Daily Market Outlook, July 12, 2023

Daily Market Outlook, July 12, 2023

Munnelly’s Market Commentary…

Asian equity markets exhibited a mixed performance as investors maintained caution ahead of the release of key US inflation data. The Nikkei 225 in Japan declined below the 32K handle. This underperformance was influenced by a stronger Japanese yen, as the USD/JPY currency pair retreated below 140.00. Additionally, disappointing Machinery Orders data also contributed to the negative sentiment. The Hang Seng Index in Hong Kong increased by 1.2%, benefiting from strength in the technology sector. However, the Shanghai Composite Index experienced a slight decline of 0.1%. Despite stronger-than-expected loans and aggregate financing data from China, the mainland market remained cautious due to upcoming key events and uncertainties.Investors in the region were particularly cautious ahead of the release of US inflation data, which is considered a key risk event. Inflation data can significantly impact market sentiment and influence central bank decisions regarding monetary policy.

UK investors will focus on Bank of England Governor Bailey who will hold a press conference to discuss the recently released Financial Stability Report. Market participants will be particularly interested in any comments regarding the interest rate outlook, especially in light of the recent acceleration in wage growth reported in the employment market statistics. There will also be a focus on any new information regarding the impact of interest rate increases. The report highlights the changing dynamics of the mortgage market and warns of a sharp rise in mortgage repayments. However, it also states that banks are well-positioned to support their customers.

In Canada, the Bank of Canada will provide an update on monetary policy. In June, the central bank raised rates for the first time since January, ending a two-meeting pause. Market expectations are for another 25 basis point hike, and investors will be watching for any indications regarding the timing of a potential second pause.

Stateside, oday's US Consumer Price Index (CPI) report for June is expected to show a further decline in annual headline inflation. The forecast suggests a sharp slowdown to 3.1% from 4.0% in May. This drop is anticipated and is primarily attributed to the comparison with energy prices from the previous year. Core inflation, which excludes volatile food and energy prices, is projected to have decreased more modestly to 5.1% from 5.3%. The relative stability of core inflation could be a concern for Federal Reserve policymakers, particularly considering the tight labour market. It will be interesting to observe any reactions from Fed officials ahead of this weekend's blackout period for Fed commentary, although indications suggest that the data will not derail their intention to raise rates at the July meeting. Several speakers scheduled to address various topics following the release of the US inflation data. Fed's Barkin (2024 voter) is expected to address the topic of inflation. Given the release of the CPI data, Barkin will likely provide insights into the current inflationary environment and its implications for monetary policy. Kashkari (2023 voter) will address banking solvency and monetary policy, Bostic (2024 voter) will provide commentary on financial payments while Mester(2024 voter) is slated to speak at a FedNow event.

CFTC Data As Of 07-07-23

USD net spec short pared in Jun 28-Jul 3 period, $IDX +0.58% in period

EUR$ -0.77% in period, specs -2,191 contracts into dip, now +142,837

$JPY +0.3% in period, specs -5,050 contracts on diverging rates now -117,920

GBP$ -0.29%, specs -1,729 contracts, now +50,265; less-dovish Fed lifts USD

$CAD +0.21% specs +7,374 contracts flip position to +4,527

AUD$ +0.09% in period, specs -5,158 contracts now -44,582

BTC +0.5% in period specs +18 contracts now short 2,076 contracts(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900 (698M), 1.0950 (776M), 1.0985-1.1000 (1.6BLN)

USD/CHF: 0.8855 (290M), 0.8900 (465M)

GBP/USD: 1.2865 (294M). EUR/GBP: 0.8600 (302M)

AUD/USD: 0.6675 (305M), 0.6780 (294M)

NZD/USD: 0.6200 (251M), 0.6240-45 (396M)

USD/JPY: 141.00 (466M). EUR/JPY: 156.00 (890M)

Implied volatility remains well supported, particularly in high beta currencies such as the Japanese yen (JPY) and the Australian dollar (AUD). High beta currencies tend to exhibit larger price swings compared to other currencies, reflecting their sensitivity to market factors.

