Daily Market Outlook, March 5, 2024

Daily Market Outlook, March 5, 2024

Munnelly’s Market Minute…

“China Data & Congress Stimulus Measures Dissapoint”

On Tuesday, Asian shares showed a mixed performance as investors took into account China's official announcements, including a bold 5% growth target. Mainland China's markets experienced a strong surge, while Japan's Nikkei 225 index surpassed the 40,000 level reached on Monday. However, the Hong Kong Hang Seng Index declined. The National People’s Congress of China released a series of statements, including goals for 5.5% urban unemployment and 3% inflation, as well as measures to stimulate the economy, which is facing challenges due to a property market downturn and persistent deflation. Markets responded with skepticism to the proposals, especially given the absence of any specific fiscal stimulus package. In Japan, the Tokyo February CPI indicated higher inflation, while in the UK, the ‘unofficial’ BRC retail sales measure for February showed unexpected slowing in annual growth.

Today's data docket is relatively quiet compared to the key events scheduled later in the week, including tomorrow’s UK Budget, Thursday’s policy update from the European Central Bank, and testimony to Congress by US Federal Reserve Chair Powell on both Wednesday and Thursday. Today's calendar is mainly dominated by updates on recent service sector activity.

The February PMI services indices for the Eurozone and the UK are both second readings expected to remain unrevised. The initial estimate for the Eurozone saw the headline index rise to the key 50 expansion/contraction differentiation level for the first time since last July, suggesting improving or leveling economic conditions in the region. However, the composite index combining manufacturing and services remains below 50. For the UK, the initial reading showed the headline index unchanged from January at 54.3, marking the fourth consecutive monthly reading above 50 and the joint highest since last May. This suggests that the UK has rebounded quickly from the mild recession seen last year, as indicated by BoE Governor Bailey.

Stateside, the ISM services index for February will be new data, considered a key indicator of US economic growth. It remained above the 50 level throughout last year, supporting the message from GDP data that the economy continued to grow at a decent pace. January’s reading was much higher than expected, and a modest fallback is anticipated in February to 52.8 from 53.4, still consistent with a strong pace of growth. However, the similarly constructed PMI index points to a potentially bigger fall, although the two indices frequently diverge.

Overnight Newswire Updates of Note

China Sets GDP Growth Target Of 'Around 5%' For 2024

China's Li Vows More Support For Property Market Stuck In The Doldrums

Japan's Economy Minister: Not Thinking Of Calling End To Deflation

Tokyo Prices Heat Up Again, Supporting Case For BoJ Rate Hike

Bostic Sees Fed Pausing After Just One Rate Cut In Q3

Sticky Services Inflation Emboldens ECB To Resist Calls For Rate Cuts

Bitcoin’s Market Value Touches Record As Token’s Price Nears All-Time High

SEC Pushes Back BlackRock, Fidelity Spot Ethereum ETF Proposals

AMD Hits US Roadblock In Selling AI Chip Tailored For China

NYCB Extends Rout After Latest Round Of Credit Downgrades

JPMorgan Sees ‘Froth’ In US Stocks, While Goldman Says Rally Justified

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0845 (EU1.58b), 1.0895 (EU1.06b), 1.0520 (EU926.3m)

USD/JPY: 149.50 ($1.01b), 149.00 ($877.4m), 150.20 ($853.1m)

AUD/USD: 0.6495 (AUD1.26b), 0.6700 (AUD952.1m), 0.6485 (AUD849.6m)

USD/CNY: 7.1000 ($624m), 7.2000 ($602.5m), 7.0000 ($600m)

USD/CAD: 1.3550 ($931.5m), 1.3535 ($480m), 1.3400 ($420.6m)

GBP/USD: 1.2590 (GBP355m)

NZD/USD: 0.6175 (NZD698.2m), 0.5955 (NZD680m), 0.6280 (NZD573.2m)

USD/BRL: 5.0100 ($594.8m), 4.8650 ($460m), 4.9500 ($365m)

FX options implied volatility remains at 2-year lows due to low FX volatility. This is expected to continue until there are signs of potential policy divergence. Traders are facing a dilemma as current low levels of implied volatility do not offer an attractive reward for short positions, and buyers would lose premium unless there is a significant increase in FX volatility. There is increased demand for JPY call/USD put options after the March 19 BoJ policy announcement. EUR/USD risk reversals favor downside strikes, reflecting the perceived vulnerability of this currency pair. USD/CNH volatility is at 7-year lows with little perceived risk premium for the upcoming annual peoples congress meeting.

