Daily Market Outlook, November 5, 2020

Daily Market Outlook, November 5, 2020

Risk tone remained positive as markets await results of the US elections. Biden looks to be on the brink of victory after winning some key battleground states, but legal challenges and possible recounts may delay the final outcome. A Biden presidency would also contend with a Senate that is expected to remain Republican-controlled, reducing the chance that a big fiscal stimulus package will be passed.

On the domestic front, MPs approved a month-long lockdown in England as expected. Brexit headlines were more downbeat, with the EU’s Barnier noting that “very serious divergences remain” in current negotiations.

The Bank of England brought forward its policy decision to 7am this morning to avoid a clash with this afternoon’s statement from Chancellor Sunak on financial support for the economy as a second wave of Covid infections takes hold. The BoE now expects the economy to contract in Q4 and the Monetary Policy Committee (MPC) voted unanimously to keep Bank Rate at 0.1%, but decided to increase asset purchases by £150bn to a total of £875bn for government bonds. That was a bigger increase than expected and purchases are expected to be completed by the end of 2021. Attention will turn to comments from Governor Bailey’s press conference (details expected to be released at 9.15am), including on the prospect of negative interest rates which so far is not a preferred policy option but has not been ruled out in the future.

In contrast, today’s monetary policy update from the US Federal Reserve may be close to a non-event. Policy is expected to be left unchanged, although the Fed will certainly again say that it stands ready to offer further support to the economy if needed. Moreover, its analysis of economic prospects is likely to remain downbeat with a continued emphasis on downside risks. Chair Powell is likely to renew his emphasis on the importance of more fiscal support for the economy.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1725 (237M), 1.1750 (866M), 1.1800 (314M)

- GBPUSD: 1.3145 (260M)

- USDJPY: 105.00 (1BLN)

- AUDUSD: 0.7130-35 (620M), 0.7210 (305M)