Overnight News of Note

Asian Stocks Mixed, Kiwi Gains Even As RBNZ Holds

New Zealand Keeps Rates On Hold As Weak Economy Damps Inflation

RBA To Cut Number Of Meetings That Set Interest Rates To 8 A Year

Australia Treasurer To Finalise RBA Governor With Cabinet ‘Soon’

China Expected To Ramp Up Fiscal Stimulus In Effort To Boost Economy

N.Korea Fires Long-Range Missile After Threat To US

Four Regional Fed Boards Sought Quarter-Point Discount Rate Hike in June

NZD/USD Sticks To Gains Above 0.6200 Mark, Moves Little After RBNZ

Dollar Slides Ahead Of US Inflation Data, Sterling Hits 15-Month Peak

FTC Leaning Toward Appealing Microsoft-Activision Loss

EU To Green Light Broadcom's VMware Deal On Wednesday, Source Says

Illumina Braces For Record EU Fine Over Closing Unapproved Deal

IBM Mulls Using Its Own AI Chip In New Cloud Service To Lower Costs

Disney Explores Strategic Options For India Business

SEC Removes Swing Pricing From Its Money-Market Fund Overhaul Plan

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

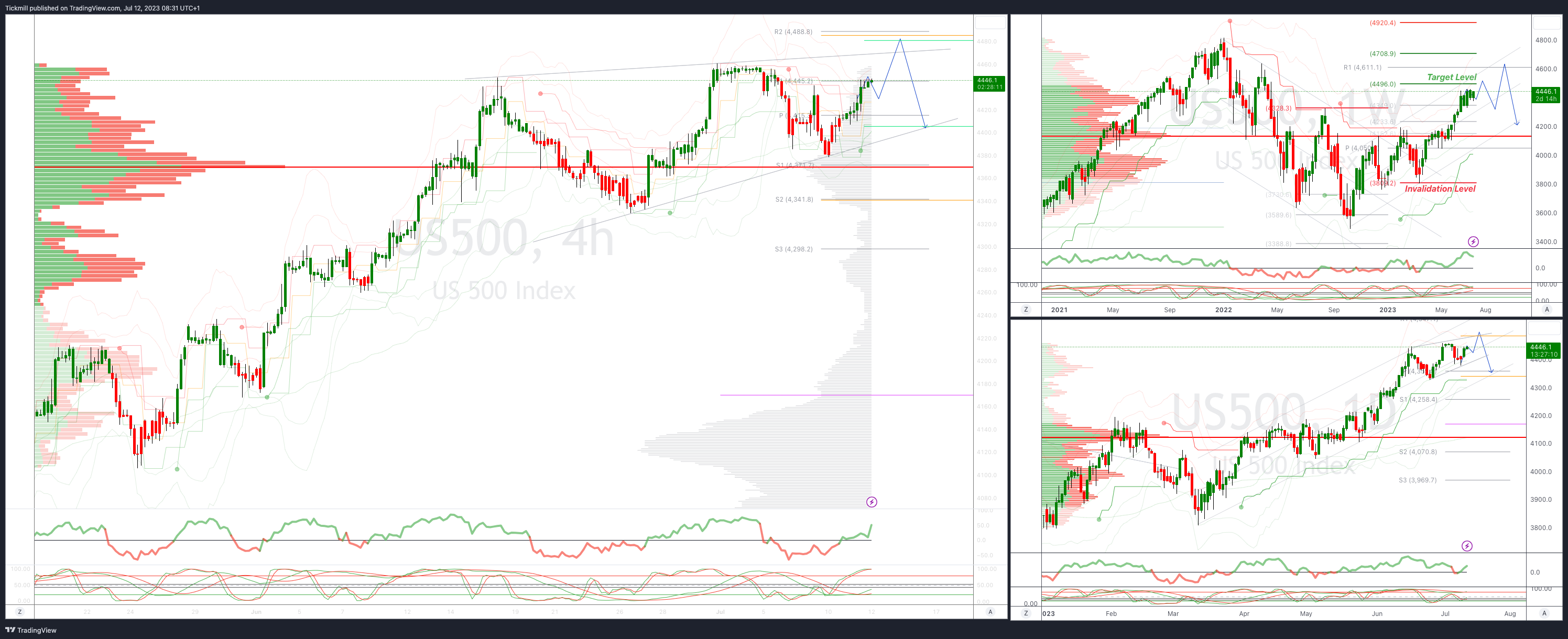

SP500 Bias: Intraday Bullish Above Bearish Below 4430

Below 4420 opens 4390

Primary support is 4300

Primary objective is 4500

20 Day VWAP bullish, 5 Day VWAP bullish

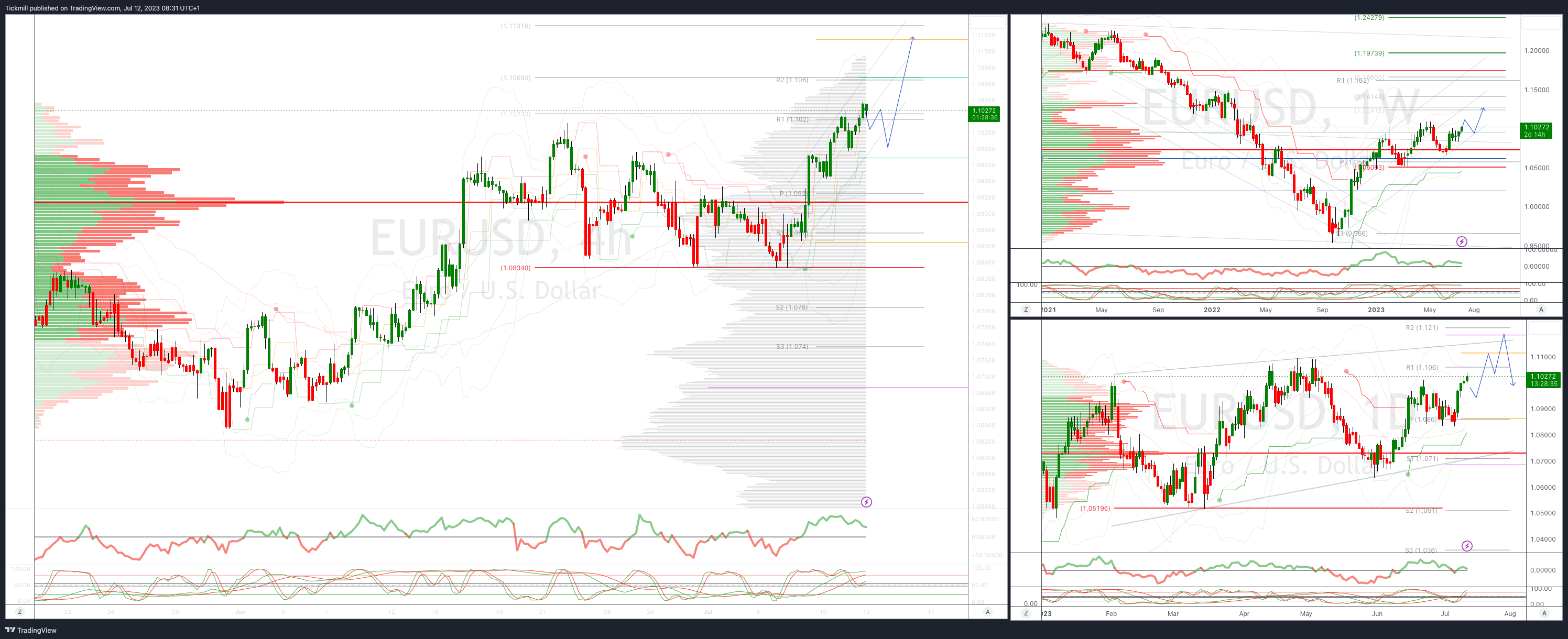

EURUSD Intraday Bullish Above Bearsih Below 1.0950

Below 1.0950 opens 1.09

