Daily Market Outlook, July 5, 2022

Daily Market Outlook, July 5, 2022

Overnight Headlines

- China's Liu Discusses Tariffs With Yellen As US Look To Ease

- Chinese Services Activity Expands At Fastest In Almost Year

- BoJ Likely To Raise Price Forecast, Ex-Chief Economist Warn

- Japan Service Sector Activity At Fastest Rate In Over 8 Years

- RBA Hikes Rates A Third Time, Fastest Tightening On Record

- Canadian Inflation Outlooks Bolster Case For Supersize Hike

- Lagarde’s Task Toughens As Nagel Fires Salvo On Crisis Tool

- PM Johnson Call On Saudi Arabia To Increase Oil Production

- Germany Drafts Law Taking Struggling Gas Importers Stakes

- Norway Oil, Gas Workers To Strike On Tuesday, Cuts Output

- Chip Giants Threaten To Delay US Expansion Without Grant

- Germany's Uniper In Talks Over Bailout To Fill $9.4Bln Hole

The Day Ahead

- Asian equity markets are mostly up this morning, but Chinese indices are down despite a rise in the Caixin services index to 54.5 in June from 41.4 in May. Reports suggest that US President Biden may scrap some import tariffs on Chinese consumer goods this week in an attempt to combat inflation. In Australia, the central bank as expected raised interest rates by 50 basis points, its third consecutive rate hike.

- Today’s economic data calendar is dominated by PMI services reports for June. However, most of these are second readings that are not expected to be revised from their initial estimates.

- In the UK, that first reading showed the headline index for June unchanged from May at 53.4, still some way above the 50 expansion/contraction level but the lowest since February 2021. While services activity is holding up a little better than manufacturing, it nevertheless seems to be slowing as the post-Omicron rebound fades. Meanwhile, inflationary pressures remain elevated but may have peaked. In the Eurozone, the first reading for the headline index fell to its lowest since January confirming a marked loss in momentum in the sector over the past two months.

- The equivalent service sector measures for the US have been delayed until tomorrow because of yesterday’s holiday. In the meantime, factory goods orders for May will be watched for further signs that manufacturing activity is decelerating. However, already released data for durable goods orders showed a solid monthly rise of 0.7%.

- The Bank of England will produce its Financial Stability Report and hold a press conference today. At the time of the last report in March, the BoE failed to undertake its usual stress tests on banks citing uncertainties related to the Ukrainian situation, so an update on its intentions will be expected. There will also be interest in the BoE’s thoughts about the impact of higher interest rates and other economic uncertainties on the financial system.

- The BoE MPC’s Tenreyro is scheduled to speak today. She is considered to be one of the members of the Monetary Policy Committee that was least convinced of the need to raise interest rates. Indeed, she was the only one not to vote in favour of the first hike back in December. However, she has voted for all four subsequent increases. She will be speaking today as part of a conference on the interaction between monetary and fiscal policy.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0450 (764M), 1.0500-05 (600M), 1.0520 (357M)

- 1.0570 (235M), 1.0600 (508M)

- USD/JPY: 134.95-00 (1.44BLN), 135.40-45 (338M), 136.05 (265M)

- 136.40 (235M), 136.75 (240M), 137.00 (1.68BLN)

- GBP/USD: 1.2280 (231M). EUR/GBP: 0.8670-80 (927M)

- AUD/USD: 0.6850 (204M), 0.6875 (390M), 0.7030 (316M)

- USD/CAD: 1.2900 (675M)

