Daily Market Outlook, September 7, 2022

Daily Market Outlook, September 7, 2022

Overnight Headlines

- Dollar Hits Fresh Peak Against Yen On Bets For Aggressive Fed

- Yen’s Rapid Decline Triggers Strongest Government Warnings Yet

- Fed’s Barkin: Has A ‘Bias Towards Moving More Quickly’ To Tighten Policy

- New UK PM Truss Pledges Action On UK’s Soaring Energy Bills This Week

- UK’s Liz Truss To Step Back From Early Confrontation With Brussels

- Chengdu Lockdown Likely To Be Extended As Covid Cases Jump

- Ex-BoJ Policymaker: BoJ To Keep Low Rates Even As Inflation Seen Hitting 3%

- Japan To Expand Fuel And Ammo Storage On Islands Near Taiwan

- Australia Economy Buoyed By Consumer Spending, Exports In Q2

- China Sets Yuan Fix At Strongest Bias On Record As Losses Mount

- Yen Set For Worst Year On Record As Traders Eye Intervention

- BoJ Boosts Bond Buying As Yields Advance Toward Policy Limit

- Oil Falls On Renewed Demand Concerns, Rate Hike Expectations

- Google Announces October 6th Event To Launch The Pixel Watch And Pixel 7

- AIG Unit Corebridge Targets Up To $15.5 Billion Valuation In US IPO

- Asian Stocks, Currencies Fall As Strong Data Fans Hawkish Fed Bets

- Bank of Canada Set To Lift Rates Into Restrictive Territory

The Day Ahead

- Asian equity markets are trading mostly lower as prospects of further global monetary policy tightening weigh on investor risk sentiment. Also adding to the uncertainty are Covid lockdowns in China and the ongoing energy crisis in Europe. Chinese data overnight revealed softer-than-expected trade reflecting weakening global and domestic demand. Meanwhile, yesterday’s US ISM report signalled a robust pace of expansion in services activity, resulting in further rises in Treasury yields and the US dollar.

- UK markets will likely remain most alert to the economic policies of the new government as well as the appearance of Bank of England Governor Andrew Bailey and other MPC members in Parliament today. New PM Truss will hold her first Cabinet meeting this morning and face PMQs later today. Her stated priorities include tax cuts to boost economic growth and the provision of a major support package for households and businesses in the face of soaring energy prices. The support measures are expected to be announced tomorrow and, according to media reports, could cost as much as £200bn.

- As noted above, BoE Governor Andrew Bailey will appear before the Treasury Committee along with Huw Pill (Chief Economist) and external MPC members Silvana Tenreyro and Catherine Mann. The latter two are, respectively, considered to be the most dovish and hawkish rate-setters on the Committee. Mann made hawkish comments earlier this week, favouring ‘acting more forcefully’ on interest rates.The MPC members will be questioned on the decision in August to raise interest rates by 50bp to 1.75% and on the outlook for rates and the economy including inflation. The new government’s action on energy prices, if confirmed, may lower the expected peak in inflation but could also increase demand in the economy. The independence of the BoE may also be discussed. Financial markets are partly priced for a 75bp rate rise at their policy update next week.

- The Bank of Canada is expected to raise interest rates today by another 75bp to 3.25% following its outsized 100bp increased at the last meeting. Fed speakers today include Cleveland Fed President Mester and Vice Chair Brainard who will discuss the economic outlook.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9875 (649M), 0.9900 (813M), 0.9950 (896M), 0.9975 (605M)

- EUR/USD: 1.0000 (691M). USD/JPY: 141.00 (1.39B)

- EUR/GBP: 0.8575 (1.21B)

- EUR/SEK: 10.6200 (652M). EUR/NOK: 9.8500 (628M)

