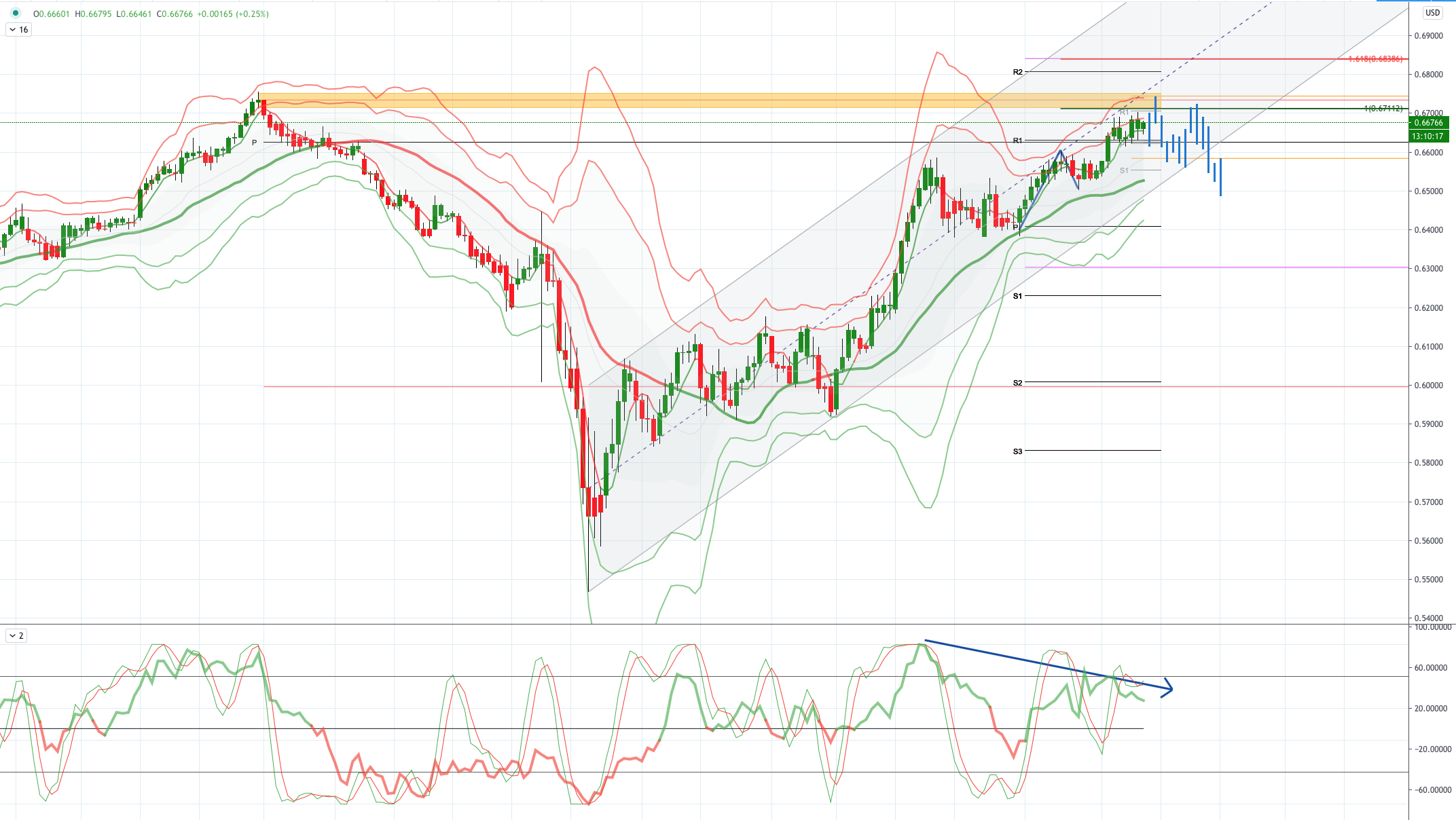

NZDUSD Potential Reversal Zone - Probable Price Path

Global risk appetite may stay restrained ahead of the FOMC meeting decision, albeit the Fed’s early decision to extend for 3 months its key emergency programs that were due to expire at end of September. Meanwhile, Congress continued to haggle over the next fiscal stimulus package with Senate Republicans proposing a $1tn plan while Democrats are more ambitious. The S&P500 slipped 0.65% in a choppy session on the back of weaker than expected earnings from McDonalds, 3M Co and Harley-Davidson, whereas Pfizer rose on hopes of higher earnings forecasts and a later-stage vaccine trail, and Starbucks rose aftermarket as sales fell less than expected. VIX also rose to 26.08. The UST bonds bull-flattened with yields lower by 1-4bps and the 10- year bond yield at 0.58% as the 7-year auction stopped out at a record low of 0.446%.

NZD: New Zealand suspends the extradition agreement with Hong Kong, the market is worried about the deterioration of New Zealand and China relations. The Chinese Consulate in New Zealand stated that it firmly opposes New Zealand’s suspension of the extradition agreement with Hong Kong and urges New Zealand to stop interfering in China’s internal affairs so as not to further damage China-New Zealand relations.

USD: For the FOMC meeting, since they have extended the emergency programs early, there is very subdued expectations for any tweaks to their policy settings at this juncture, but more clarity on their economic assessment and policy direction, including explicit policy guidance and even yield curve control, will be key.

From a technical and trading perspective, the NZDUSD is close to testing the pivotal .6710/50, it is noteworthy that there is a distinct momentum divergence developing, as such bears should watch for bearish reversal patterns in this potential reversal zone, if sufficient supply is seen here bearish exposure should be rewarded, beas will look for an initial test of ascending trendline support at .6560, this level will likely support for a retest towards highs before the third wave of the pullback sets up a test of symmetry swing support to test .6500. A close through .6750 would negate the corrective thesis setting up a test of .6838 as the next upside objective.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!