Dissecting the Markets: USD Advances on Growing Strength of US Economy Relative to Its Peers

The US Dollar retreated from a three-week high, ceding ground above the 107 foothold. The pullback seems to be purely technical, given the preceding five-day winning streak fuelled by robust US employment data, strong inflation readings such as the PPI, and dovish monetary signals from both the ECB and China.

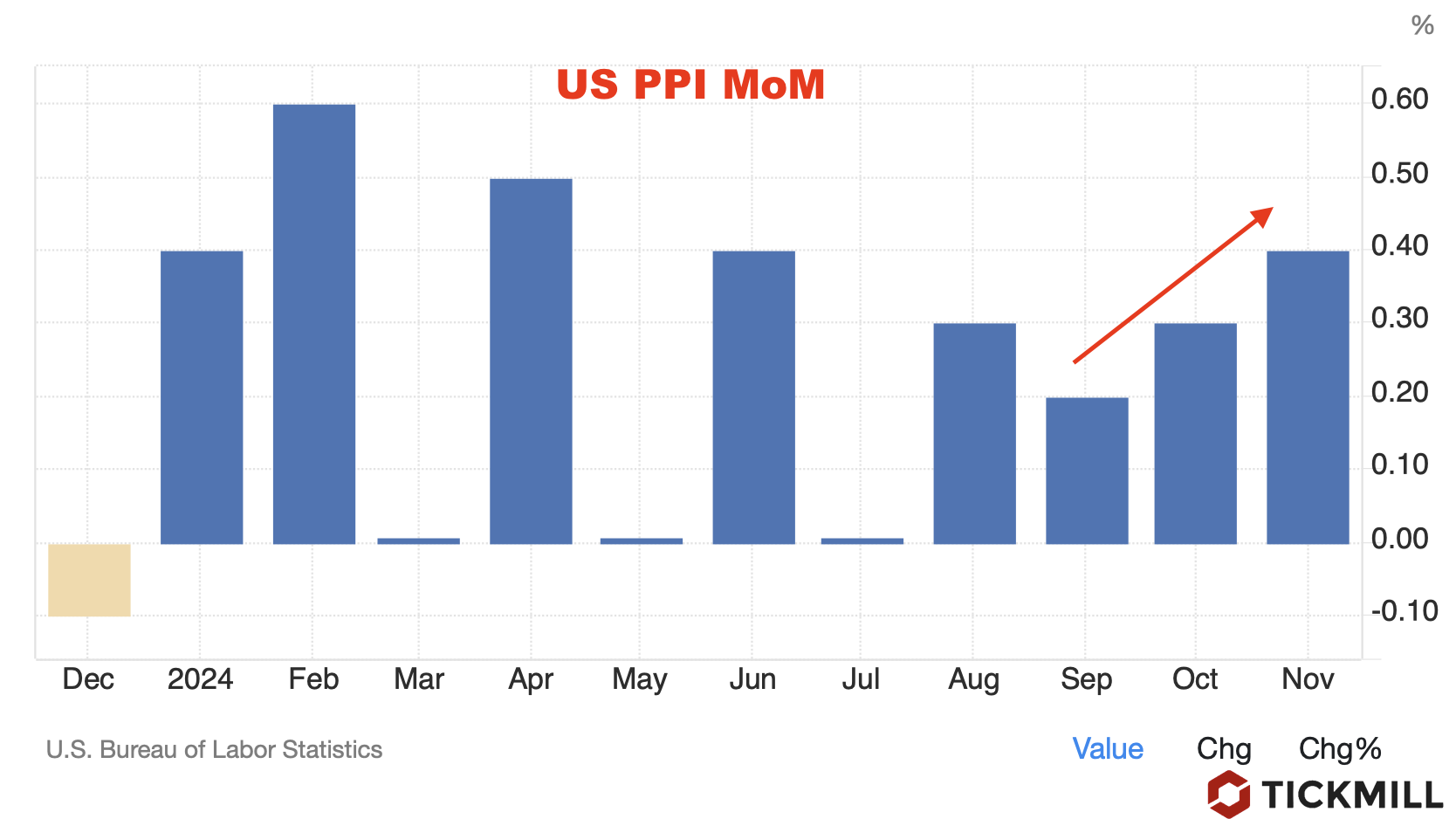

On Thursday, the US Producer Price Index for November exceeded market expectations, solidifying the dollar's position from a fundamental point of view. While this data did not alter the prevailing market consensus that the Federal Reserve (Fed) is poised to cut interest rates by 25 basis points (bps) at its upcoming meeting on December 18, it certainly affected the view of market participants on how hawkish the guidance regarding the rate path in 2025 will be:

Meanwhile, the 10-year US Treasury yield climbed to 4.34%, marking a weekly high. The robust performance of US bonds underscores the strength of the American economy relative to its global counterparts, which drives repricing of expectations regarding the rate cuts by the Fed, luring foreign capital into US fixed income assets and hence driving the dollar price higher.

The DXY Index’s attempt to break above the 107.00 level is a significant technical signal, which hints that the USD decline in the second half of November should be interpreted as a pullback rather than a reversal. Immediate resistance lies near 107.50, while the area of potential support now shifts to 106.50, where the key ascending trendline will lie:

The Euro faced headwinds following the ECB acknowledgment of potential monetary easing. ECB President Christine Lagarde confirmed that a 50 bps rate cut was under consideration, but the Governing Council ultimately opted for a more cautious 25 bps reduction. Influential policymakers such as the Bank of France’s Francois Villeroy de Galhau and Latvia’s Martins Kazaks have signaled support for further rate cuts, reflecting the growing consensus among policymakers, which removes hurdles for further rate cuts. This interpretation by the market is, of course, a bearish development for the Euro.

The ECB’s updated economic projections suggest the Eurozone economy will grow by just 0.7% in 2024 and 1.1% in 2025, a downgrade from earlier forecasts. This is another bearish signal for the Euro, indicating the ECB's openness to further stimulus if required.

In China, the Politburo, led by President Xi Jinping, pledged to adopt a “moderately loose” monetary policy in 2025 alongside a “more proactive” fiscal approach. The dovish stance from Beijing signals a commitment to reviving economic growth, but it also exacerbates the yield gap between US and Chinese assets, further supporting USD strength.

The Pound Sterling suffered sharp declines against major currencies on Friday following disappointing economic data from the United Kingdom. According to the Office for National Statistics, the UK’s GDP contracted by 0.1% in October, mirroring September’s decline and defying expectations of a modest 0.1% expansion. Additionally, both Manufacturing and Industrial Production fell by 0.6% month-over-month, marking the second consecutive monthly contraction. Goldman Sachs responded to these developments by revising its 2024 GDP growth forecast for the UK downward from 1.2% to 1.0%.

The technical outlook for GBPUSD reveals that the price has started to retreat after encountering resistance at the medium-term descending trendline. Attempts to break above this level were weak, signaling growing fragility and buyer indecision amid the strengthening dollar and the absence of strong domestic economic drivers from the UK. The swift decline has led to a retest of the medium-term support line, raising the possibility of a bearish breakout. Such a move could pave the way for sellers to target 1.25, with the potential for even lower levels as momentum traders may reinforce the downward trend:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.