Daily Market Outlook, October 21, 2019

Daily Market Outlook, October 21, 2019

Main Market Themes

Daily market outlook: The next few days will be crucial as far as Brexit is concerned. Saturday’s special parliamentary session in the House of Commons offered little detail on when, or even if, the UK will finally leave the EU. UK PM Boris Johnson has now – compelled by the so-called Benn Act – sent a letter to the EU to request a three-month delay to Brexit, though EU leaders do not necessarily have to accept it. EU leaders are expected to take their time with a response, but it could come as early as Monday. Meanwhile, the UK government is keen to have its “meaningful vote” on Monday (21 October), but this could be rejected by the house speaker as it is not parliamentary convention to repeatedly ask the same questions to politicians. The UK government could instead present the full “Withdrawal Agreement” Bill early this week and slowly try to pass it through both the House of Commons and the House of Lords. A crunch, decisive question to lawmakers would then come later in the week or be pushed back even further.

Global risk sentiments were dented by China’s disappointing 3Q19 GDP growth print of 6.0% yoy and warnings of a weak global growth prognosis at the IMF-World Bank annual meetings on Friday. US president Trump also backpedalled on his plan to host the 2020 G7 meeting at his Trump National Doral resort in Miami amid widespread criticism.

On the CFTC front, non-commercial and leveraged accounts extended implied USD longs (largely due to a flip into net JPY shorts), whereas asset managers increased their implied USD shorts. The flip into a net short on JPY underlies the improvement in risk sentiments. Note that EUR and AUD shorts were pared by leveraged accounts.

Market has almost fully priced in the third consecutive rate cut for the upcoming 29-30 October FOMC after Fed’s Clarida opined that the Fed would take appropriate action to support the US economic expansion. Kaplan, on the other hand, said he was “more agnostic” whether to take more time to decide as there is also the December FOMC meeting.

In a relatively light calendar this week, watch for global preliminary PMIs later this week, and the ECB policy decision on Thursday.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1095-1.1100 (1.6BLN), 1.1110 (300M), 1.1120-30 (1BLN), 1.1150-60(1BLN), 1.1185-90 (900M), 1.1200 (1.1BLN)

- GBPUSD: 1.2700-10 (850M), 1.2900 (310M), 1.3000 (401M)

- AUDUSD: 0.6790-0.6800 (1BLN)

Technical & Trade Views

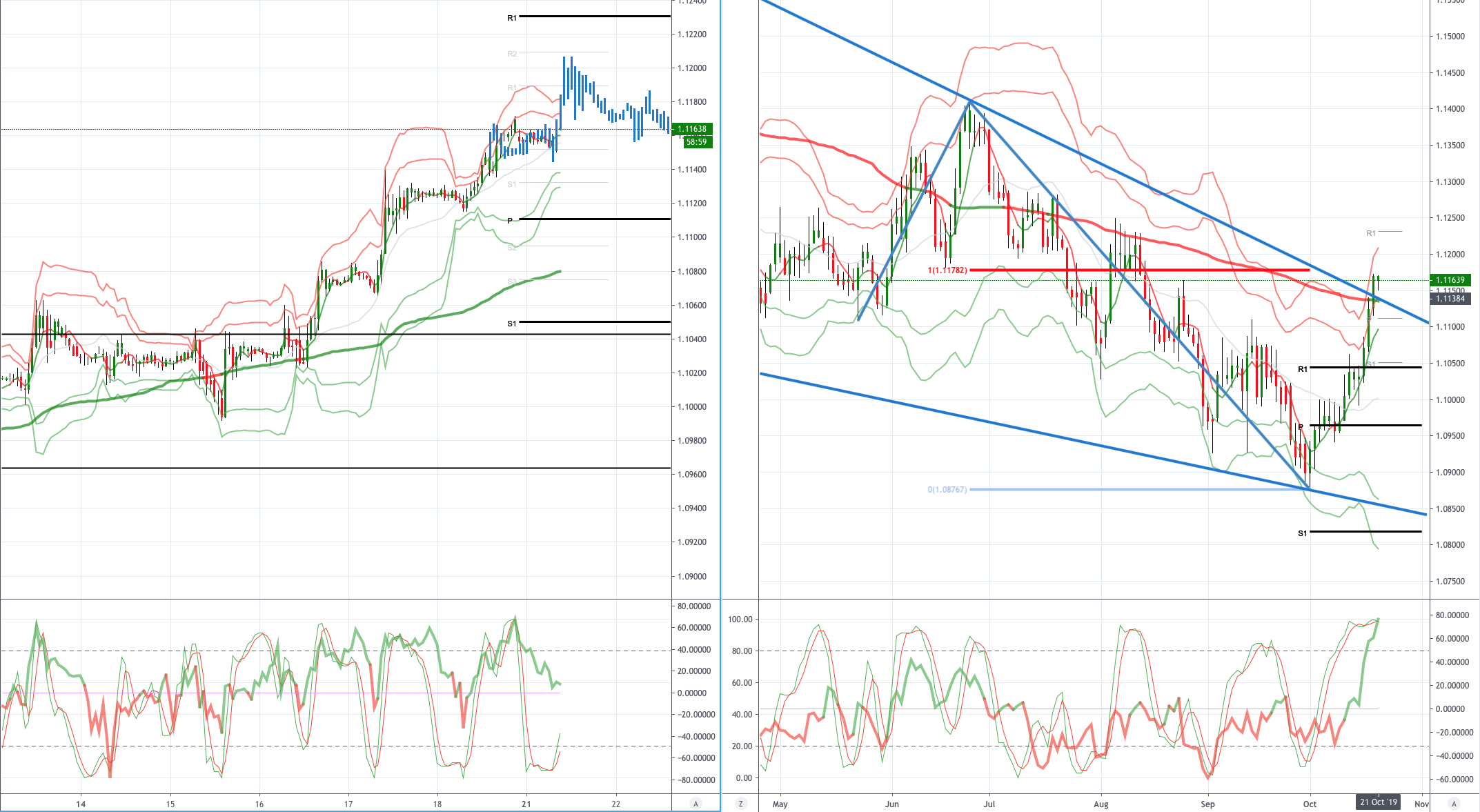

EURUSD (Intraday bias: Bullish above 1.11 target 1.1230)

EURUSD From a technical and trading perspective, as 1.11 acts as support look for an initial test of offers and stops above 1.12, expect profit taking on newly minted long positions on the initial foray above 1.12. The October upswing has impulsive qualities and as such I will be looking to buy corrective pullbacks in the near term. Only a failure below 1.1040 would concern the bullish bias.

GBPUSD (Intraday bias: Bullish above 1.2830 target 1.3150)

GBPUSD From a technical and trading perspective, as 1.2830 acts a support bulls look to establish traction above 1.30 targeting an extension to 1.3150/60 from this level I anticipate profit taking to emerge. The impulsive quality of the advance suggests a buy on dip strategy should be rewarded over the near term, on the week only a move through 1.25 would concern the bullish bias.

USDJPY (intraday bias: Neutral, bullish above 108.30 bearish below 108)

USDJPY From a technical and trading perspective USDJPY appears to be moving into a consolidation phase in the 108/109 range. As 108.40 supports I still anticipate a test of offers and stops above 109 which should cap on the initial test, however, a failure below 108 would open a swift test of bids below 107.50.

AUDUSD (Intraday bias: Bullish above .6850 target .6905)

AUDUSD From a technical and trading perspective pivotal as .6850 now acts as support look for a test of the pivot cluster at .6905 expect profit taking from this area, on the day only a breach of .6810 would concern the bullish bias.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!