Daily Market Outlook, February 29, 2024

Munnelly’s Market Minute…

“Markets Focus Shifts To US PCE Data Ahead Of Month End”

Equity markets in China are higher, while elsewhere in the Asian region they are more mixed. The Japanese Yen outperformed after a Bank of Japan board member hinted at a possible end to negative interest rates. Overnight the latest PMI indices for China will be of interest, reflecting ongoing concerns about the world’s second-largest economy. Chinese markets have experienced a significant upswing this month, outperforming global stocks by a considerable margin. This surge is attributed to a series of measures enacted by the government aimed at bolstering market confidence. Markets are optimistic and expect further support measures to be announced during the upcoming National People's Congress meeting.

UK Economic Outlook: The February Lloyds Business Barometer survey indicates a positive outlook for the UK economy despite a slight dip in overall confidence. Staffing level expectations are the highest in nearly two years, signaling optimism for future output. January money supply and bank lending data are expected to show a slight pickup in mortgage approvals, suggesting a tentative stabilization in the housing market.

Eurozone Inflation: European markets await tomorrow’s Eurozone flash CPI inflation estimate for February. National releases today from Germany, France, and Spain show a decline in EU-harmonized headline inflation rates.

US Data Focus: Yesterday's Q4 GDP for the US was revised down marginally but still reflects strong annualized growth of 3.2%. Today's focus is on the release of the January PCE deflator, the Fed’s preferred inflation gauge. PCE inflation is expected to show larger monthly rises compared to previous months but may still support Fed policymakers’ caution in loosening policy.

Overnight Newswire Updates of Note

BoJ Board Member Signals Exiting Negative Interest Rate Policy Is Closer

Japan Retail Sales Beat Expectations In Jan, Industrial Production Slides

RBNZ’s Orr Says RBNZ Rejected Hike As Data Show Inflation Slowing

Australian Treasurer Chalmers Warns Over Weak Economic Growth

US Lawmakers Strike Deal To Avoid Imminent Government Shutdown

Fed Officials Emphasize Data To Guide Pace Of Interest-Rate Cuts

ECB’s Nagel: Need To Stay The Course Until More Comforting Wage Data

BoE’s Mann: Wealthy Britons’ Spending Habits Make It Harder To Curb Inflation

UK Chancellor Hunt Considers Scrapping Non-Dom Tax Status At Budget

HP Q1 Revenue Declines At Lower Rate As Market Appears To Stabilize

Justice Department Looking Into Boeing Midair Door Plug Blowout

Disney, Reliance Sign $8.5 Bln Deal to Merge India Media Operations

Alibaba Unveils Big Cloud Price Cuts As AI Rivalry Intensifies

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0860 (EU1.42b), 1.0900 (EU1.37b), 1.0855 (EU932.4m)

USD/JPY: 141.50 ($885.9m), 150.00 ($563m), 144.55 ($490m)

AUD/USD: 0.6820 (AUD668.6m), 0.6550 (AUD474.2m), 0.6510 (AUD440m)

USD/CAD: 1.3545 ($518.7m), 1.3080 ($480m), 1.3430 ($413.2m)

USD/CNY: 7.2000 ($1.54b), 7.3000 ($1.28b), 7.4000 ($488.4m)

USD/BRL: 5.0000 ($1.47b), 4.8500 ($966m), 4.7500 ($699m)

NZD/USD: 0.6150 (NZD350m), 0.6200 (NZD309.6m)

USD/MXN: 17.26 ($591.9m)

USD/KRW: 1475.00 ($309.3m)

Credit Agricole’s month-end rebalancing model indicates that there will likely be moderate USD selling across the board, with the strongest sell signal for USD vs CAD and AUD. Our corporate flow model suggests EUR selling at the end of the month. Therefore, we are using the signals from the standalone month-end rebalancing model for our combined strategy. They have entered a trade to sell the USD against a weighted basket of G10 currencies and intend to hold the position until 29 February at 17:00 GMT, unless stopped out of the trade.

CFTC Data As Of 20/02/24

Japanese Yen net short position is -120,778 contracts.

British Pound net long position is 46,312 contracts.

Euro net long position is 68,016 contracts

bitcoin net short position is -2,098 contracts.

Swiss Franc posts net short position of -9,923 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.027 contracts to 947,280.

Equity fund speculators increase S&P 500 CME net short position by 35.358 contracts to 419,832.