CFTC Data As Of 27/02/24

Euro net long position is 62,854 contracts

Japanese yen net short position is -132,705 contracts

Swiss franc posts net short position of -11,981 contracts

British pound net long position is 46,358 contracts

Bitcoin net short position is -1,967 contracts

Equity fund managers cut S&P 500 CME net long position by 5,157 contracts to 942,123

Equity fund speculators increase S&P 500 CME net short position by 14,679 contracts to 434,512

Technical & Trade Views

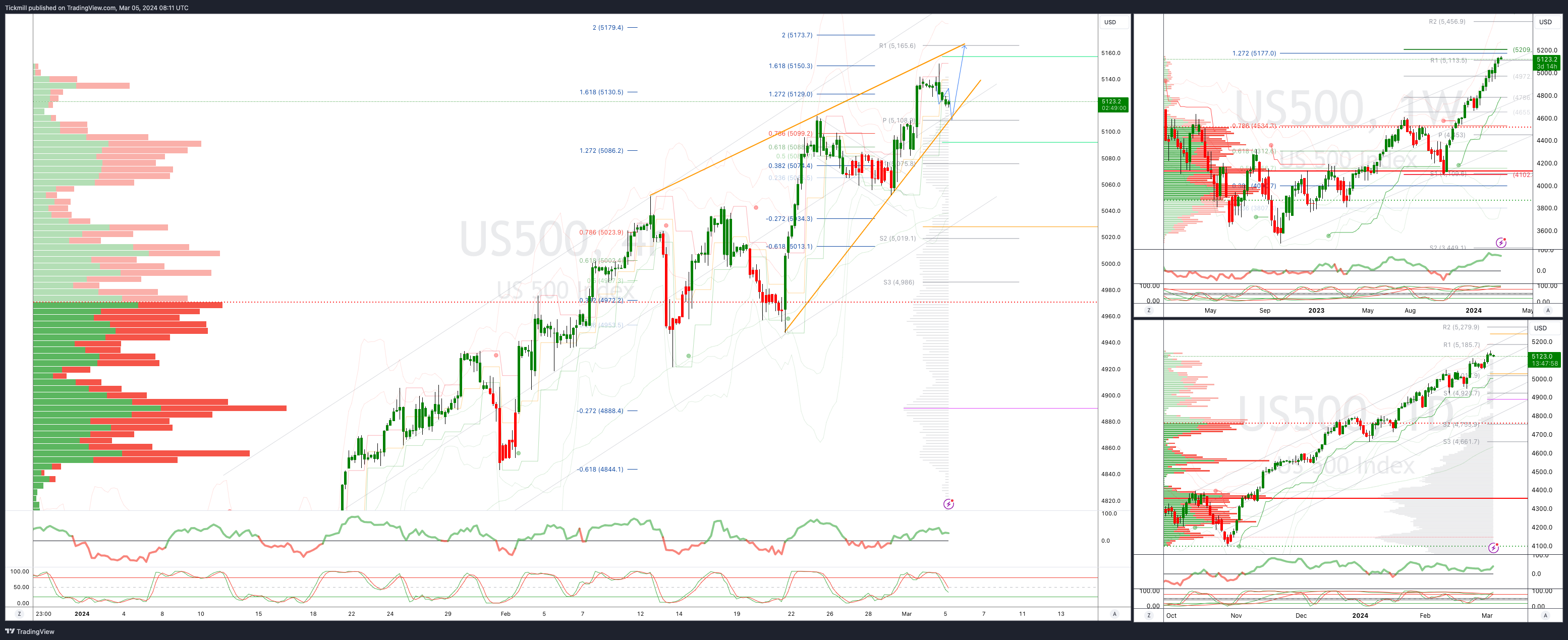

SP500 Bullish Above Bearish Below 5110

Daily VWAP bullish

Weekly VWAP bullish

Below 5090 opens 5050

Primary support 5050

Primary objective is 5165

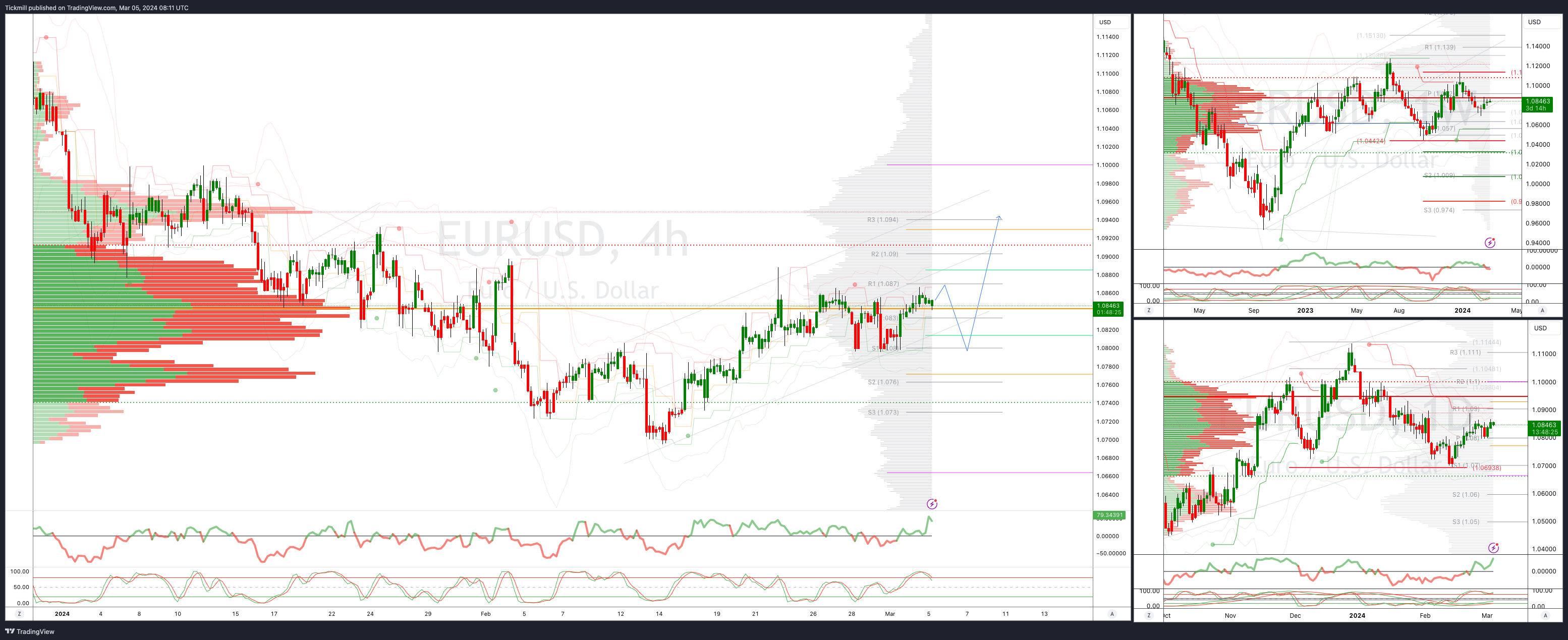

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

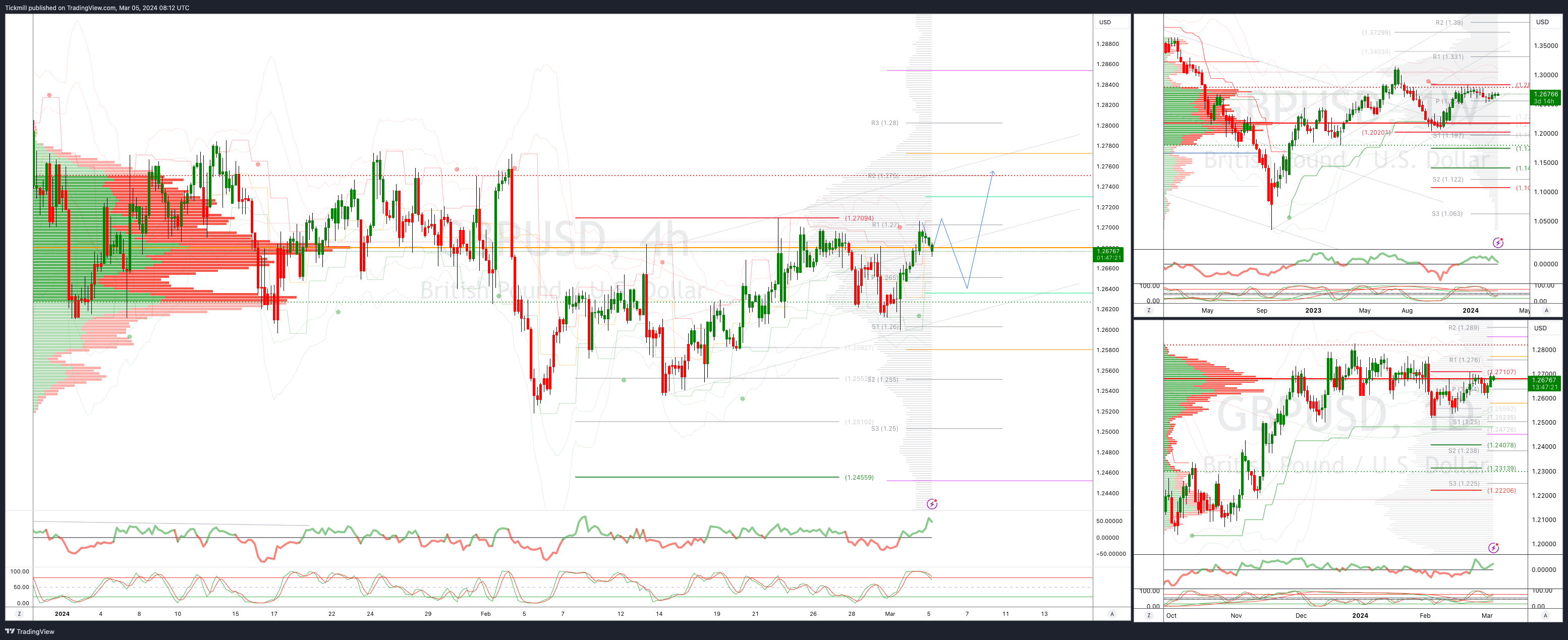

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bullish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