Technical & Trade Views

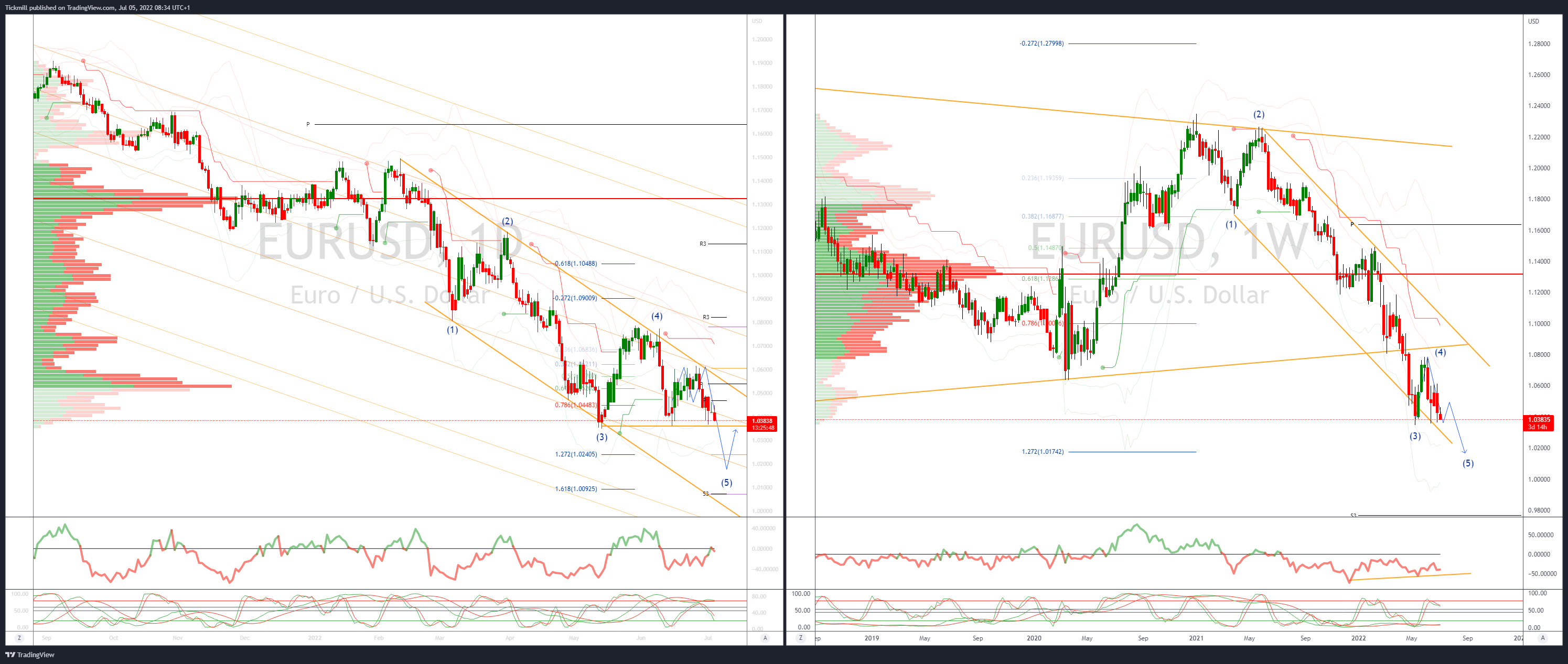

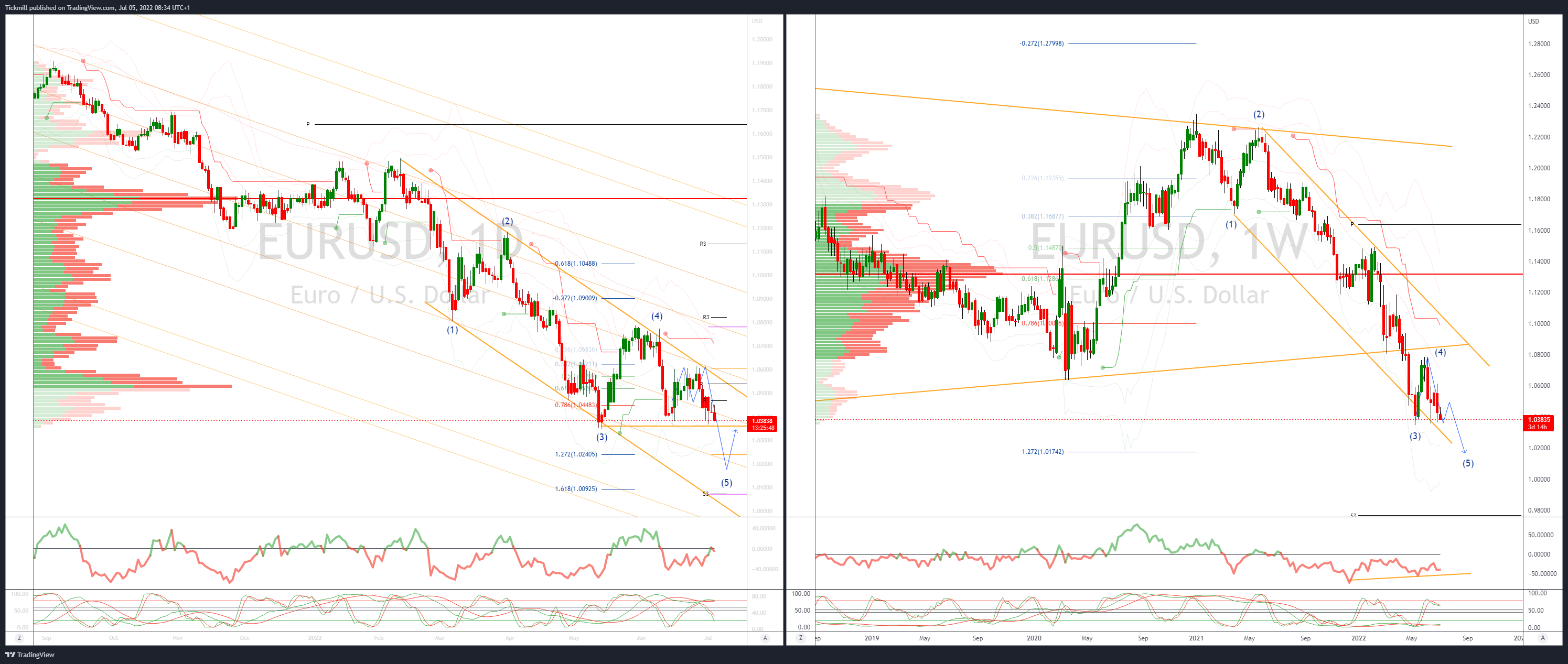

EURUSD Bias: Bearish below 1.0650 Bullish above

- Opens the LDN rotating around 1.04

- Trading in a tight range reduced flows due to US holidays

- Asian trade has seen support for USD on firmer US yields

- EUR/USD will likely remain under pressure in the short-term