Technical & Trade Views

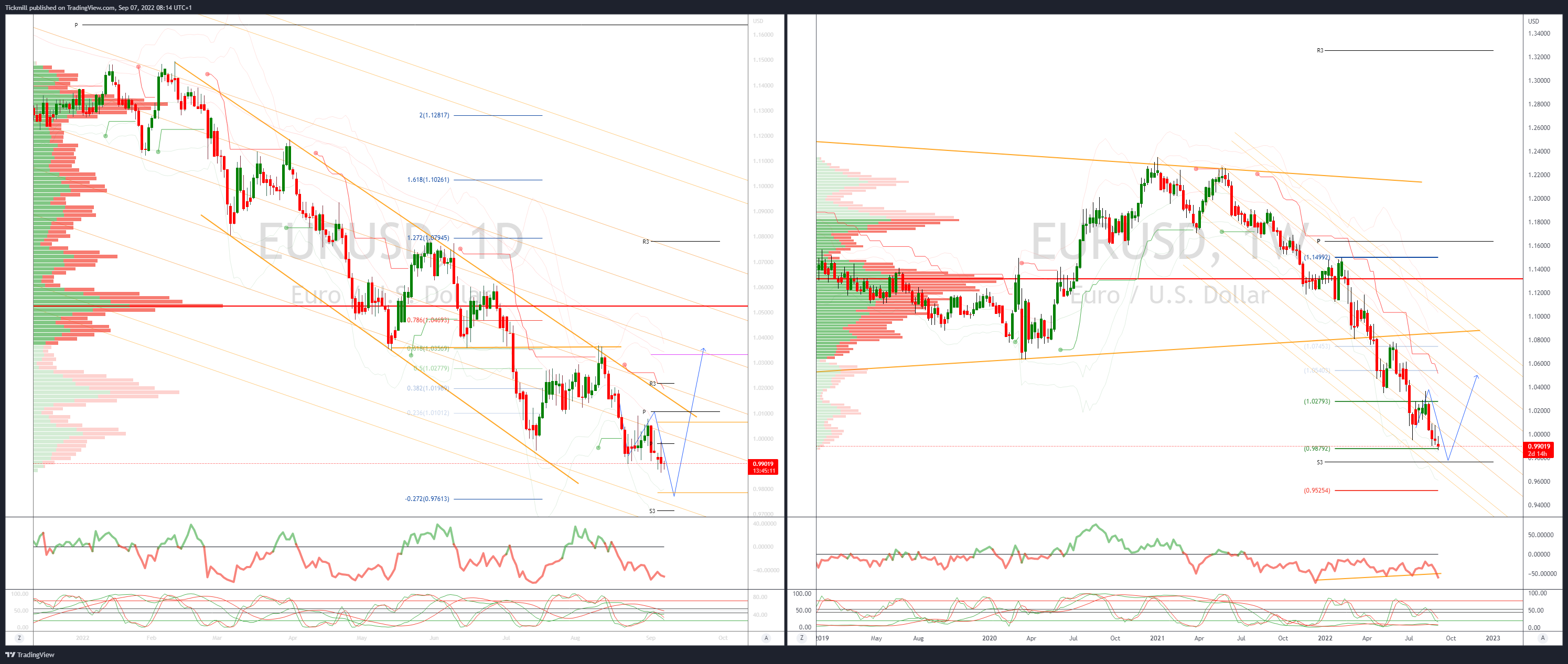

EURUSD Bias: Bearish below 1.0250

- Asia was risk-off with E-Minis easing 0.6% while AXJ index fell 1.5%

- USD was bid from the start and made solid gains across the board

- The EUR/USD eased to 0.9878 and is at the session low into the afternoon

- Support yesterday's 0.9864 low & there isn't a lot of support below there

- Market not too concerned about prospect of 75 BP hike by ECB

- Only a move above 0.9961 puts the trend in doubt

- Sustained 0.9900 break would target 0.9608 base in September 2002