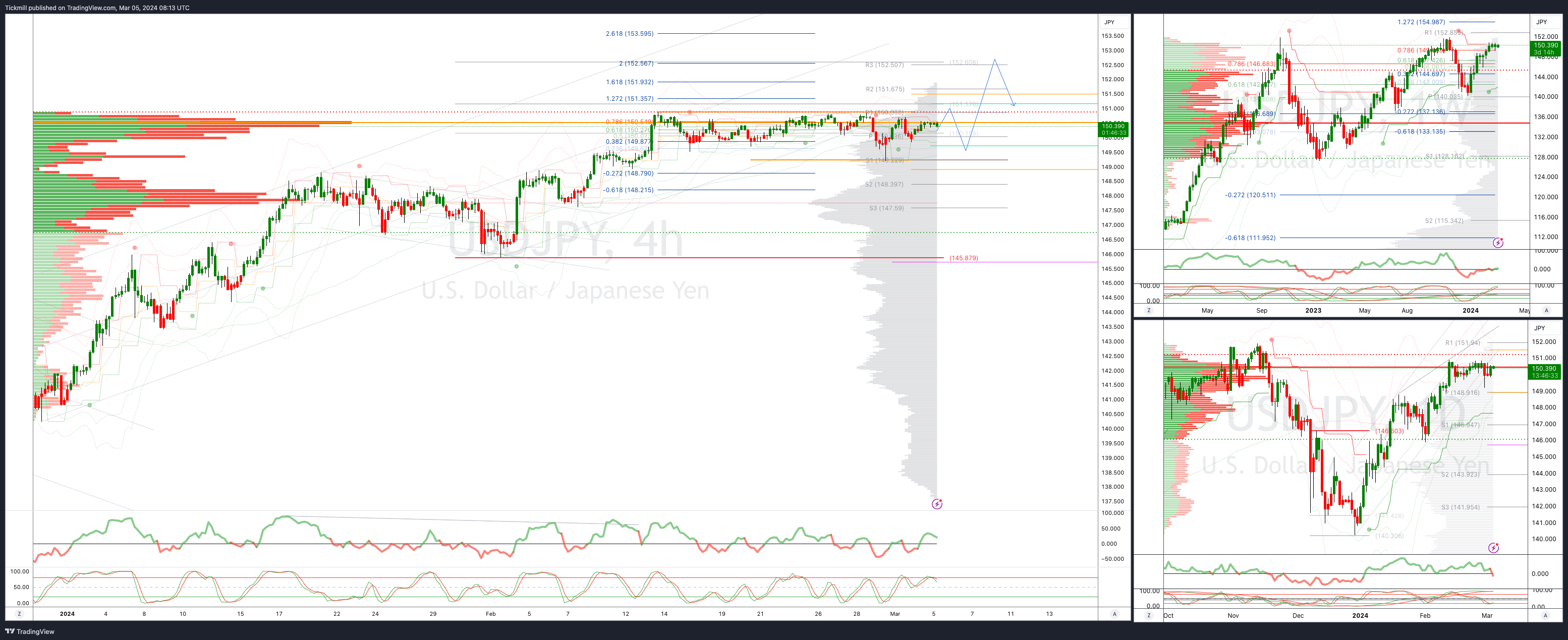

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

AUDUSD Bullish Above Bearish Below .6535

Daily VWAP bearish

Weekly VWAP bearish

Below .6400 opens .6260

Primary support .6400

Primary objective is .6700