- Failure below the base opens a test of 1.0270’s next

- Initial offers are seen at 1.0530/50

- Bids being eroded at 1.04 stops below to fuel a retest of cycle lows

- 20 Day VWAP is bearish, 5 Day bearish

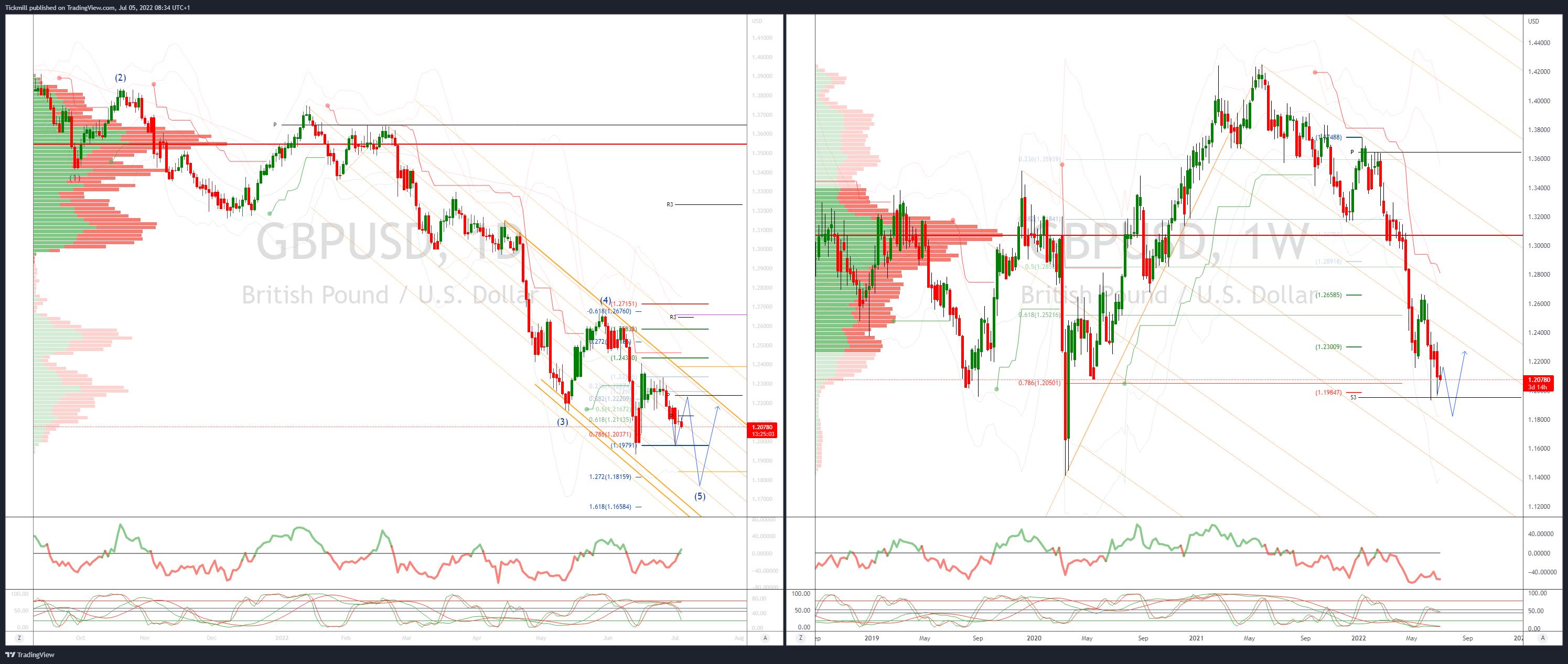

GBPUSD Bias: Bearish below 1.24 Bullish above.

- GBPJPY provides some support for the GBP

- Headwinds continue to cloud cable outlook, high inflation, PM issues, dovish BoE