- 20 Day VWAP bearish, 5 Day bearish

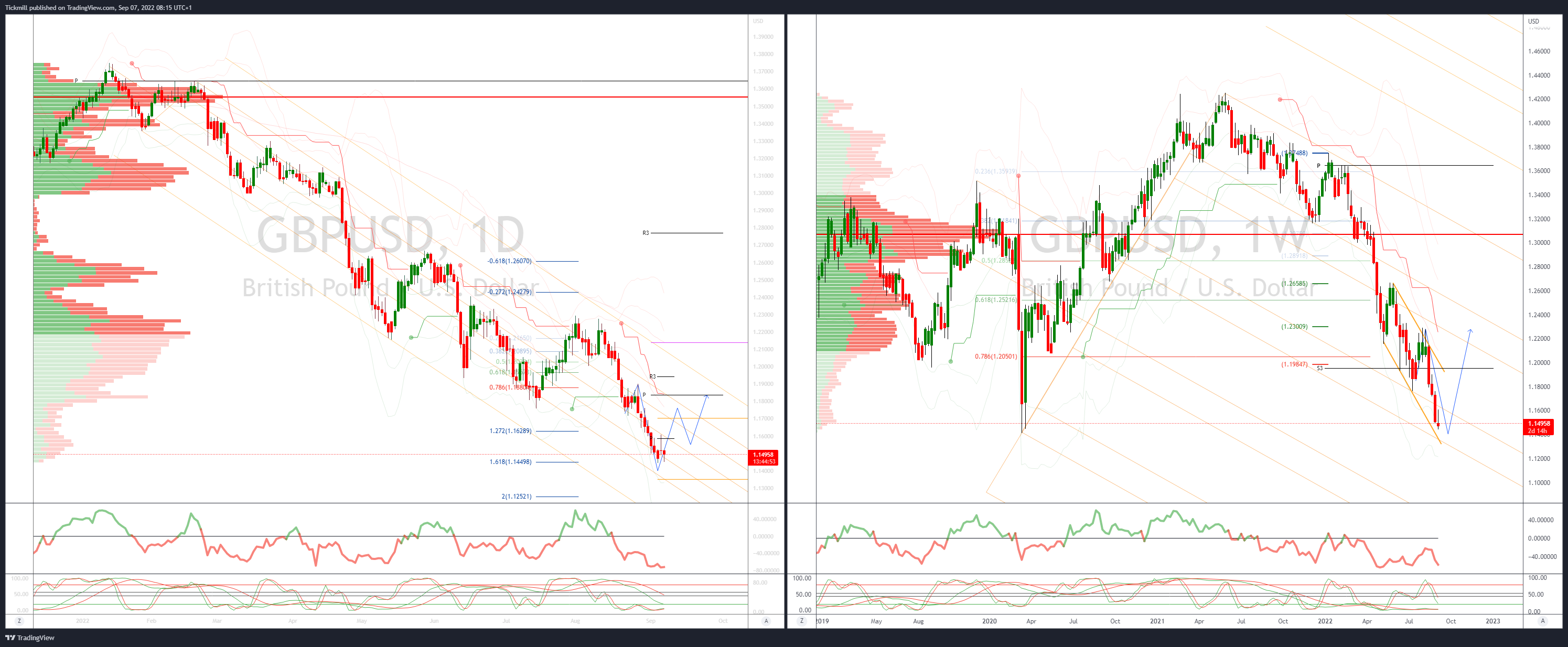

GBPUSD Bias: Bearish below 1.2050

- New PM fails to lift negative sterling sentiment

- Trades down 0.3% with EUR/GBP up 0.15%, as risk currencies sold in Asia

- Sustained sharp rise in UST yields on Tuesday weighed on sentiment in Asia

- Latest poll suggests sterling will remain under pressure

- Bearish trending setup targets a test of the 1.1413 March 2020 base

- Close above 1.1612 10 day moving average needed to undermine downside bias

- 20 Day VWAP is bearish, 5 Day bearish

