Daily Market Outlook, October 25, 2021

.png)

Daily Market Outlook, October 25, 2021

Overnight Headlines

- China Expands Property Tax Trials In Next Step Of ‘Common Prosperity’ Drive

- Moody's: Housing Affordability To Worsen In Australia Amid Rising Prices

- New Zealand Reports Second-Highest Daily Covid-19 Cases In Pandemic

- Biden, Key Senators Huddle As Dems Drive Toward Budget Deal

- Italy, UniCredit Talks On Deal For Monte Paschi Have Collapsed

- Turkey's State Banks Likely To Follow Cen Bank And Slash Rates On Monday

- UK Chancellor Prioritises NHS, Skills And Levelling Up In Budget Windfall

- Governments Need To Fix Supply Chain Crisis, Top Shipping Boss Warns

- Investors Show Fear Of Central Bank Errors In Short-Term Bonds

- Oil Prices Extend Gains To Multi-Year Highs On Tight Supply

- Asian Shares Edge Higher, Dollar Weak As Traders Await Earnings

- HSBC Q3 Profit Up 74%, Beats Estimates, Announces Up To $2B Buyback

- Investors Pull $9.4bn From UK Funds In 2021 On Rising Inflation Angst

- Tesla Pulls Its New Full Self-Driving Beta Due To Software 'Issues'

- Inflation Pressure Now ‘Brutal’ Because Of Supply Squeeze, US Companies Say

The Week Ahead

- ECB meets, U.S. earnings season kicks into gear The European Central Bank will meet on Thursday, but the market is expecting it to be a non-event. The U.S. corporate earnings season kicks into high gear, with a large proportion of S&P 500 companies due to report results this week. The ECB is likely to say as little as possible, as policymakers look ahead to the December meeting when there will be an update of forecasts. The ECB will likely remain on record as saying inflation is transitory – even though market pricing suggests otherwise. In the U.S., a number of tech giants are due to report earnings this week and the focus will be on Apple, Amazon, Microsoft and Alphabet, among the market leaders in this year's rally. The tone of their reports and outlooks will likely determine if the 2021 rally continues or starts to peter out into year-end. The Bank of Japan is also due to deliver its policy decision on Thursday, but no change is expected at this week's meeting.

- Inflation and growth data lead to a quiet calendar Preliminary Q3 GDP and inflation data out of the U.S. and Europe will stand out in an otherwise quiet week for global economic data. The U.S. will release a raft of housing data, but the main events will be advance third-quarter GDP and the Federal Reserve's favoured inflation gauge, the core PCE price index. Other data of note includes consumer confidence, durable goods, weekly jobless claims and final University of Michigan October consumer sentiment. Euro zone highlights are flash Q3 GDP and October HICP; EZ sentiment indices, consumer confidence and the German Ifo are also due. There is no top-tier UK data this week, but finance minister Rishi Sunak will deliver his budget on Wednesday. Japan data includes Tokyo CPI, unemployment, industrial production and retail sales. China's industrial profits are due during the week, but the focus will be on Sunday's NBS October PMIs. It will be a fairly busy week in Australia with Q3 CPI and PPI out, along with September retail sales. New Zealand data includes trade numbers and the NBNZ business outlook. Canada has a central bank decision and August GDP due.

CFTC Data

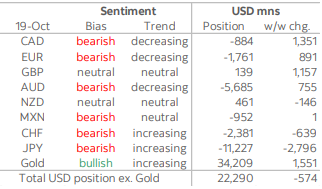

- Investors again trimmed the aggregate USD long position slightly by USD574mn to USD22.3bn or less than USD1bn below its recent high in early October, in line with the near 1% decline in the dollar (Bloomberg dollar index basis) over the week to Tuesday. The overall ‘minor’ adjustment in dollar sentiment hides a broad move against the classic haven currencies, the JPY and CHF, likely due to their high-sensitivity response to climbing long-term US yields while accounts favoured the CAD, EUR, GBP, and AUD.

- The bearish JPY position rose by USD2.8bn to USD11.2bn as investors increased their short contract holdings while longs held relatively steady; shorts now exceed longs by over 100k contracts which represents the most JPY-bearish position since late-2018. Over the period covered in this report, the JPY was the only currency that lost ground against the dollar with a 0.7% depreciation. The CHF short also increased by USD639mn to USD2.4bn although the CHF managed to hold a respectable ~0.9% gain against the dollar in line with the EUR and CAD.