- Market feels heavy below 1.2230/60 resistance

- Note Friday has GBP810 mln in option expiries at 1.2000 strike

- Bears targeting a break of YTD lows en-route to a test of 1.18

- Resistance remains sited at 1.2275

- 1.2150 failure opens a test of bids at 1.2050 ahead of 1.11950

- 20 Day VWAP is bearish, 5 Day bearish

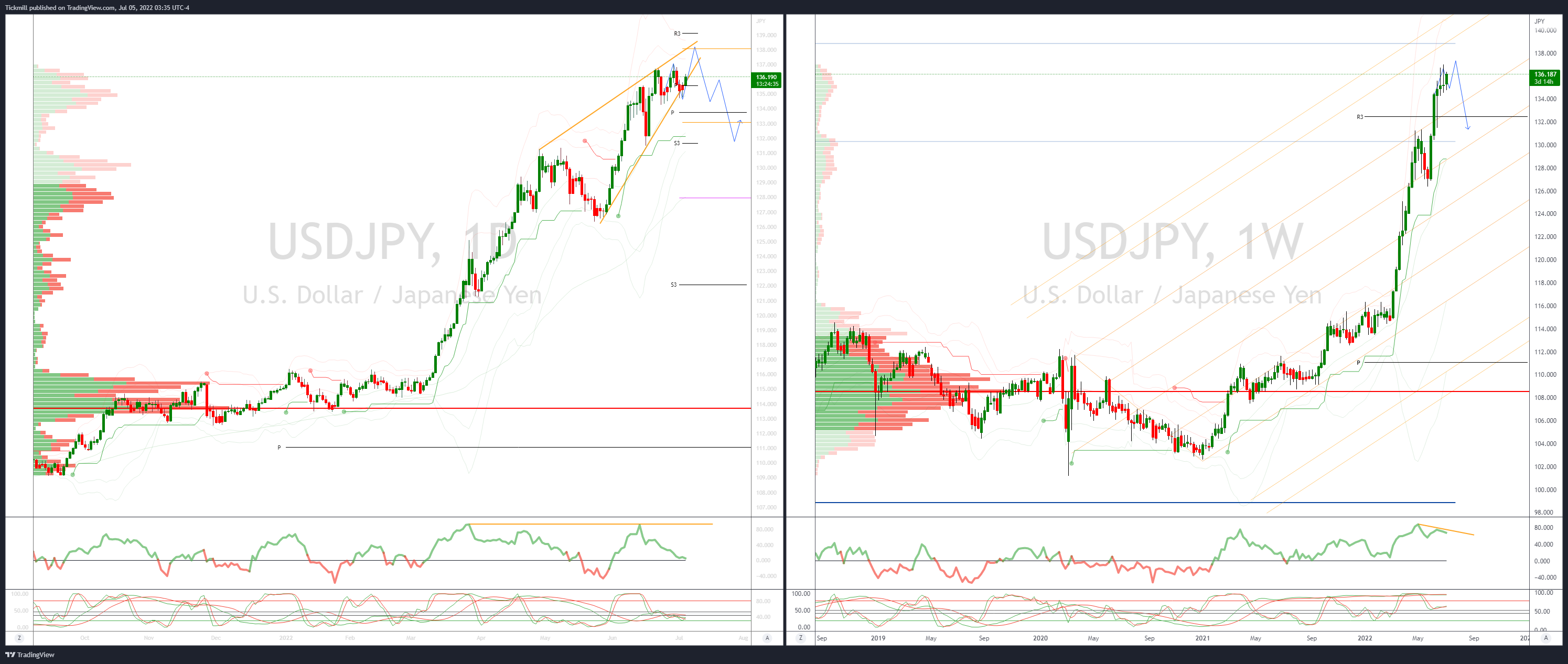

USDJPY Bias: Bullish above 132 Bearish below