Technical & Trade Views

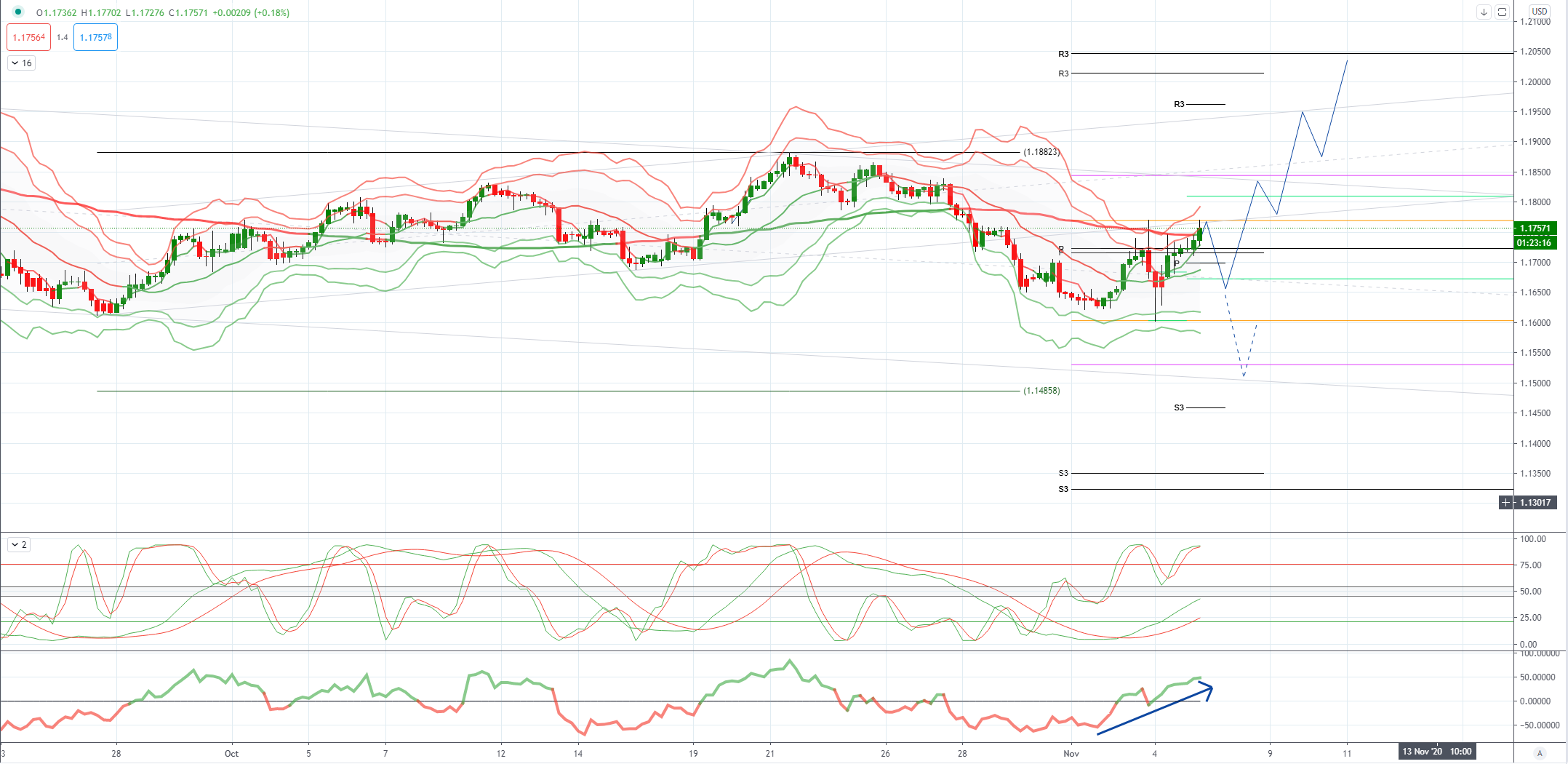

EURUSD Bias: Bullish above 1.1780 bearish below targeting 1.15

EURUSD From a technical and trading perspective, the failure to hold 1.1687 lows opens quick move to test 1.1610 as 1.1780 contains upside attempts look for a test of the pivotal 1.15. UPDATE through 1.1780 opens a move to challenge offers and stops above 1.19 as the nest upside objective

Flow reports suggest downside bids into the 1.1600 level with stops likely on a dip through the 1.1580 areas and technically weak through to the 1.1500 area and likely some stronger bids appear with limited congestion into the 1.1480 level vulnerable to further strong stops. Topside offers light through to the 1.1780 level with strong congestion then through to the 1.1820 areas before a mix of weak stops and congestion likely through to the 1.1850 and increasing offers on a push through to the 1.1900 level.

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, while 1.2950 attracts sufficient bids look for a test of primary equality objective at 1.3264

Flow reports suggest topside offers now very light through to the 1.3150 level with stronger offers likely to continue through to the 1.3200 and strong stops on a push through the 1.3220 areas opening a move to the 1.3250 area before congestion moves in and the possibility of slowing the market, stronger offers then through into the 1.3300 level and weakness then appearing beyond. Downside bids light through to the 1.2900 level with weak stops limited through the level and likely increasing bids into the 1.2850 area to limit the downside through to the 1.2800 failing any surprises this late in the day, weak stops through the level opens a big drop and worries over Brexit at that point.

USDJPY Bias: Bearish below 104.30 bullish above

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50

Flow reports suggest topside offers through the 105.40-60 area with stronger offers likely to be building into the 105.80-106.00 areas with weak stops likely through the 106.20 area and opening the topside through to the 106.40 area before stronger offers appear, downside bids light through to the 104.50 with some support in the area and then increasing through to the 104.00 level and a concern for the BoJ on any dip through the level and weak stops on a move through the 103.80 area and stronger bids likely to appear into the 103.50 area

