Daily Market Outlook, March 18, 2024

Daily Market Outlook, March 18, 2024

Munnelly’s Macro Minute…

“Markets On Central Bank Watch”

Asian stock markets are experiencing a mix of trading on Monday, following the generally negative trends from Wall Street on Friday. Traders appear hesitant to make significant moves and are looking ahead to the U.S. central bank's upcoming monetary policy meeting. While it is widely anticipated that the US Fed will maintain interest rates at their current level, traders will be paying close attention to the accompanying statement for any indications about the future of interest rates. Recent inflation readings, which have been higher than expected, have dampened the optimism that the Fed may cut rates in June. According to the CME Group's FedWatch Tool, the likelihood of the Fed keeping rates unchanged at its June meeting has risen to 43.3 percent from 25 percent. In spite of subdued Machinery Orders, the Nikkei 225 demonstrated strong performance, fueled by widespread expectations of a policy adjustment at the upcoming BoJ announcement. The index's upward trajectory was reinforced by currency depreciation and declining yields.

Speculation regarding imminent interest rate cuts continues to significantly influence fluctuations in financial markets. The optimism observed in the previous week was dampened last week by stronger-than-anticipated US inflation data, prompting market participants to postpone their expectations for the timing of the first rate cut in the US. Meanwhile, mixed data from the UK further complicates the timing of potential rate adjustments in the country. Looking ahead, policymakers at both the US Federal Reserve and the Bank of England are set to provide updates on monetary policy. Although neither institution is anticipated to make immediate changes to interest rates, market focus will be on their guidance regarding future policy directions. Early tomorrow morning, in contrast to the anticipated decisions to maintain the status quo in the UK and the US, the Bank of Japan (BoJ) is potentially preparing for a rate move next week, albeit in the form of a hike. The BoJ has hinted at the possibility of ending its negative rate policy, which has been in place since 2016, and signs of larger-than-expected wage increases during the spring wage-round have further fueled speculation. Therefore, an increase at the March meeting seems increasingly likely, and even if the BoJ opts to delay the move, it is expected to signal the probability of action at its next update in April. Additionally, the Reserve Bank of Australia will announce its latest policy decision. Although no change is expected at this meeting, financial markets are attributing a significant probability to a cut by mid-year.

There are no significant releases on the data docket for today. The final Eurozone CPI reading for February is expected to remain unchanged from the preliminary reading, indicating a slowdown in the inflation rate to 2.6% year-on-year from 2.8% in January. In the US, the NAHB survey of housebuilders is forecasted to reveal a further improvement in sentiment in March compared to February. ECB governing council member Centeno is scheduled to speak at an awards ceremony in Lisbon, but his remarks may not provide substantial insights into the ECB policy outlook.

Overnight Newswire Updates of Note

Putin Warns Russia Won’t Be Stopped After Record Election Win

Fed Will Have To Keep Rates High For Longer Than Mkts Anticipate, Say Economists

BoE Set To Hold Interest Rates As It Awaits More Signs On Inflation

ECB’s De Cos Says First Interest Rate Cut Could Come In June

China Kicks Off The Year On Strong Note As Retail, Industrial Data Tops Expectations

Japan CEOs See Higher Prices, Wages With BoJ Move ‘Just A Matter Of Time’

Australia Set To Extend Rate Pause As Economy Enters Slow Lane

Netanyahu Says Israel To Press On With Assault As Truce Talks To Resume

Israel Army Launches Raid On Al-Shifa Hospital In Gaza City

Oil Pushes Higher As China Data Beats And Russian Refineries Hit

Apple Is in Talks To Let Google’s Gemini Power iPhone Generative AI Features

Sony Hits Pause On PSVR2 Production As Unsold Inventory Piles Up

CATL Shares Rise Sharply On Robust Earnings, Special Dividend

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0900 (EU3.21B), 1.1000 (EU3b), 1.0500 (EU2.46b)

