Dollar Recovers but key Trend Line is Broken, Hampering Swift Rebound

TheDollar managed to gain a foothold after touching 100-day SMA on Friday, but onMonday the recovery was difficult - the dollar index dangled near the week’s opening:

Sellershave broken the uptrend that has lasted since June 2021, so ongoing correctionmay take place in several stages. The main resistance in the index, where awave of sales may occur, is the level of 95.50.

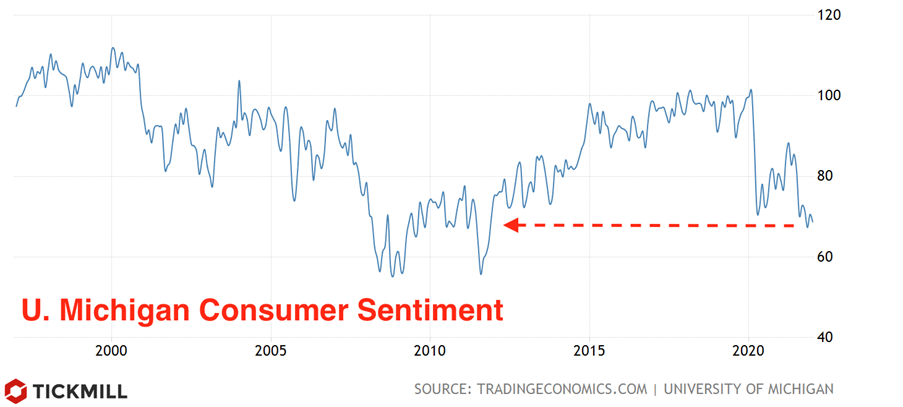

Aseries of data on the US economy last week pointed to a slight weakening ofactivity in December, which made it possible to remove overbought from thedollar. This includes a report on retail sales, industrial production andconsumer sentiment from U. Michigan. In particular, the latter indicator onceagain fell short of forecasts and, due to the negative perception of highinflation by households, has been at its lowest level since 2012:

Atthe same time, the decline in confidence was uneven and primarily affectedlower-income households, which, however, have a higher propensity to consume.In the list of reasons that led to a decrease in consumer confidence, highinflation was in first place among 3/4 of the respondents.

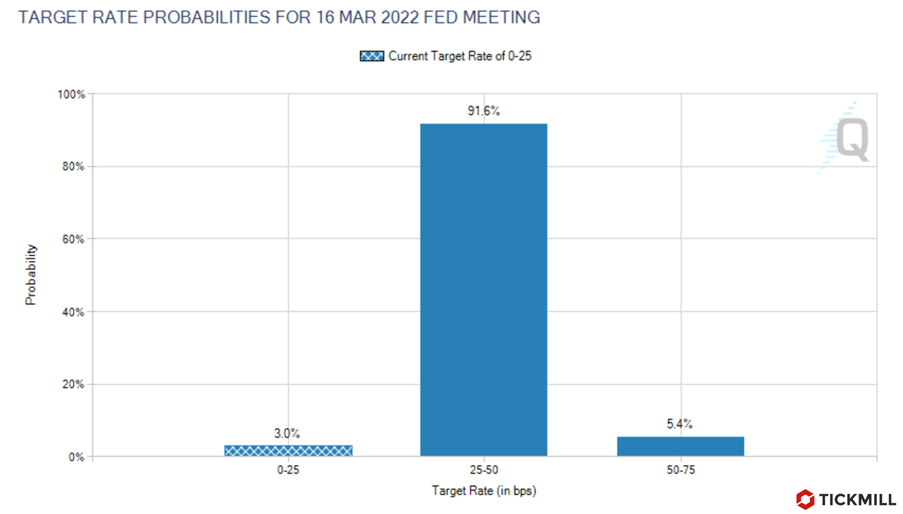

Thegrowing negative impact of inflation, which at one point could begin to curbaggregate consumption, could force the Fed to accelerate the pace of stimulus withdrawal.So, in part, the report could raise the chances of a hawkish FOMC decision inMarch. According to futures markets, investors are almost certain that the Fedwill raise rates in March:

Thegeneral positive mood on the markets today was supported by data on the Chineseeconomy and the PBOC policy. The growth of industrial production and investmentin fixed assets in December was higher than expected, GDP in the fourth quartergrew by 4% (forecast 3.6%). The Central Bank of China cut its one-year lendingrate more than expected to 2.85% (2.95% forecast). This was another signal thatthe central bank is looking to ease policy.

TheEURUSD rally last week failed to thoroughly test the 1.15 zone. The balance ofrisk remains tilted to the downside after last week's dollar long squeeze asFed policy expectations continue to form that the FOMC will clear plans forseveral rate hikes this year and presumably a QT asset sale on the Marchmeeting. The ECB is not yet able to offer a weighty counterargument, sincealthough inflation is growing, it is not uniform and there is no incentive torush.

Apartfrom the data from ZEW on the German economy, there are no interesting data onthe Eurozone this week. The focus will be on the minutes of the Decembermeeting of the ECB (release on Wednesday) and the comments of Lagarde, Villeroyand Holzmann.

Asfor the pound, there is a risk that Johnson's removal from the post of primeminister may cause some uncertainty and negatively affect British assets, butso far, the key factor for the pound is rather aggressive stance of the Bank ofEngland in terms of rate hikes. Closer to February 4, when the meeting willtake place, some strengthening of the GBPUSD and especially the EURGBP ispossible on the expectations that the Central Bank's hawkish maneuver will beatexpectations. On Tuesday and Wednesday, data on the labor market and inflationin the UK are expected, which, in the light of the upcoming meeting, may alsosupport the British currency.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.