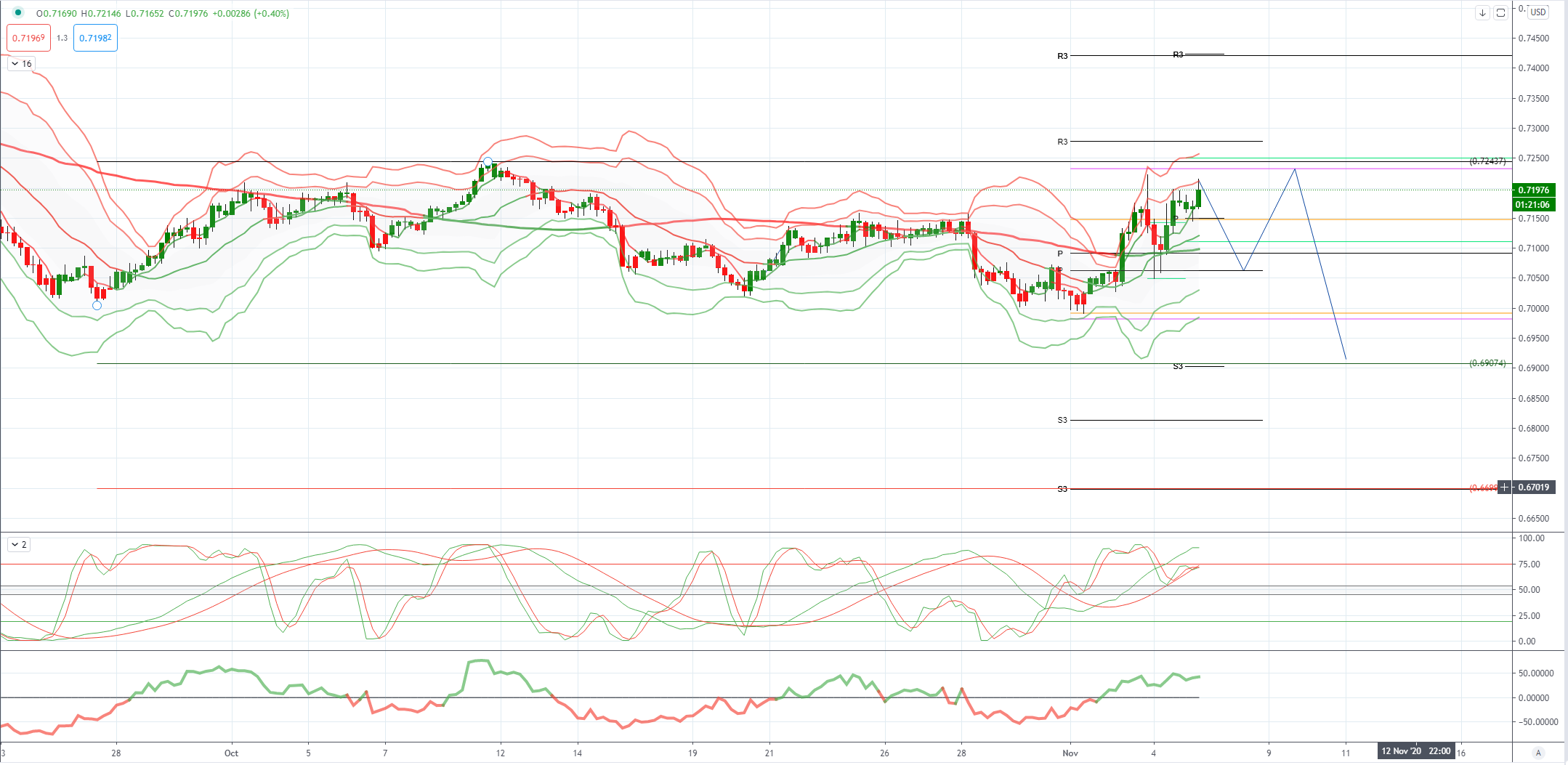

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, as .7243 caps upside attempts look for decline to resume to expose bids and stops towards .6900

Flow reports suggest downside bids into the 0.7000 level with weak stops on a dip through the 0.6980 area and increasing bids on any move through to the 0.6950 areas and likely continuing to increase on any test of the 69 cents level, Topside offers likely through the 0.7250 area with strong congestion through to the 73 cents with mixed stops and congestion continuing through the level to the 0.7350 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!