USD/JPY: 147.00 ($1.39b), 146.50 ($1b), 150.50 ($900.3m)

USD/CNY: 7.2000 ($1.09b), 7.4000 ($639.7m), 7.2055 ($555.1m)

AUD/USD: 0.6500 (AUD599.7m), 0.6425 (AUD515m), 0.6275 (AUD500m)

GBP/USD: 1.2250 (GBP395m), 1.2750 (GBP328m)

USD/MXN: 18.00 ($300m)

EUR/GBP: 0.8460 (EU600m), 0.8550 (EU501.8m)

NZD/USD: 0.6150 (NZD380m)

USD/KRW: 1315.00 ($475m)

CFTC Data As Of 15/03/24

Bitcoin net short position is -994 contracts

Euro net long position is 74,407 contracts

Japanese Yen net short position is -102,322 contracts

Swiss Franc posts net short position of -17,870

British Pound net long position is 70,451 contracts

Equity fund managers cut S&P 500 CME net long position by 3.983 contracts to 913,990

Equity fund speculators increase S&P 500 CME net short position by 71,149 contracts to 474,044

Technical & Trade Views

SP500 Bullish Above Bearish Below 5150

Daily VWAP bearish

Weekly VWAP bullish

Below 5090 opens 5060

Primary support 5090

