Asia stock market stay mixed after a mixed U.S. session. US Treasuries yields steady after U.S. manufacturing PMI posted upside surprise, which helps improve the mood.

After a slew of under performance from the Eurozone PMIs, which intensify the global growth concern, the market sentiment is slightly saved by a robust U.S. PMI reading. The most recent Purchasing Managers’ Index (PMI) survey from IHS Markit showed that U.S. manufacturing, which is closely tied to engineering and industrial production, came in better than expected for September, hitting a new five-month high. Manufacturing sector activity scored 51.0—up from 50.3 in August and beating out the consensus estimates of 50.4. Elsewhere, Fed Bullard says that the FOMC may choose to provide additional accommodation going forward, but decisions will be made on a meeting-by-meeting basis. This brings no surprise to the market due to his hawkish stance for monetary policy for long.

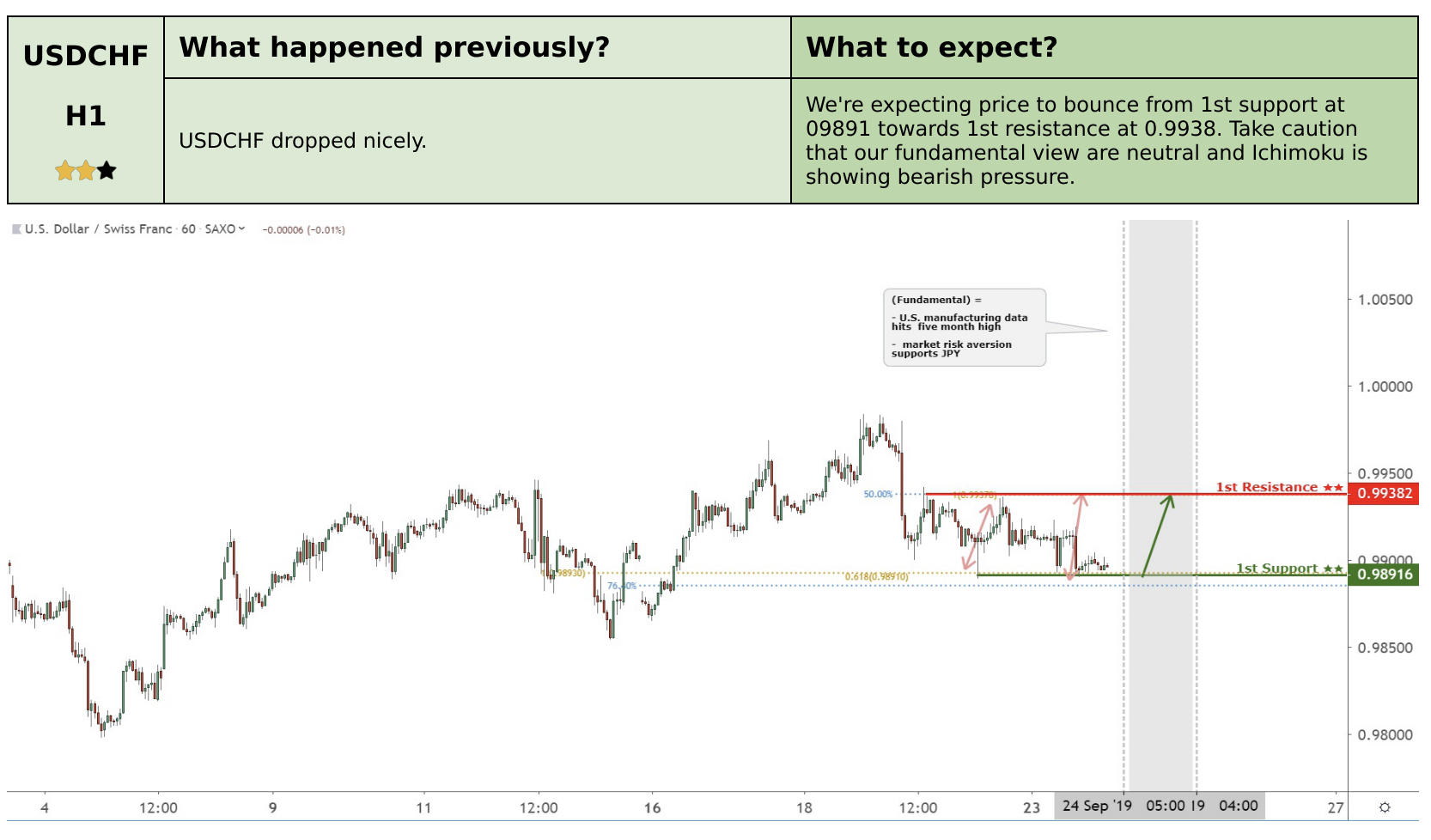

USDCHF

Technical Analysis:

Fundamental Analysis:

USDCHF | Bullish ↑ | ★☆☆

24 Sep: CHF benefited from the gloomy growth in the Eurozone. The flash eurozone manufacturing purchasing managers index fell to an 83-month low of 45.6 in September, down from 47 in August.German manufacturing PMI fell to 41.4 in September from 43.5, the worst reading in more than a decade.The flash eurozone services PMI fell to an 8-month low of 52 from 53.5 in August, which was below the 53.2 reading expected by economists. The downturn in the manufacturing has split over to the services sector, which dampens the concern. As the risk aversion hovers in the Eurozone, CHF is likely to strengthen further.

NZDUSD

Technical Analysis:

Fundamental Analysis:

NZDUSD | Neutral | ★☆☆

24 Sep: The Kiwi rebounded strongly yesterday, gaining back some of the drop from last week. The fact that there weren't many macroeconomic data releases from NZ or major developments surrounding the US-China trade talks last week suggests that the strong bounce on the Kiwi yesterday was that the technical correction in price has been a long time coming. Tomorrow would be an extremely important day for the NZD as the RBNZ will announce it's interest rate decision and also release it's monetary policy statement at the same time. Market expects to see yet another rate cut, despite the 50 bps cut back in August. We turn neutral for now on the Kiwi.

USDCAD

Technical Analysis:

Fundamental Analysis:

USDCAD | Neutral | ★☆☆

24 Sep: The price action of CAD overnight could be described as "Moving alot, yet going nowhere". The CAD has has been a strong sideways range against the US Dollar. While the Loonie has been mirroring the swings in oil prices, it could possibly start to switch its rhythm to follow that of Canada's central bank. Even though yesterday's wholesale sales data release, which measures consumer spending, came out better than expected, the movement of the CAD was muted. We remain neutral on the CAD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.