Primary support is 1.07

Primary objective is 1.12

20 Day VWAP bullish, 5 Day VWAP bullish

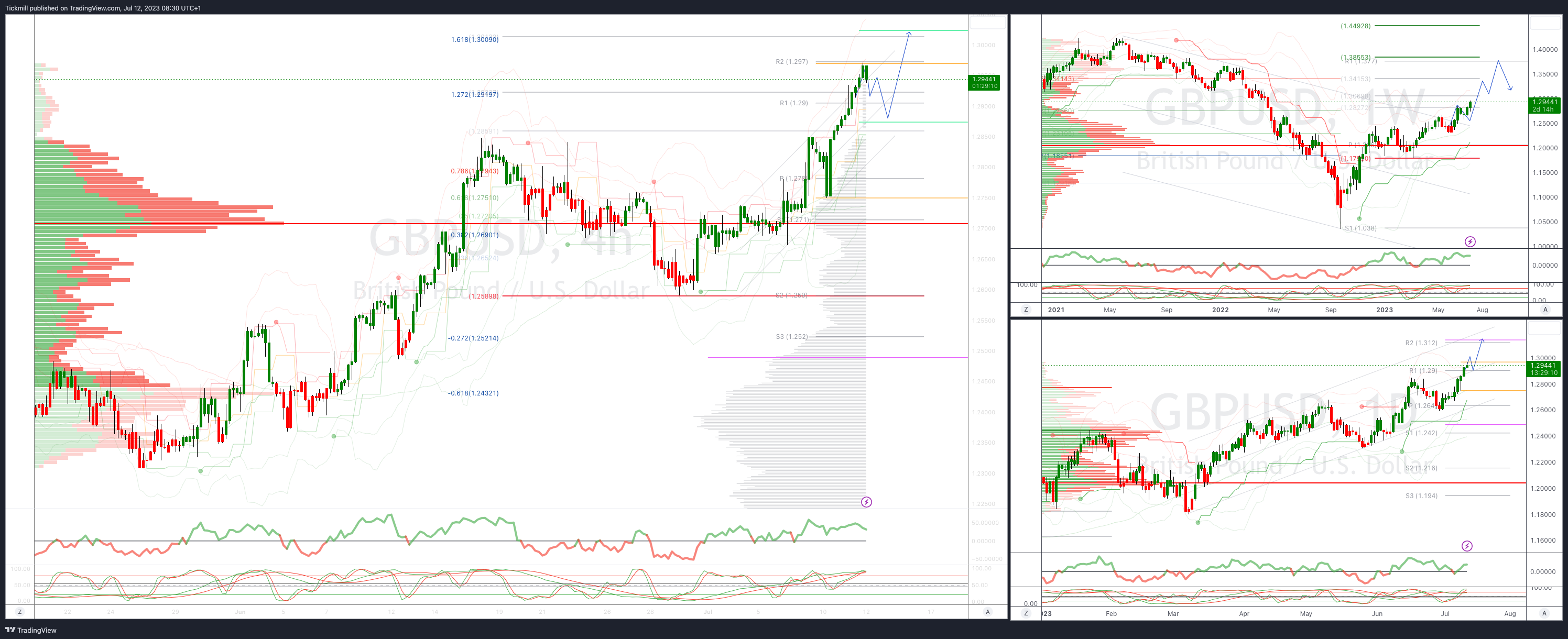

GBPUSD: Intraday Bullish Above Bearish Below 1.2850

Below 1.2830 opens 1.2710

Primary support is 1.26

Primary objective 1.3128

20 Day VWAP bullish, 5 Day VWAP bullish

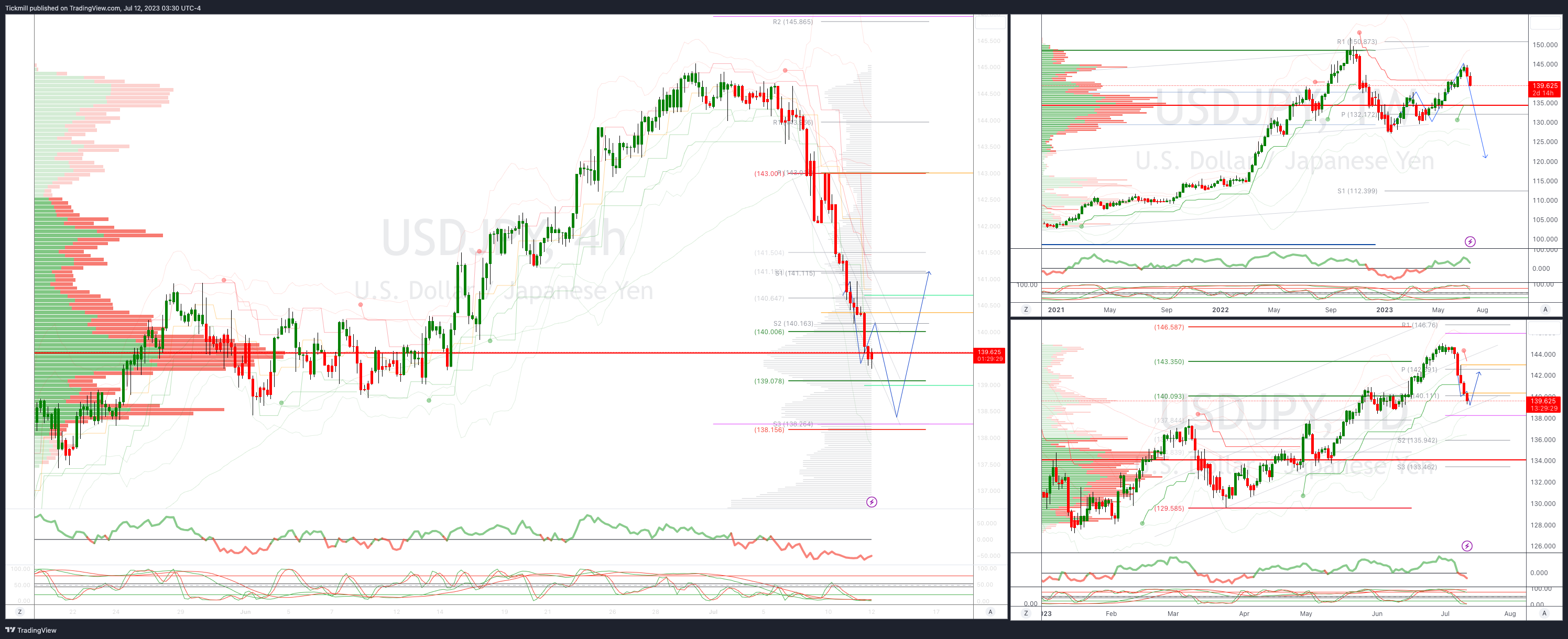

USDJPY Bullish Above Bearish Below 141

Above 141.15 opens 141.80

Primary support is 138.90

Primary objective is 138.90