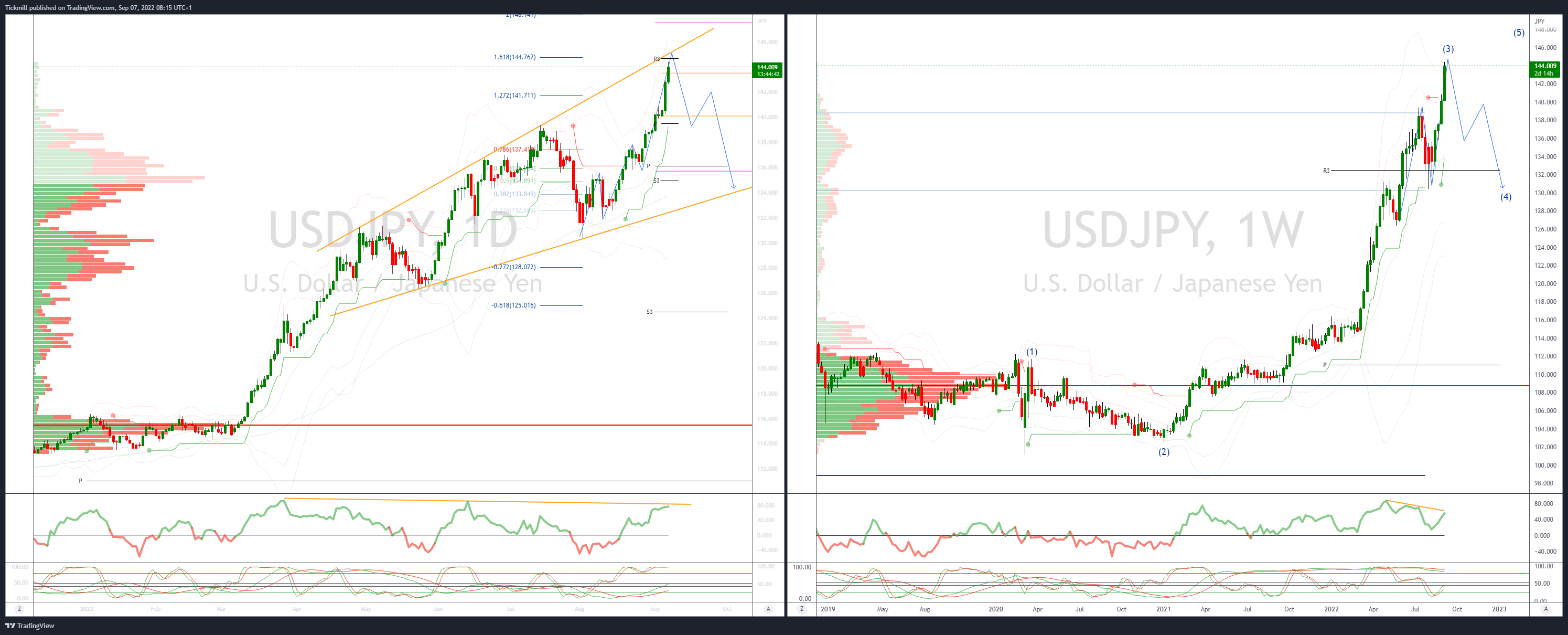

USDJPY Bias: Bullish above 133.40

- Japan FX jaw – boning again fall on deaf ears as USDJPY trade above 144

- Yield on US Treasury 2s as high as 3.515% overnight, Tsy 10s to 3.355%

- US yields near trend highs on expectations of aggressive Fed

- Large 141.00 $1.4 bln option expiries today but well below current spot

- Meteoric USD/JPY rise should see even more heated jaw-boning today

- Japanese exporters also likely busy today into Tokyo fix

- Hawkish Fed, higher US yields, importer demand to keep USD bid on dips