Technical & Trade Views

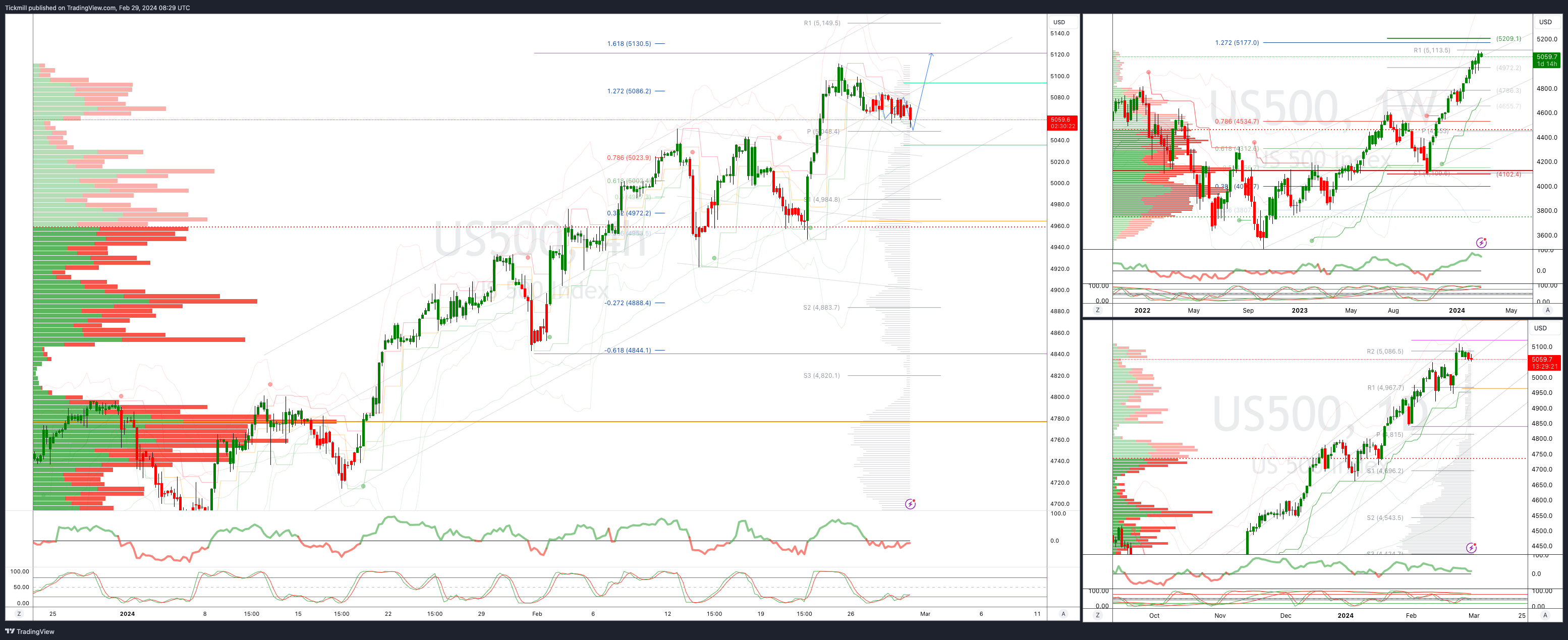

SP500 Bullish Above Bearish Below 5040

Daily VWAP bearish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 4940

Primary objective is 5120

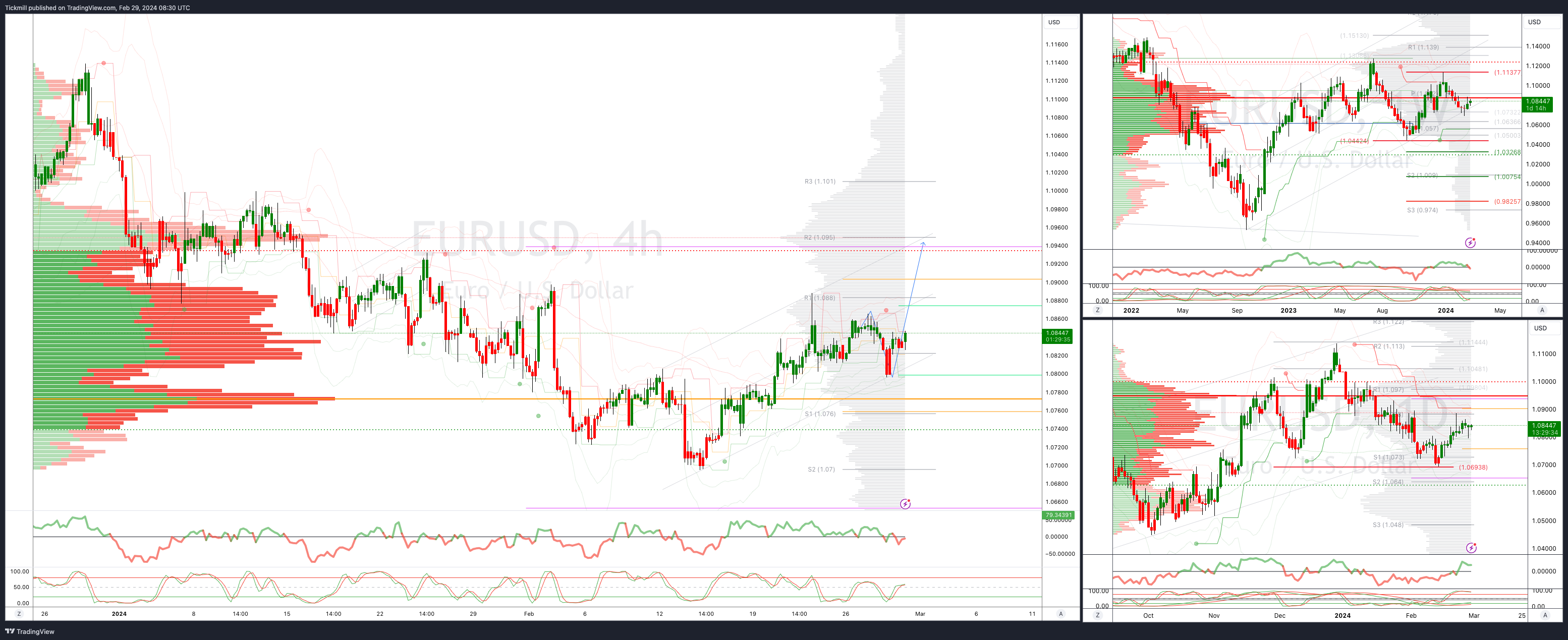

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