20 Day VWAP bullish, 5 Day VWAP bearish

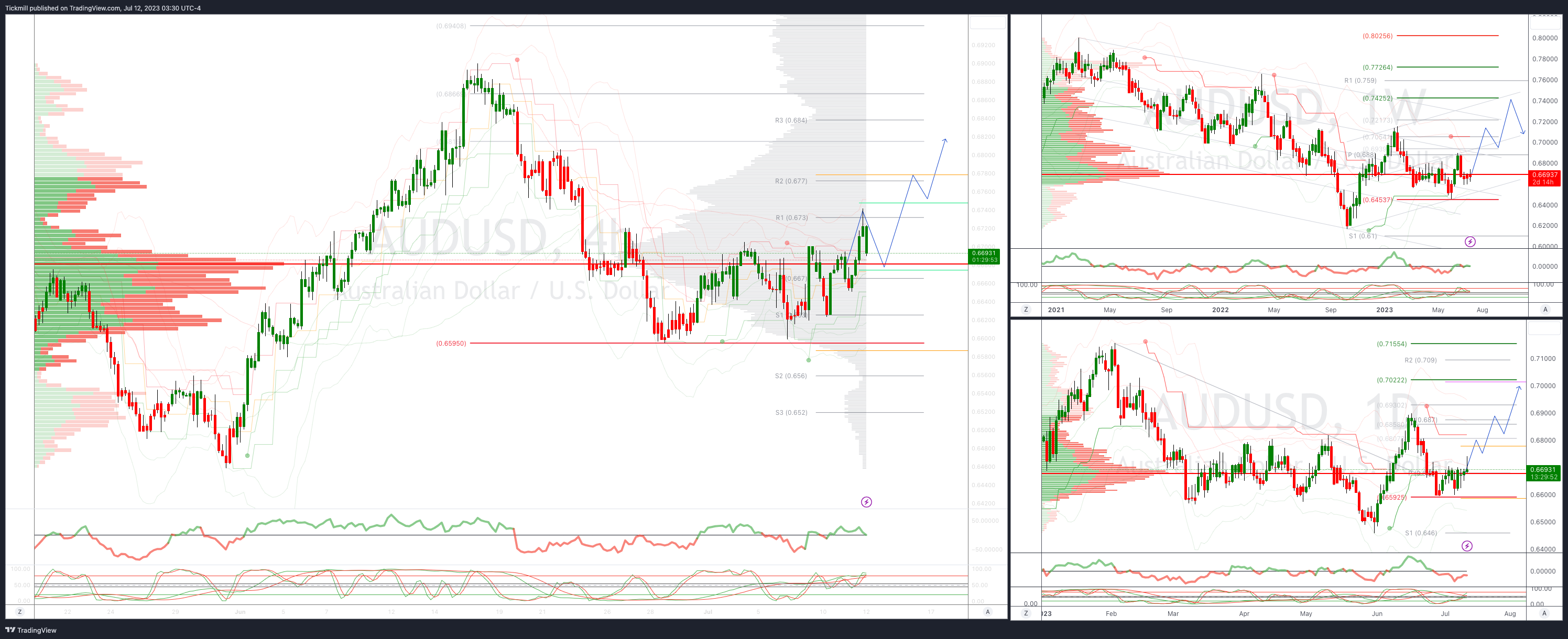

AUDUSD Bias:Intraday Bullish Above Bearish Below .6650

Below .6595 opens .6550

Primary support is .6448

Primary objective is .7000

20 Day VWAP bearish, 5 Day VWAP bullish

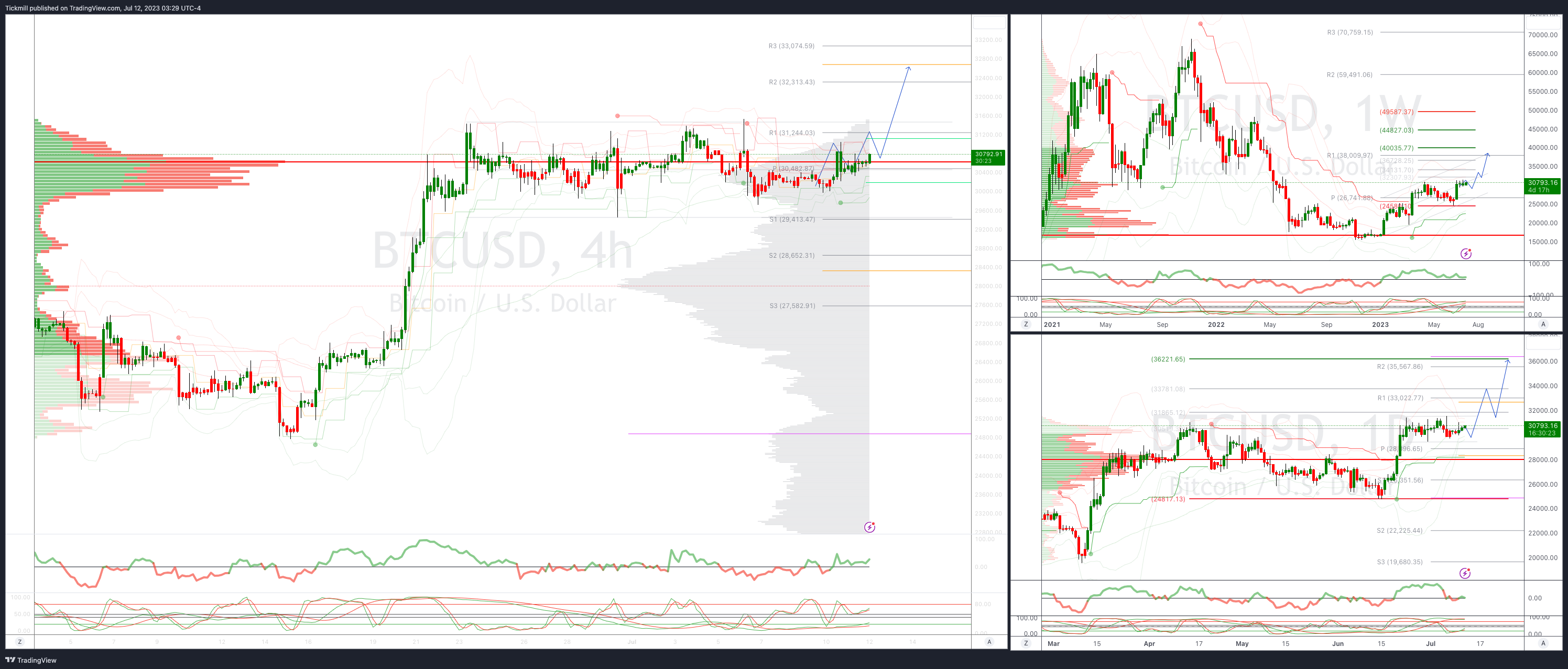

BTCUSD Intraday Bullish Above Bearish below 30000

Below 29400 opens 28600

Primary support is 28400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!