- USD/JPY retinas a bid tone driven by firmer US yields

- Short covering driving the pop higher

- US10Y 2.94% adding support

- Initial offers seen at 136.55/65 stops above to see retest of 137

- Option barriers KO’s quoted at 137 remain intact

- 20 Day VWAP is bullish, 5 Day bullish

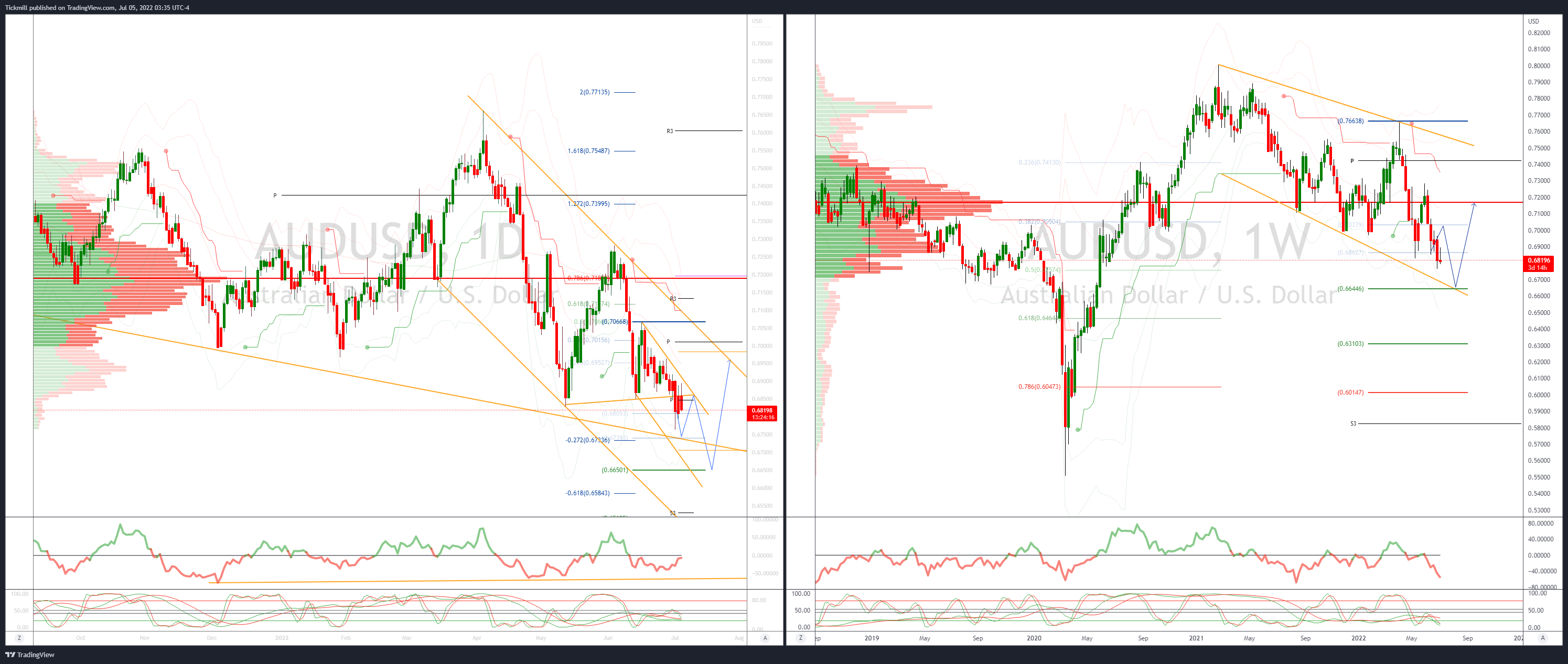

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD retreats after brief pop on RBA 50bps move

