Daily Market Outlook, November 8, 2021

.png)

Daily Market Outlook, November 8, 2021

Overnight Headlines

- Biden Seeks Way Out Of Doldrums After Legislative Victory

- Biden’s Quest For Oil Relief Turns To Energy Data This Week

- Democrats Pass $1Tln Infrastructure Bill, Ends Day Standoff

- China’s Zero-Covid Policy Under Strain As New Cases Spread

- China Posts October Record Trade Surplus As Exports Surge

- BoJ Officials Stress Need Keep Easy Policy On Weak Inflation

- BoC Gov Macklem: Inflation ‘Transitory But Not Short-Lived'

- UK To Be Ready Scrap Northern Irish Protocol Customs Laws

- Ireland Minister Warns EU-UK Deal In Jeopardy Over NI Row

- Russia Keeps Grip On EU’s Gas Market Despite Putin Pledge

- Musk Urged To Sell 10% Tesla Stake By Holding Twitter Poll

- Crypto Rally Lifts Ether To Record, Bitcoin Near 3-Week High

The Week Ahead

- U.S. CPI in focus as inflation concerns persist U.S. inflation data will be the main focus for markets this week. Equities rallied and bond yields eased last week when the Federal Reserve, Bank of England and Reserve Bank of Australia played down inflation concerns and maintained that mainly transitory factors are pushing up prices. There is a camp that believes the central banks are underestimating inflation pressures and falling behind the curve. Hotter-than-expected U.S. CPI and PPI will harden those views. Core CPI is expected to rise 4.3% year-on-year, up from 4.0% in September. Other data out of the U.S. includes weekly jobless claims and University of Michigan consumer sentiment. It will be a quiet week in Europe, with German ZEW the featured release. German trade and inflation data and the euro zone Sentix Index and industrial production are also due. UK Q3 GDP will be released in the week ahead, along with IP and trade data. PPI and CPI will be the key data out of China, while October lending data is also due. Japan's calendar includes current account and trade balance for September. Australian employment data will be released this week, with the market expecting a 50,000 rise in jobs after September's 138,000 drop. No top-tier data is due in New Zealand or Canada.

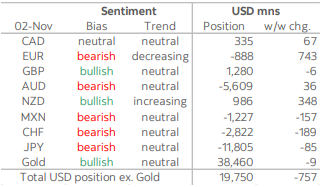

CFTC Data

- Investors trimmed their bullish bets on the USD for a fourth consecutive week ahead of the Federal Reserve’s policy decision on Wednesday. The aggregate USD long position fell by USD757mn to USD19.8bn. This is still relatively close to its early-October high of USD23.2bn, however, representing a sizable USD long position that reflects solid bullish sentiment in the greenback as markets look to the beginning of the Fed’s hiking cycle.

- The EUR’s net short saw the biggest week on week change of the currencies covered in this report, with a USD737mn reduction to total USD888mn and declining from as high as USD3.2bn a month ago through a week that included the ECB’s decision last Thursday where it held all of its policy settings unchanged. The weekly change reflects a decrease in shorts of about 10.5k contracts while longs were trimmed by 5.1k contracts. The NZD long saw the second largest increase in the week with USD348mn added to the now USD986mn bullish position (its highest level since March).

- The GBP’s net long was left practically unchanged at USD1.3bn following a large USD1.1bn buildup the previous week with no clear sense of guidance in the days leading to the Bank of England’s announcement on Thursday. The quick increase in GBP longs of the previous three weeks from a net bearish position of USD1.7bn in early-October came amid strong signaling from BoE officials in recent weeks that they would hike this week. In the week to Tuesday, short and long positions increased by about 5k contracts each. The BoE’s rate hold and guidance that rate increases may wait until February has likely seen a significant share of these recently acquired longs unwound with the GBP reaching a five-week low this morning.

- Similarly, speculative accounts trimmed the large AUD short by only USD36mn to USD5.6bn (the second biggest bearish position in this report). The near-absence of movement in the Aussie’s position likely understates the worsening of AUD sentiment in recent days after the RBA held on to its guidance that it will not hike until 2024; expectations that it could hike as soon as late-2022 likely saw a reduction in the net AUD short prior to the Tuesday decision.

- Elsewhere, the small CAD bullish position saw a marginal increase of USD67mn to USD335mn in similar size to the USD85mn increase in the JPY short to USD11.8bn. The yen’s haven/funding peer, the CHF, also saw a USD189bn increase in net bearish bets to USD2.8bnbut the MXN’s bearish position (as a typical target of carry trades) also rose by USD157mn to USD1.2bn

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1500-10 (653M), 1.1515-25 (503M), 1.1550-60 (614M)

1.1570-75 (257M), 1.1600 (550M)

GBP/USD: 1.3350 (359M), 1.3500 (294M). EUR/GBP: 0.8575 (1.1BLN)

AUD/USD: 0.7400 (254M), 0.7460-70 (383M), 0.7500 (378M)

USD/JPY:111.90-112.00 (1.5BLN), 113.60-65 (700M)

114.10 (422M), 114.25 (1.2BLN). EUR/JPY: 132.50 (286M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.17 Bullish above

- Finds support after drifting lower in early trading

- EUR/USD opened 1.1560 after closing Friday at 1.1566

- It traded down to 1.1554 when USD broadly edged higher in early Asia

- Heading into the afternoon it is settling around 1.1560 - little changed

- EUR/USD resistance is at 1.1590/1.1600 where the 10 & 21-day MAs converge

- Support comes in at Friday's 1.1513 low and 50% retracement at 1.1492

- Range trading likely to continue while those levels hold

GBPUSD Bias: Bearish below 1.37 Bullish above.

- Heavy above key support – EU – UK impasse fears weigh

- -0.1% towards the of a 1.3473-1.3492 range - busy as Asia fully opened

- Potential for EU-UK trade impasse on N Ireland increases

- EU-UK friction could trigger the next sterling fall

- Charts 5, 10 & 21 DMAs track lower, while 21 day Bollinger bands expand

- Bearish trending setup in place while 1.3682 21 day moving average caps

- 1.3412-19 a base Friday, September low and 38.2% of May 2020-June 2021 rise

- 1.3400 break targets 1.3166, 38.2% of the overall 2020-2021 rise.

- Friday's London 1.3425-1.3509 range is initial support and resistance

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY bounces in Tokyo on some bargain hunting

- USD/JPY up from 113.39 EBS early in Asia to 113.63 before steadying

- Japanese importer, other bargain-hunting tipped, specs buying back shorts

- Further upside likely limited with US yields soft, rate diffs narrower

- Japan-US 10-year interest rate diff @141.20 bps, high 10/22 160.30 bps

- Offers also eyed towards 114.00, likely cap of sorts for now

- Some option expiries today near current spot - 113.60-65 $696 mln

- Nikkei off small now after gains earlier, -0.1% @29,578

AUDUSD Bias: Bearish below 0.75 Bullish above

- Soft tone as firm USD and sluggish equities weigh

- AUD/USD opened 0.7397 after closing Friday at 0.7401

- It traded in a 0.7387/0.7402 range and is around 0.7390 into the afternoon

- USD broadly firmer in Asia while AXJ equity index -0.20% and E-minis -0.25%

- AUD/USD support is at the 55-day MA at 0.7359, which was Friday's low

- Resistance at Friday's 0.7412 high and 21-day MA at 0.7448

- A break below 0.7355 targets the 61.8 of 0.7170/0.7555 at 0.7317

- AUD/USD will likely be influenced by broad USD moves this week

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!