EUR Sinks Again

Following a rebound higher yesterday, EURUSD has come under fresh selling pressure today with the pair turning back down towards the YTD lows printed last week. USD strength over the last two months has seen the pair shedding more than 6%, reversing from YTD highs to new lows on the year in around 6 weeks.

USD Strength

With traders eyeing higher US inflation under Trump, Fed easing expectations have been scaled back accordingly. This view gained traction last week when Fed chair Powell warned that the Fed is in no rush to ease rates and can take its time. Pricing for a further cut in December is now sitting around the 60% market from highs above 80% earlier in the month.

Dim Outlook from Lagarde

Speaking yesterday, Lagarde sounded downbeat on the prospects for the eurozone. The ECB chief warned that without bold economic policies and a pooling of resources, the single union won’t be able to cope with rising spending need, amplifying the current decline in growth. Looking ahead, Lagarde warned that the prospect of a fresh trade war with the US under Trump was a big risk to the eurozone economy alongside the geopolitical risks linked to the ongoing Russia-Ukraine war and conflict in the Middle East.

Technical Views

EURUSD

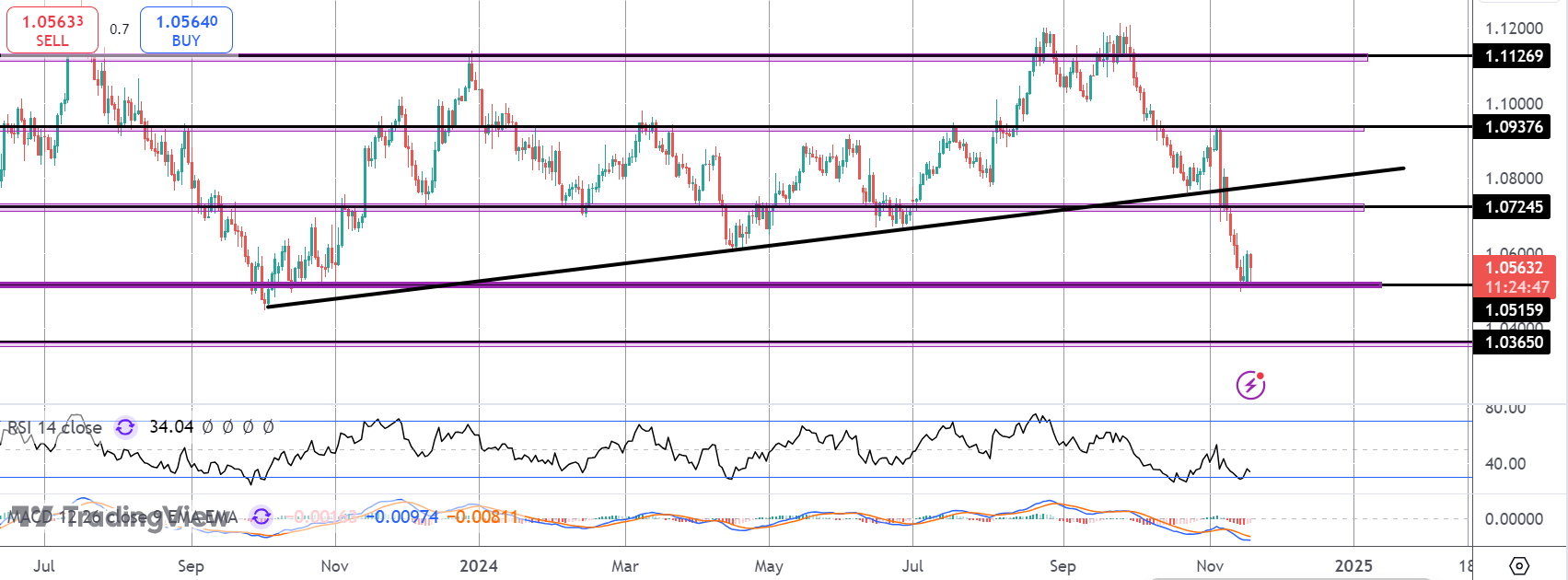

The breakdown through the rising trend line from 2023 lows has seen the market falling heavily. Price is now testing support at the 1.0515 level. If broken, focus turns to deeper support at 1.03650 next. Bulls need to get back above 1.0724 near-term to ease bearish risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.