Covid-19 Incidence Rate in the UK hit an All-time High. What’s Next?

Stock markets continue to feel unwell as signs that some governments are restoring social restrictions curb risk appetite and raise fears of downturn due to the second wave of COVID-19.

Despite active resistance from bulls, the SPX futures touched 3200 points yesterday, an outpost of growth that formed in August, having also tested the 100-day MA. In addition to the fact that there is nothing to base the rally on, sell-side news continues to hit the wires such as decisions of the governments of EU, UK, and United States to bring back lockdowns albeit in softer form.

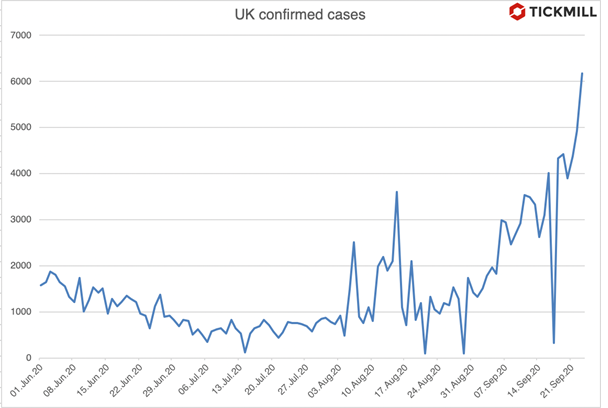

Covid-19 incidence in the UK hit an all-time high:

Thursday remarks of the Fed officials was quite unusual because of sharp division in expectations and forecasts. For example, the head of Boston FRB Rosengren mentioned thigh risk of the second wave in the fall and winter, so Congress should agree on fiscal assistance as soon as possible. His colleague, St. Louis Fed President Bullard, downplayed the risk of a new outbreak, stating that advances in treatment, reduced mortality, and increased vigilance in people at risk could lead to a milder second wave, allowing the economy to continue to expand. Bullard believes that inflation will reach 2% as early as next year, which is one of the most aggressive forecasts among his colleagues.

The head of the Central Bank Powell repeated his mantra that the Central Bank has done everything necessary and now Congress must act.

The chances of a quick deal in Congress are slim, but pressure from the Central Bank, and especially the threat of a second wave, could force senators to move. As we understand, this will take time and a slightly more negative development of events with the virus, so before there a reason for equities rally will appear, deeper correction may be necessary.

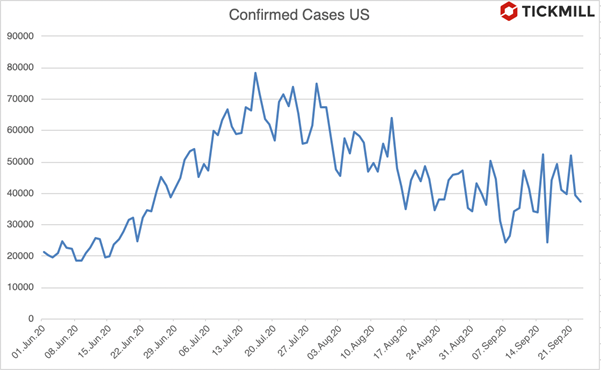

Covid-19 confirmed cases in the US show signs of acceleration starting from September:

As for the Euro, the risk is brewing that the ECB, following the Fed, will begin to revise the concept of inflation targeting. ECB member Villeroy hinted on Friday that a symmetric inflation target should be considered instead of “below or 2%” target. In practice, this means that the ECB may not react to accelerating inflation for a longer time (i.e. same lower-for-longer stance as in the Fed). Clearly ECB transition to a new inflation target hasn’t been priced in the euro yet, therefore there is a growing risk that EURUSD will go lower on these if ECB will start to provide more information on this matter. Against the backdrop of a strong dollar, the currency pair is eyeing the 1.15-1.1550 zone.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.