Dissecting The Markets: Euro Advances Amid Robust Eurozone Data; Dollar Softens Despite Strong US Labor Indicators

Recent data releases suggest that the Eurozone economy is displaying greater resilience than previously forecasted. Eurostat reported that the Eurozone's GDP expanded by 0.9% year-over-year in the third quarter, surpassing consensus estimates. Germany, the bloc's largest economy, avoided a technical recession with a surprising 0.2% quarter-over-quarter growth, beating expectations of a 0.1% contraction.

Inflationary pressures are also more pronounced than anticipated. The flash HICP for October accelerated to 2.0% year-over-year, exceeding both the previous month's 1.7% and market expectations of 1.9%. This uptick suggests that underlying inflation is gaining momentum, complicating the ECB's path toward policy normalization.

ECB President Christine Lagarde's recent remarks reflect this dilemma. While expressing confidence in the central bank's ability to tame price pressures, she refrained from committing to a definitive rate cut trajectory. The combination of stronger growth and higher inflation has led traders to pare back bets on significant interest rate reductions in the December policy meeting, contributing to the Euro's appreciation.

From a policy perspective, the ECB faces a delicate balancing act. The central bank must navigate between supporting the recovery amid lingering uncertainties and addressing rising inflationary risks. The recalibration of market expectations underscores the sensitivity of currency movements to shifts in anticipated monetary policy actions.

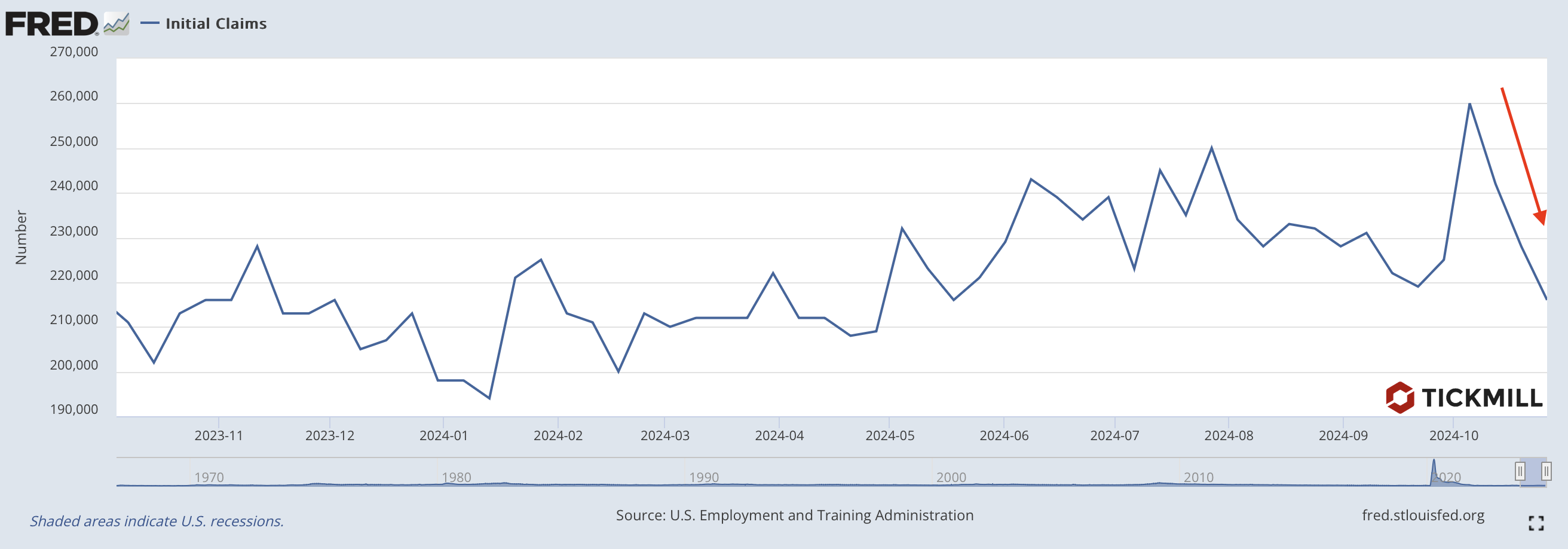

In contrast, the US labor market continues to exhibit strength. Initial Jobless Claims for the week ending October 25 fell to 216K, the lowest level in nearly 22 weeks, signaling robust employment conditions:

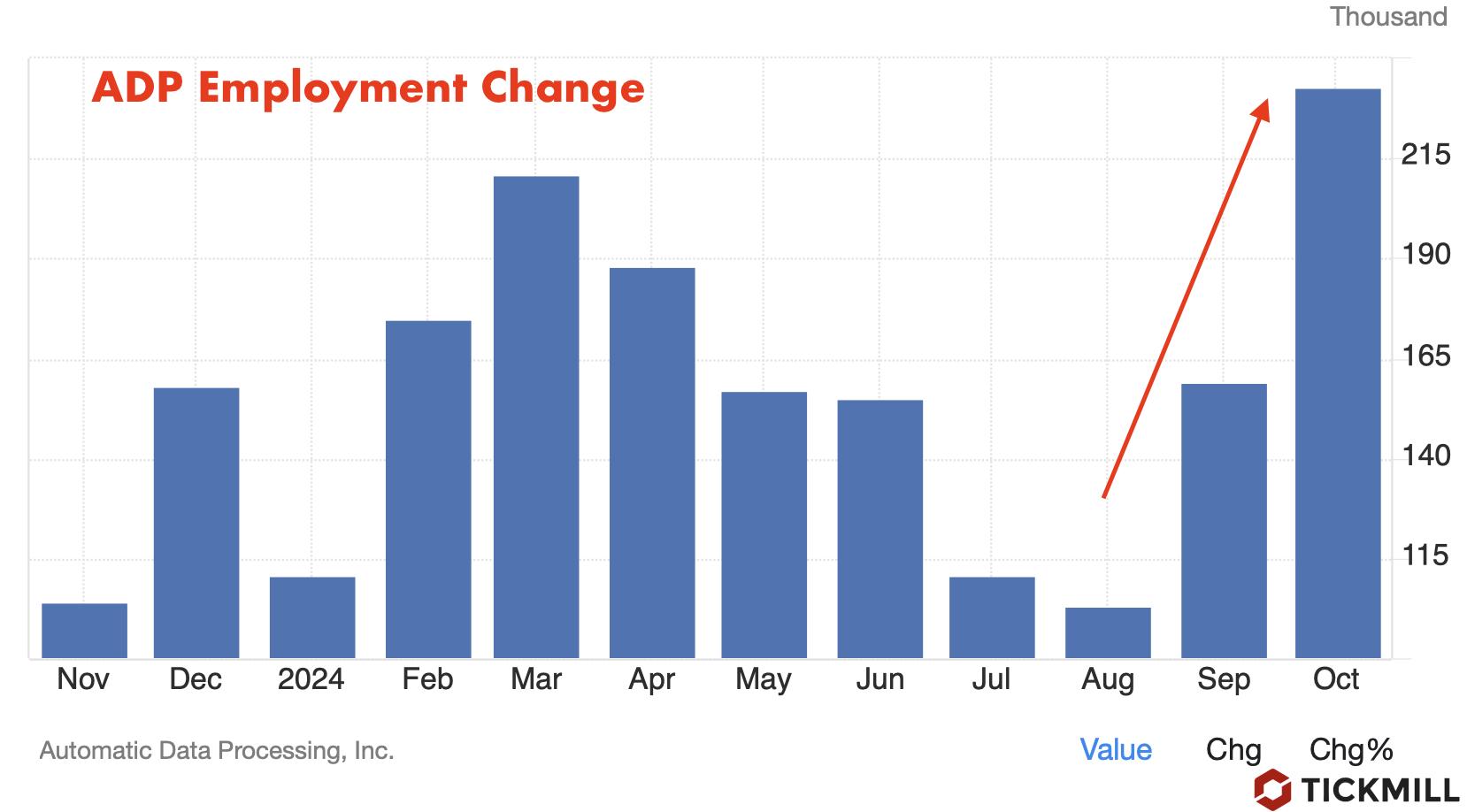

Additionally, the ADP Employment Change report showed private payrolls increasing by 233K in October, significantly above September's 159K. These figures suggest that the labor market remains tight, which could sustain consumer spending and support economic growth:

Inflation indicators also point to persistent price pressures. The core Personal Consumption Expenditures Price Index—the Fed’s preferred measure of inflation—accelerated to 2.7%, slightly above market estimates of 2.6%. This level exceeds the Fed's long-term target, potentially warranting a reassessment of the current monetary policy stance.