- RBA implied further hikes to come, will remain data dependant

- China tariff news not sufficient to give further support as LDN opens

- Resistance is sited at .6900/10

- Support seen at the 50% retracement of the 0.5510/0.8007 move at 0.6758

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

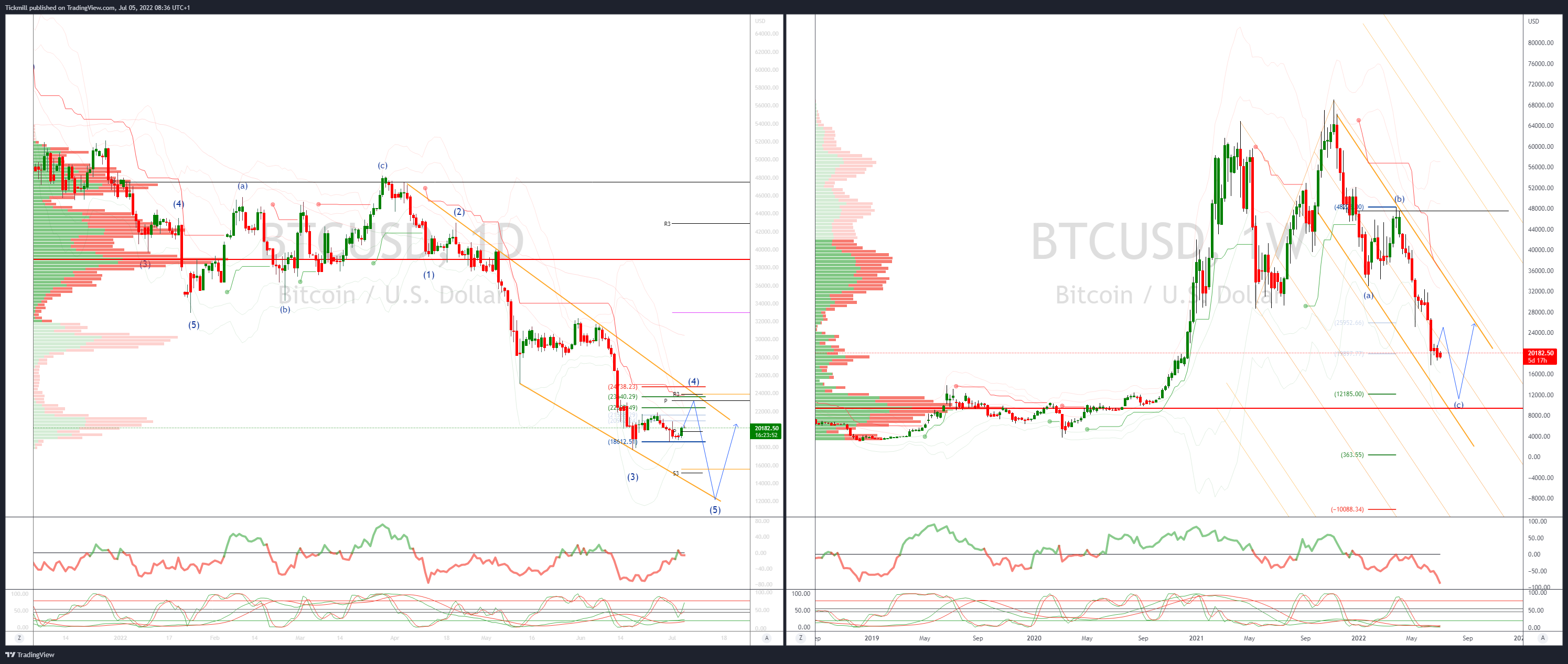

BTCUSD Bias: Bullish above .22000 Bearish below

- BTC lifts over 4% on better risk sentiment overnight trading above 20k

- Tested the 20 day VWAP which remains bearish

- 20 VWAP band contracting ready for next directional drive

- Trend remains down as within broader bearish channel beckons

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- 20 Day VWAP remains bearishly oriented and untested

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!