- 20 Day VWAP is bullish, 5 Day bullish

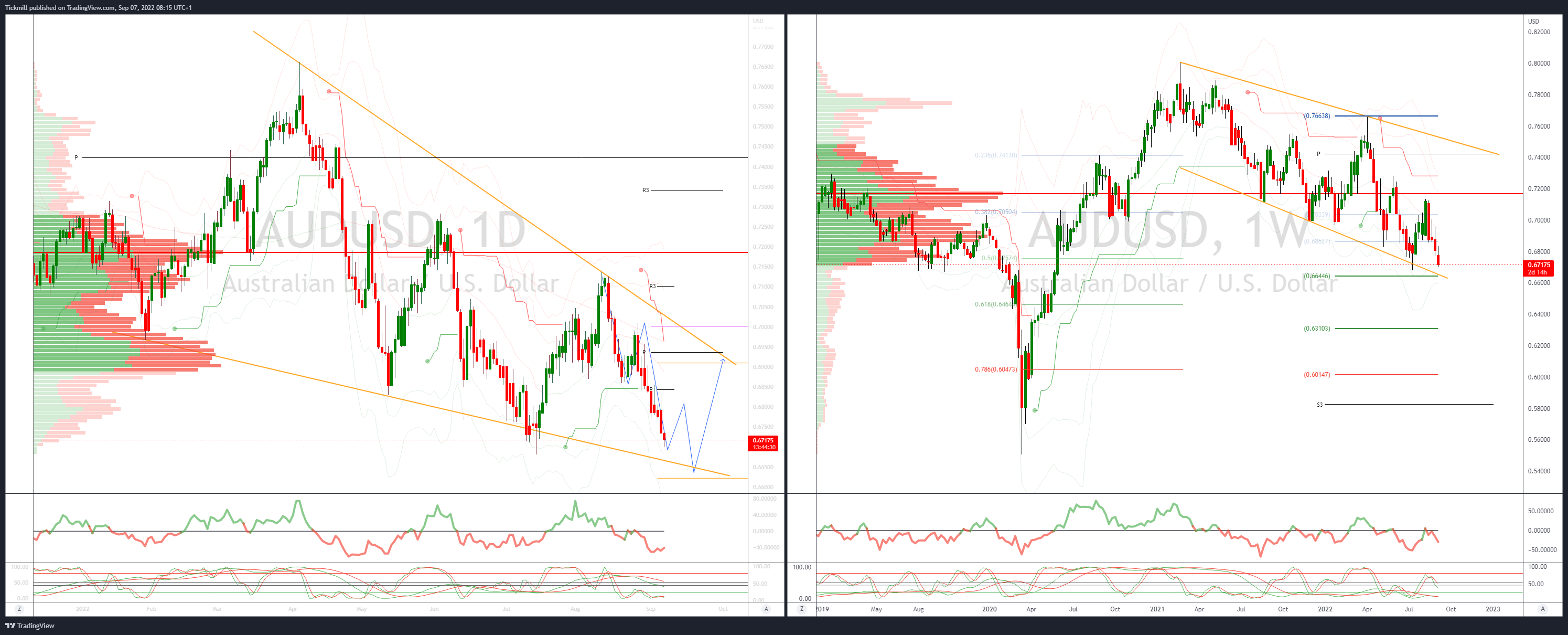

AUDUSD Bias: Bearish below .71

- Aus Q2 GDP comes in close to expectations and there is a muted reaction

- AUD/USD has been under pressure all morning and remains so

- Risk off mood in Asian with E-minis -0.55% and Nikkei -1.29%

- AUD/USD at session low below 0.6710 and nearing 2022 low at 0.6682

- Weak global growth outlook weighing on AUD/USD sentiment

- AUD/USD trending lower and break below 0.6680 could see trend accelerate

- 20 Day VWAP is bearish, 5 Day bearish

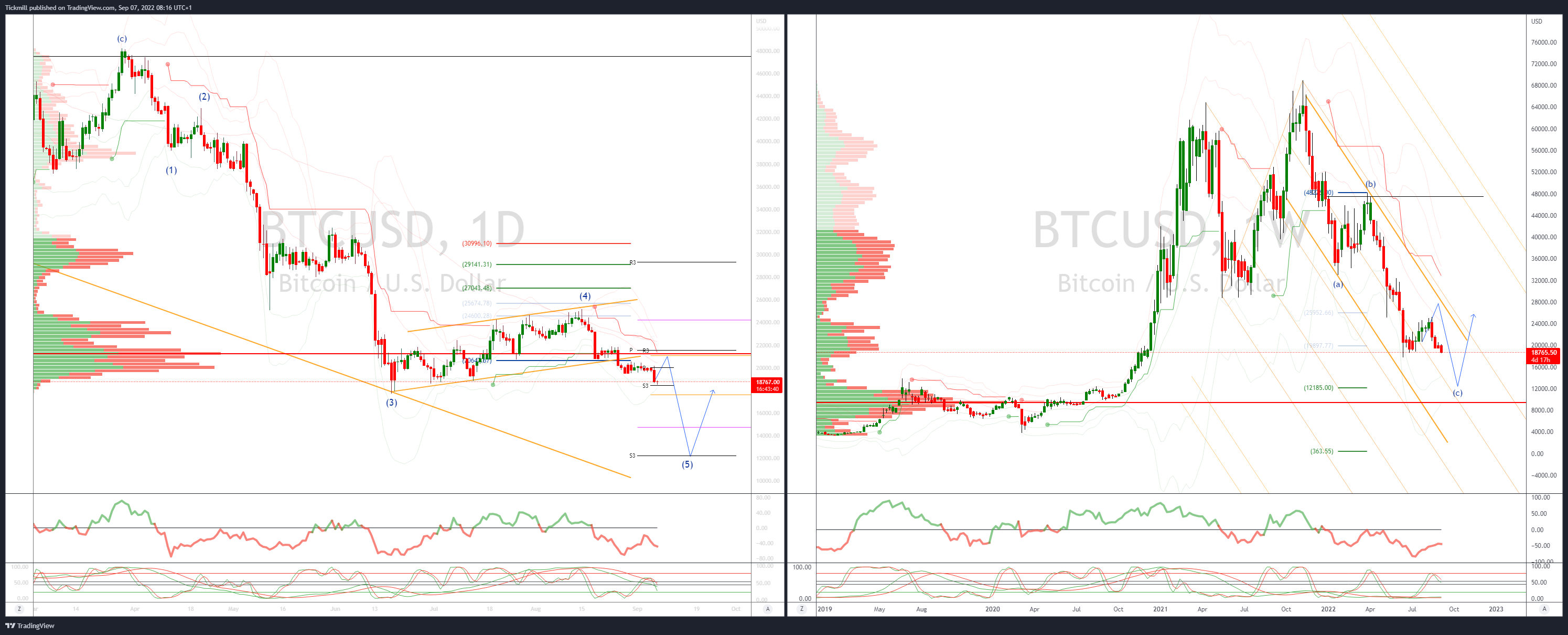