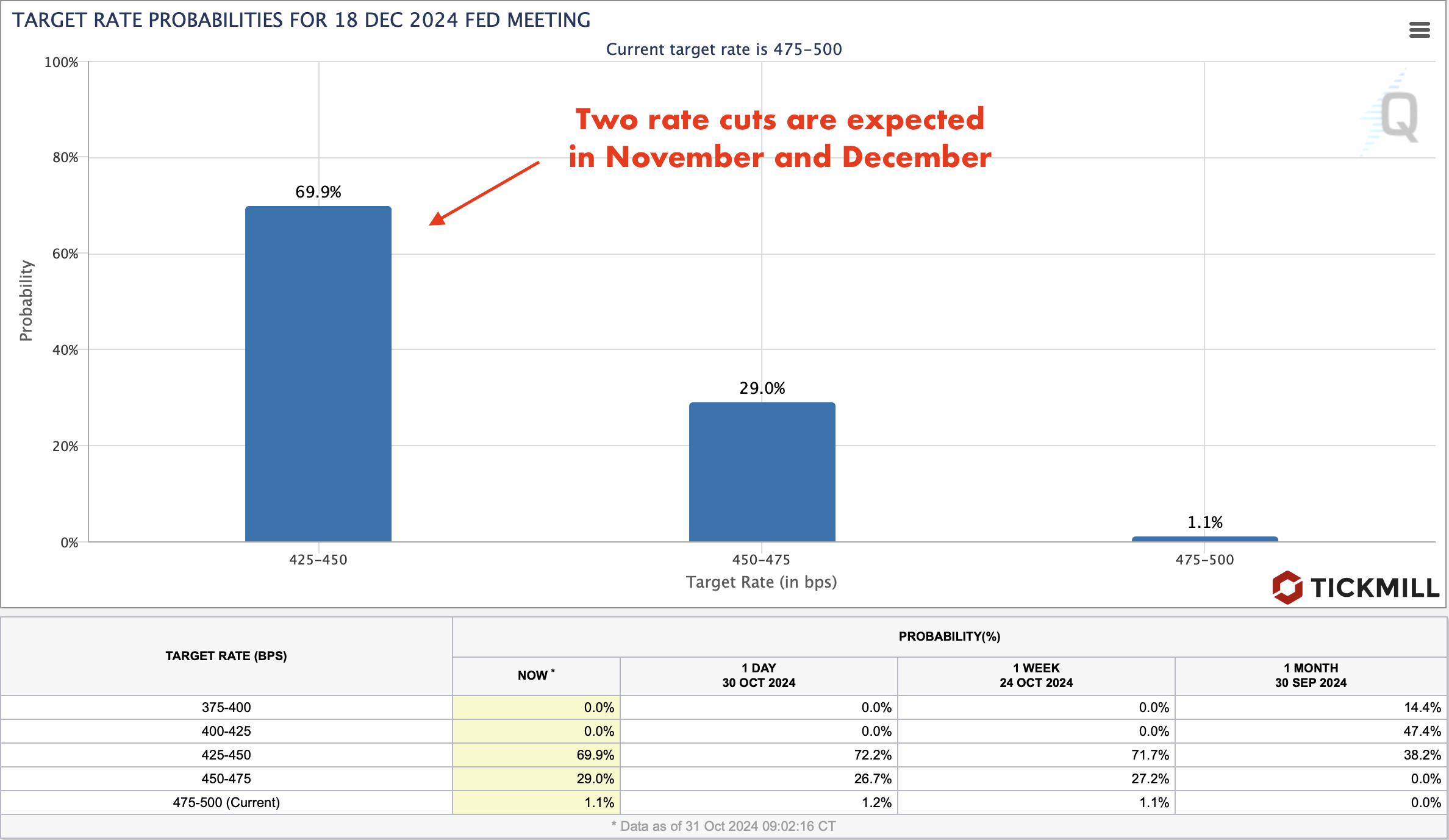

However, despite these strong indicators, market participants anticipate that the Fed will proceed with interest rate cuts in the upcoming November and December meetings, as reflected in the interest rate futures:

Geopolitical factors additionally complicate market expectations as they increase uncertainty that can't be quantified. Traders appear to be factoring in the possibility of former President Donald Trump winning the upcoming election against Vice President Kamala Harris. Trump's recent statements about imposing a 10% tariff on all imports could have significant repercussions for the global economy, particularly for export-oriented regions like the Eurozone.

The threat of increased tariffs introduces downside risks for the Eurozone's manufacturing sector, which is heavily reliant on international trade. A shift toward protectionism could dampen external demand, exacerbate supply chain disruptions, and ultimately weigh on economic growth. These considerations may influence the ECB's policy deliberations, potentially offsetting the impact of stronger domestic data.

The GBP/USD pair remains relatively stable near the 1.30 mark, despite strong US economic data. The UK's Office for Budget Responsibility has revised its inflation forecasts upward for 2024 and 2025, now projecting rates of 2.5% and 2.6%, respectively, compared to earlier estimates of 2.2% and 1.5%. This adjustment suggests that inflationary pressures may persist longer than initially anticipated, which has implications for the BoE monetary policy.

While the BoE is expected to cut interest rates by 25 basis points to 4.75% at its upcoming November 7 meeting, the upward revision in inflation forecasts could lead to a more cautious approach in future policy decisions. The central bank faces the challenge of supporting economic activity without fueling inflation, particularly in an environment where wage growth and consumer spending remain robust.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.