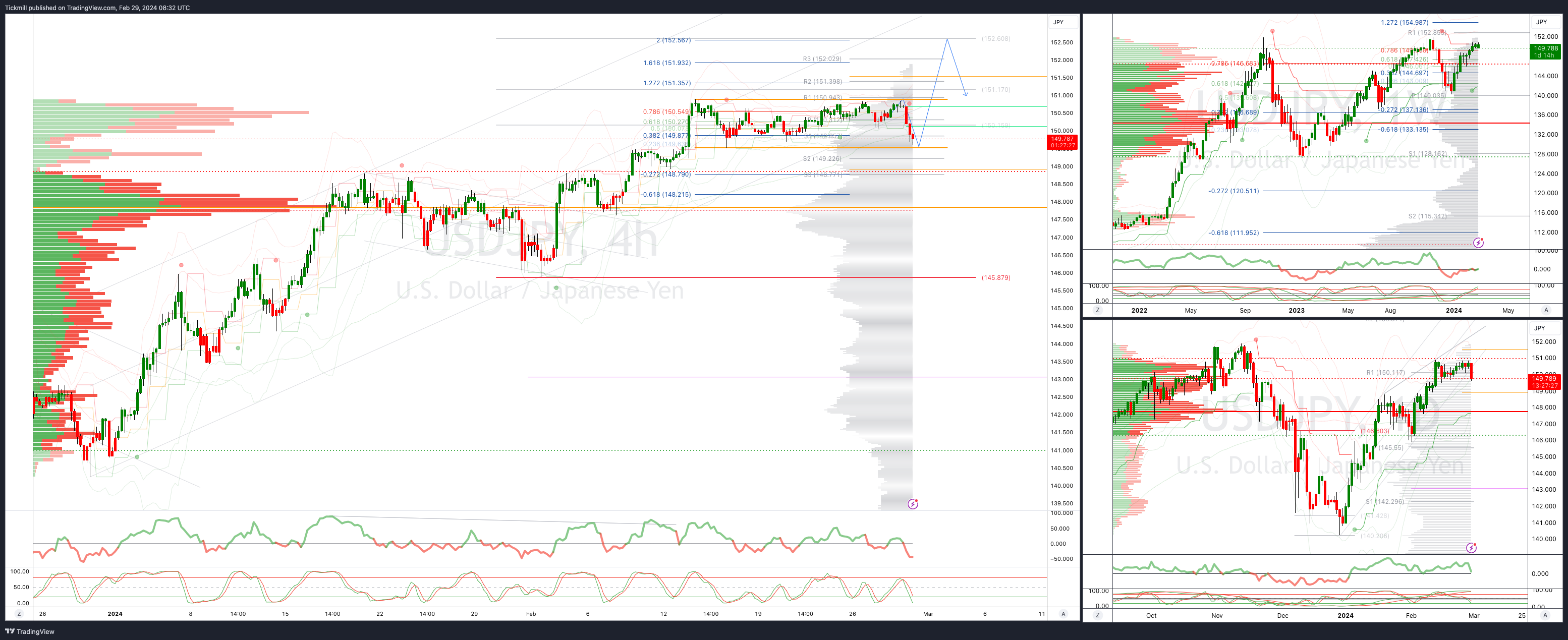

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6440

Primary objective is .6700

BTCUSD Bullish Above Bearish below 58400

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 50000

Primary objective is 66000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!