Dollar Holds The Line Following NFP Beat

NFPs Beat Forecasts

The US Dollar has managed to avoid a more aggressive sell-off as we head into the weekend. Following softness ahead of the data, USD rallied yesterday as the June US labour market reports came out better than expected. The headline NFP rose to 147k from 139k prior (revised higher to 144k), above the 11k print expected. The unemployment rate was also seen falling back to 4.1% from 4.1% prior, in contrast to the 4.3% reading expected. A softer wage growth reading was the only downside result yesterday and did little to stop USD from rebounding as the data was digested.

Fed Easing Expectations

There had been plenty of chatter ahead of the release suggesting that a weak NFP could fuel an uptick in July Fed easing expectations. The CME was pricing around a 25% probability of a July cut going into the data, which has since fallen to less than 5%. With a July cut now effectively ruled out, September remains the key target with CME pricing in a more than 70% chance of a cut.

Trade & Trump

Despite the better data, however, USD has failed to see a fuller recovery as the outlook remains threatened by lingering tariff uncertainty as well as fiscal concerns. The end of the US/China 90-day tariff suspension window next week runs the risk of causing fresh volatility in markets if no deal or extension is made. Furthermore, Trump’s tax and spending bill passing through the House last night means the US is now facing a steep rise in national debt which is set to further exacerbate uncertainty and could see USD moving lower as Trump starts to action the bill.

Technical Views

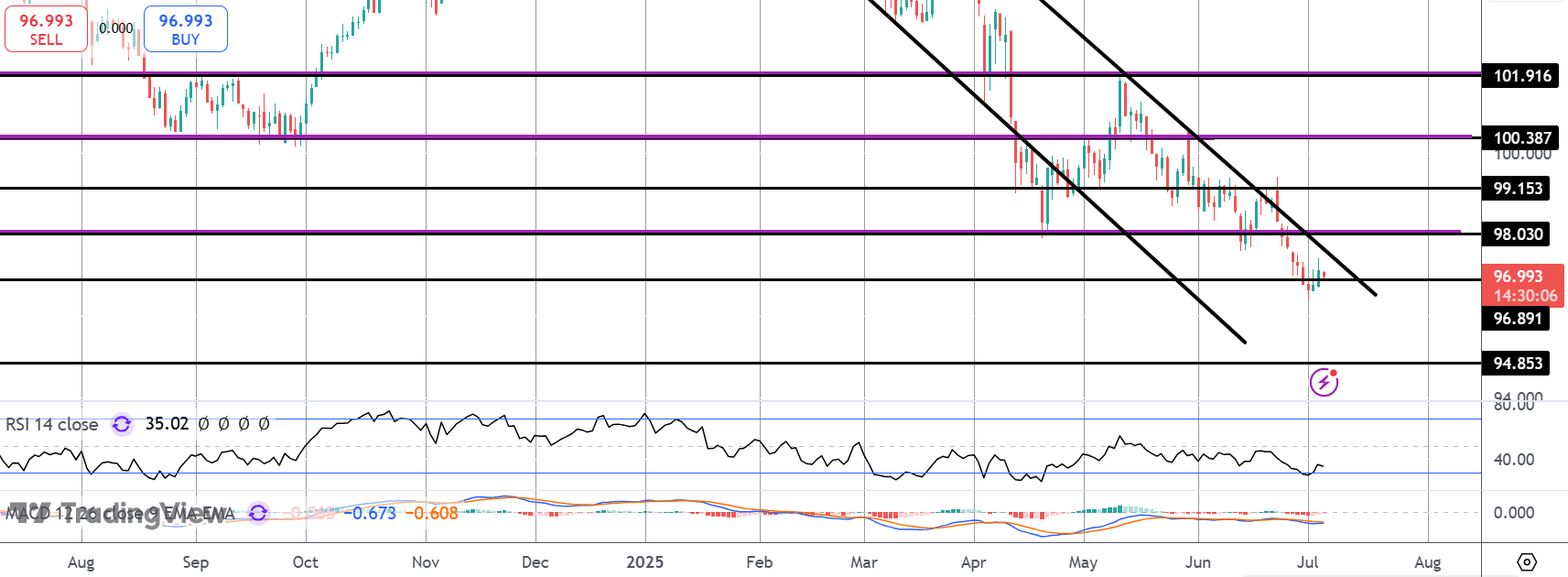

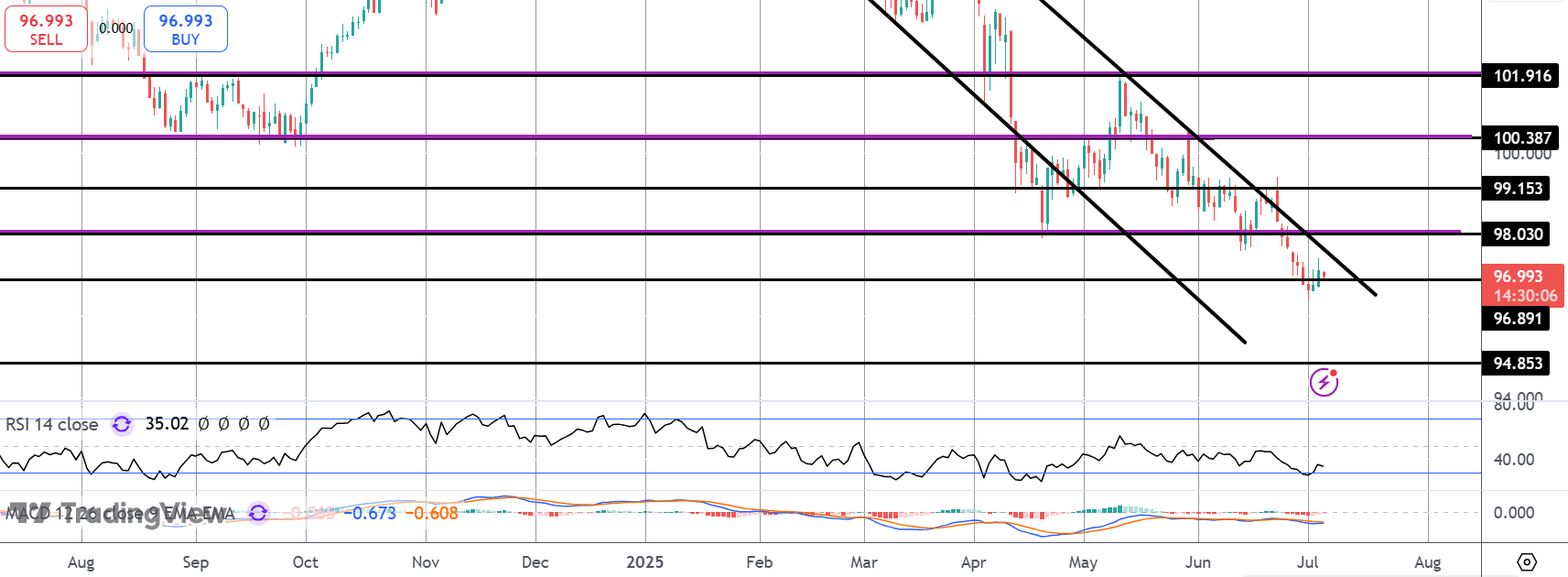

DXY

Price is holding above the 92.89 level for now. However, still within the bear channel and with momentum studies bearish, focus is on a fresh break lower with 94.85 the deeper support area to watch. Bulls need to see a break back above 98 to ease downside pressure here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.