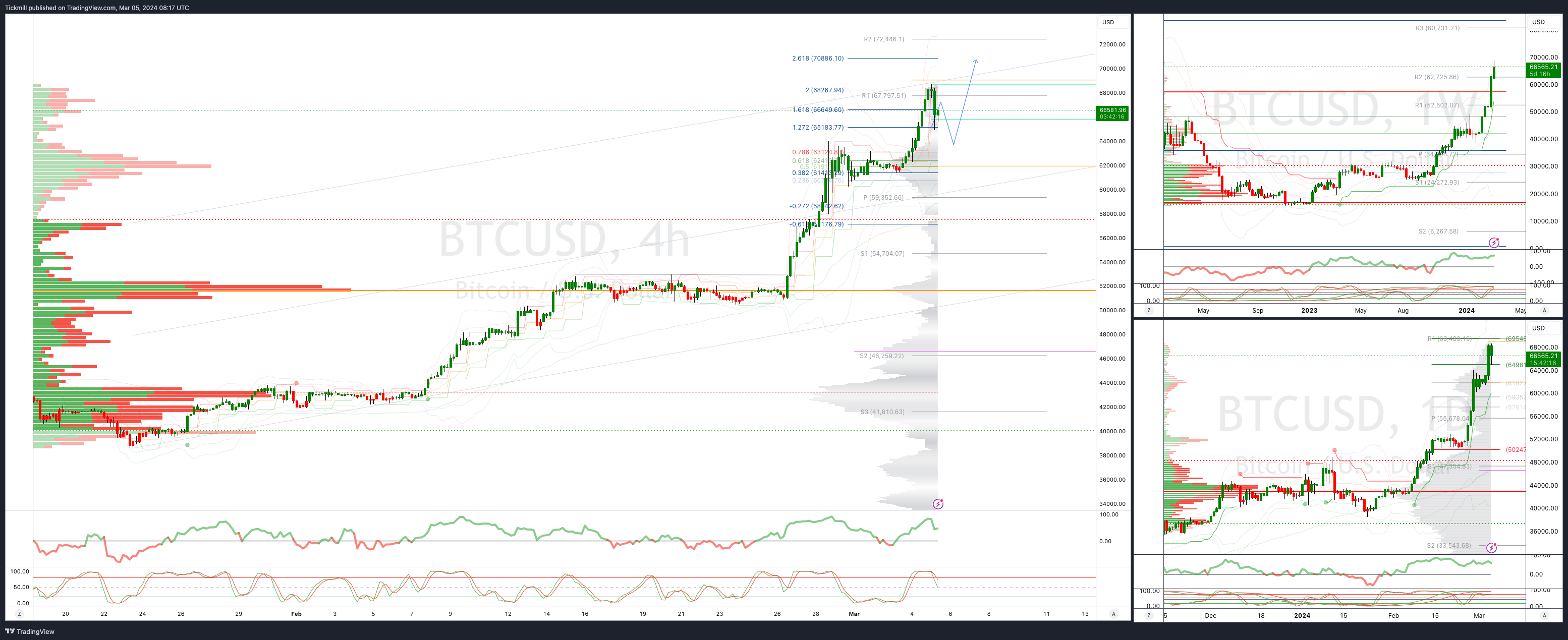

BTCUSD Bullish Above Bearish below 60000

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 52800

Primary objective is 66000 Target Hit New Pattern Emerging

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!