Primary objective is 5220

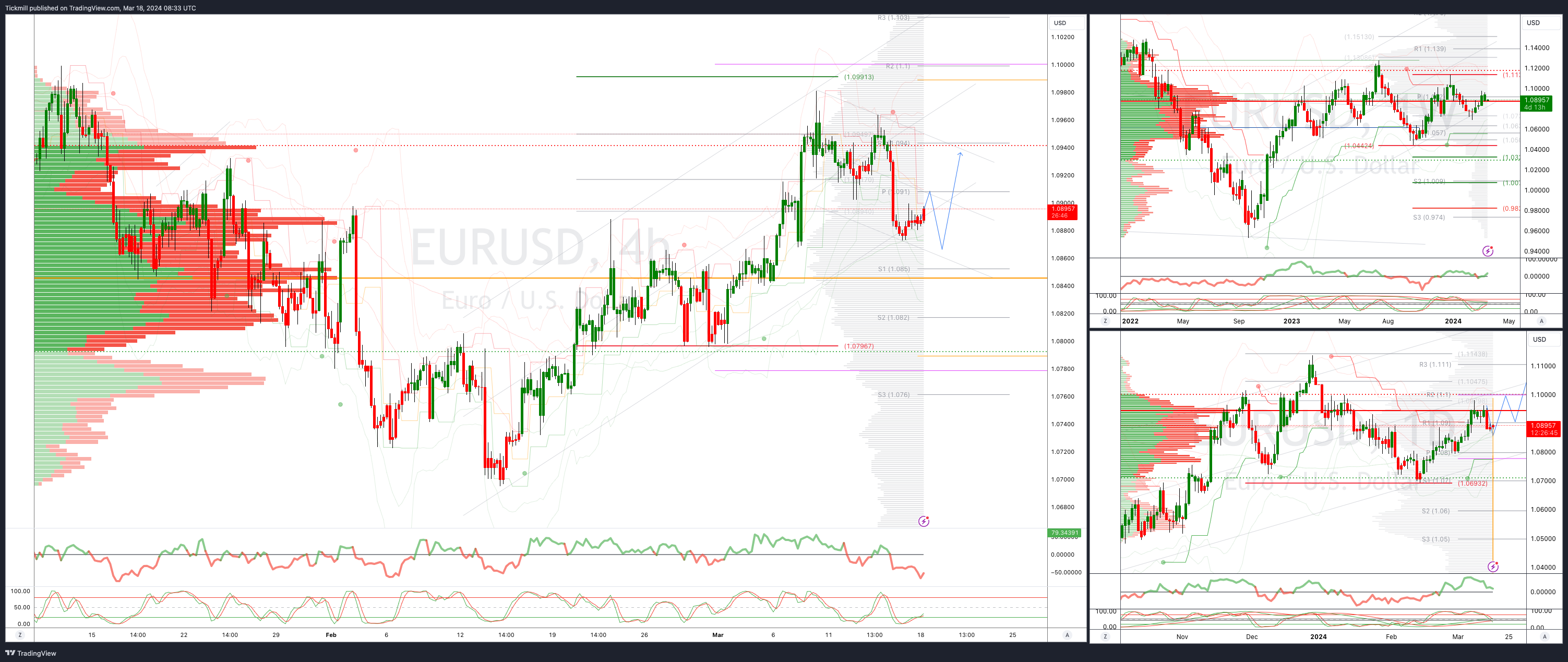

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bullish

Below 1.0840 opens 1.08

Primary support 1.08

Primary objective is 1.10

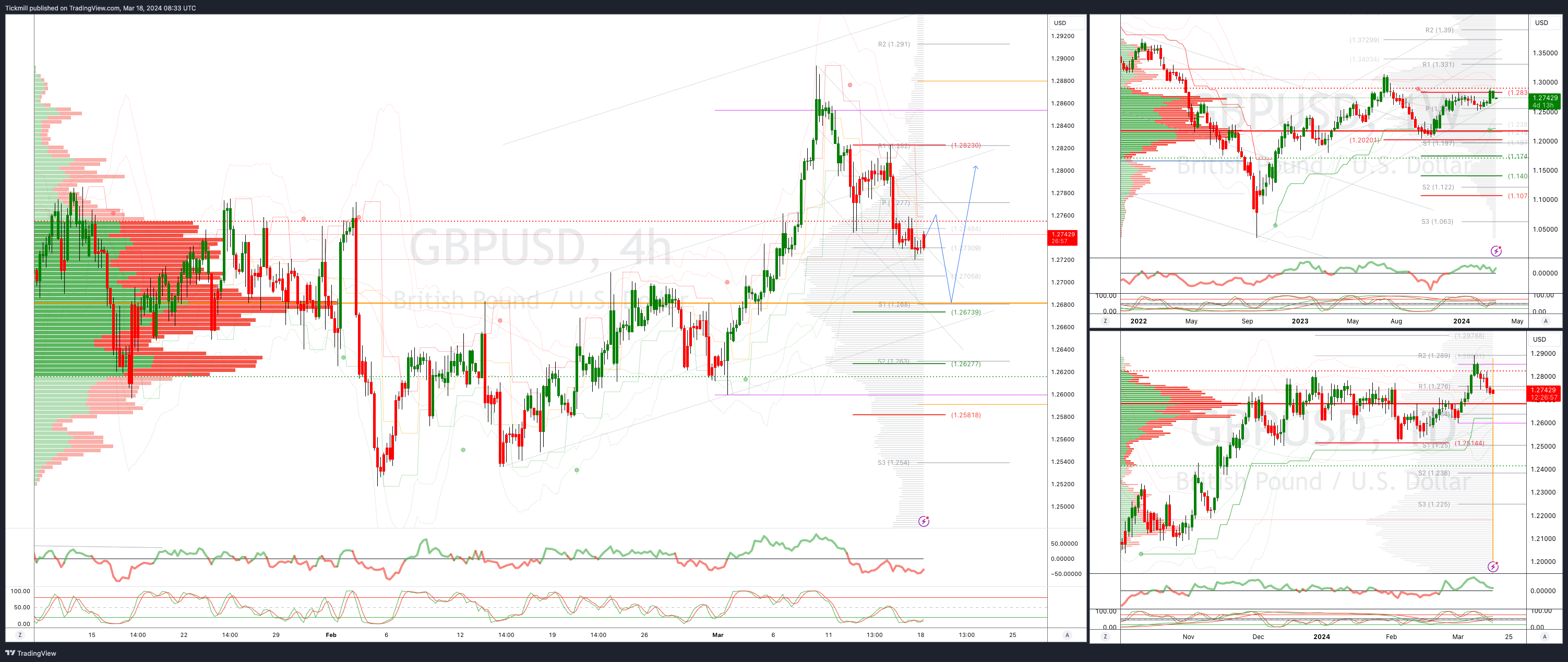

GBPUSD Bullish Above Bearish Below 1.2770

Daily VWAP bearish

Weekly VWAP bullish

Below 1.2670 opens 1.2630

Primary support is 1.2660

Primary objective 1.29

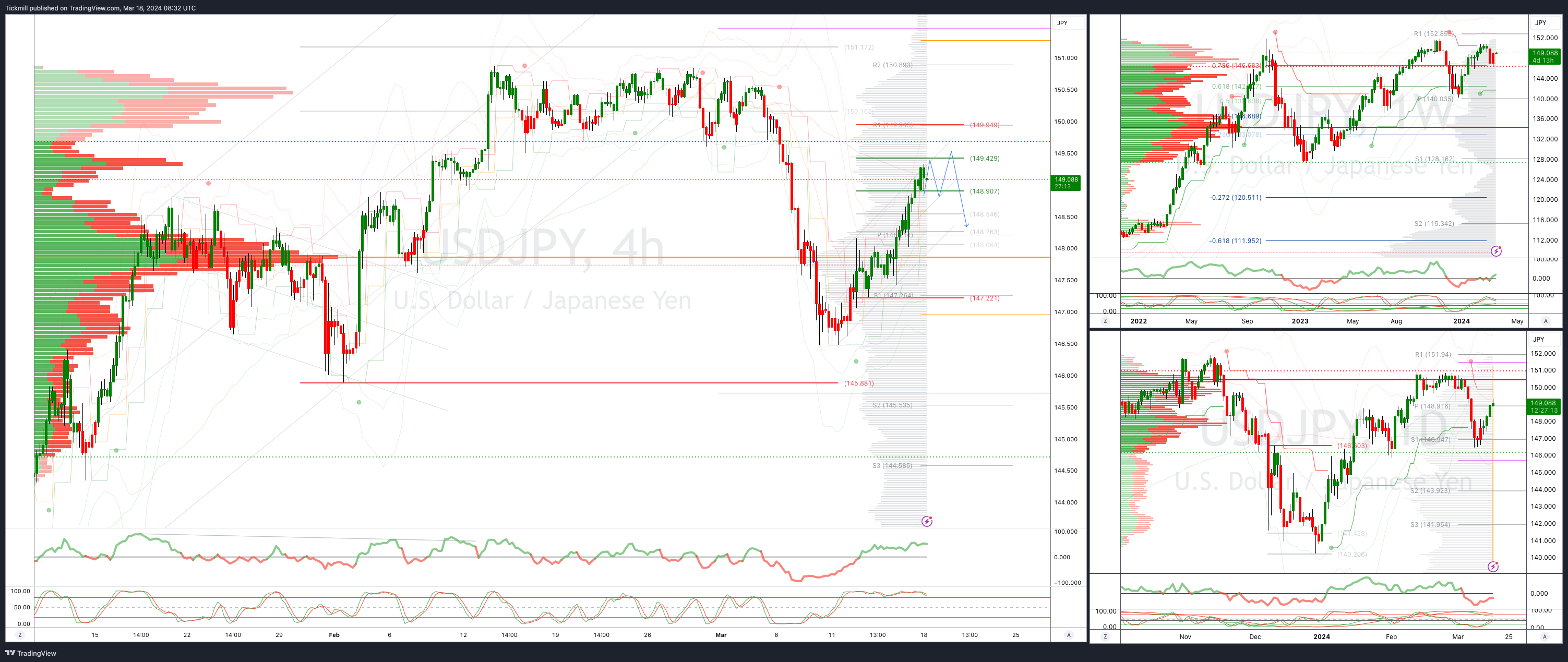

USDJPY Bullish Above Bearish Below 149