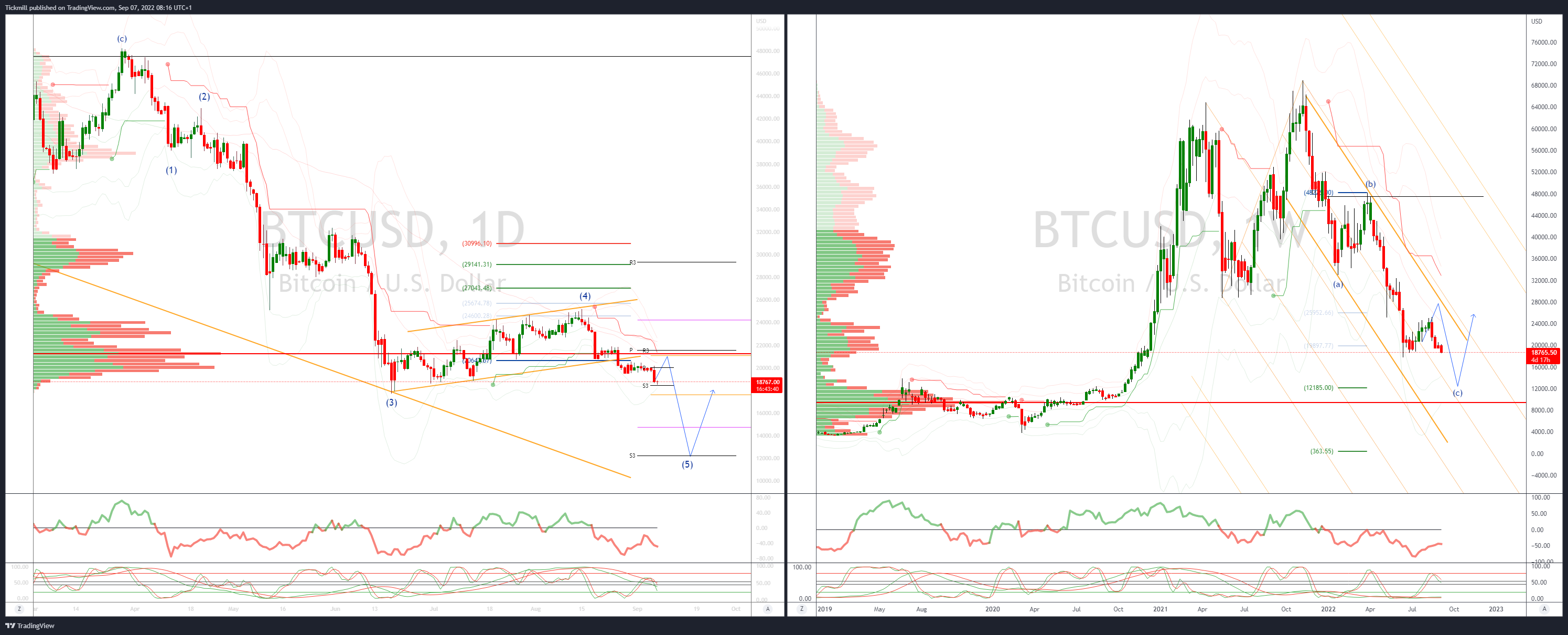

BTCUSD Bias: Bearish below 25.3K

- BTC trades sub 19k again

- Crypto market sinks below $1Trillion as BTC trades to test 2022 lows

- KMPG report suggests Crypto investment to remain depressed remainder of 2022

- Russia exploring stablecoin settlements with friendly nations according to Coindesk

- Macro econ uncertainty continues to weigh on BTC as USD prints 20yr highs

- BTC supported by Jul 13 low 18.9k

- Aug 28's 22.2k may pull BTC higher

- 20 Day VWAP is bearish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!