- Negative sentiment in the CAD eased as investors trimmed the currency’s net short by USD1.35bn—the biggest change in positioning after the JPY to USD884mn. While short contracts held practically unchanged, accounts increased longs by 18k contracts, representing the largest bullish push into the CAD since July 2019, and taking the dollar terms position to below USD1bn for the first week in five. • The GBP short was erased with a USD1.16bn shift in sterling’s favour as investors likely prepare for earlier-than-anticipated hikes from the Bank of England that may come as soon as early-November. Speculators mainly continued to slash their short bets against the GBP from its two-year high two weeks ago while long contracts only rose slightly. For similar reasons, with markets wagering that the RBA may increase rates as soon as late2022, bearish AUD positioning was reduced by USD755mn to a still very large net short of USD5.7bn. •

- Elsewhere, the NZD long fell by USD146mn to USD461mn (still larger than the only other ’long’, the GBP’s) while MXN positioning was left practically intact at slightly under USD1bn. In other markets, bullish WTI positioning rose to a twelve-week high amid continued demand/supply imbalances in energy markets.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.1600-15 (1BLN), 1.1660 (452M), 1.1720-25 (637M)

- GBP/USD: 1.3700 (513M), 1.3745-50 (234M)

- USD/CAD: 1.2500 (620M)

- USD/JPY: 112.50 (780M), 113.00-15 (1.2BLN), 113.50-60 (440M)

- 114.00 (480M), 114.25 (421M), 114.35-40 (425M), 114.50-55 (650M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.17 Bullish above

- EUR/USD opened 1.1626 after closing Friday at 1.1646

- That was the bottom as EUR/JPY demand helped to underpin EUR/USD

- EUR/USD grinded higher and is at session high at 1.165 into the afternoon

- Resistance is around 1.1670 where tops and 38.2 fibo comes into play

- A break above 1.1675 targets the 55-day MA at 1.1709

- Support comes in at the 10-day MA at 1.1612 and 21-day MA at 1.1606

- FX option implied volatility heavy near pandemic-era lows

- Low implied volatility consistent with low actual FX volatility

- Volatility premium for downside strikes retreats from early Oct highs

- Mild demand for 1.1700-50 strikes last week, but overall traded volumes low

- Minimal premium for Thurs ECB, slightly more for Nov Fed, but focus on Dec

- 2-month at a premium to 1-month since Dec ECB and Fed capture

- Price action remains consistent with EUR/USD trading limited/familiar range

GBPUSD Bias: Bearish below 1.37 Bullish above.

- Steady demand, supported by major budget spending

- +0.2% with the USD softer, at the top a 1.3752-1.3780 range with steady flow

- Budget - Sunak says inflation, rates feed into budget thinking

- UK plans GBP 6 billion package to boost health service capacity

- UK plans GBP 8 billion of extra health and education spending

- Charts; 5, 10 & 21 day moving averages climb, 21 day Bollinger bands expand

- Daily momentum studies conflict - bullish setup while 1.3733 10 DMA holds

- 1.3831, 50% of 2021 fall capped last week - break to test 1.3913 Sep high

USDJPY Bias: Bullish above 112.50 Bearish below

- Firmer as U.S. Treasury yields edge higher

- +0.2% in a 113.50-113.83 range, edging higher throughout the morning session

- U.S. Treasury yields recovered a touch with the 10yr 1.4bp higher at 1.648%

- Nikkei trades -0.99% led by the tech sector after Nasdaq Friday

- BOJ discussing phasing out pandemic support as economy reopens

- Friday's close below the Tenkan line, a support on the climb, was negative

- Tenkan line becomes initial resistance on Monday, coming in at 113.95

- Support starts at 112.56, 38.2% Sept-Oct climb, then 111.90 50% & Kijun line

- 113.50/60 440MLN and 114.00 480MLN are Monday's close strikes

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD opened at 0.7465 and traded in a 0.7464/81 range

- Heading into the afternoon it is settled around 0.7475

- AUD was underpinned against JPY and USD by rise in commodities

- Lon copper is 1.8% higher while Dalian iron ore is up close to 4%

- AUD/USD sellers tipped above 0.7500 with resistance at 200-day MA at 0.7562

- Support is at the 10-day MA at 0.7438 and break would suggest top is forming

- AUD/USD may consolidate ahead of crucial Aus CPI data in Wednesday

- The CPI reading will likely determine AUD direction in short-term

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!