Daily VWAP bullish

Weekly VWAP bearish

Above 149 opens 149.50

Primary support 145.85

Primary objective is 152

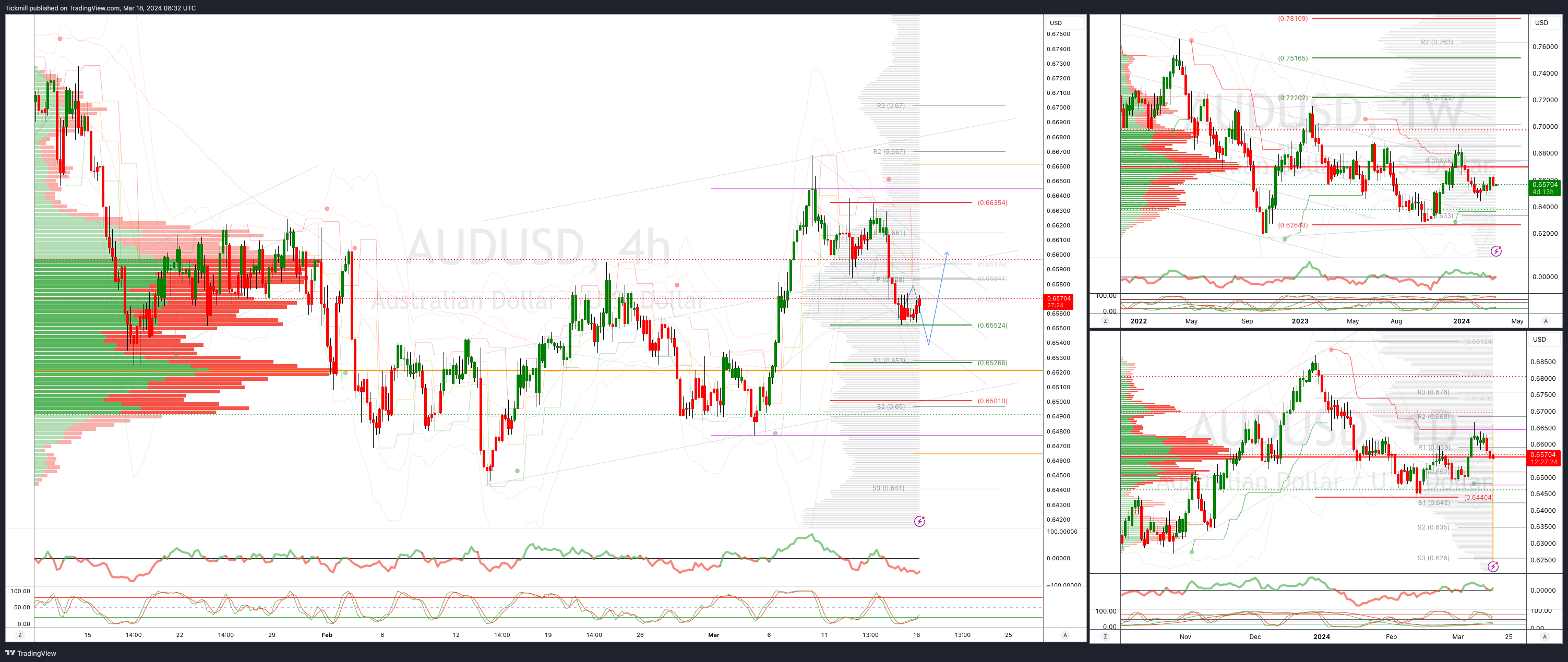

AUDUSD Bullish Above Bearish Below .6600

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6520/00

Primary support .6477

Primary objective is .6700

BTCUSD Bullish Above Bearish below 68000

Daily VWAP bearish

Weekly VWAP bullish

Below 66000 opens 62000

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!