BOE on Deck

Following the Fed last night, all eyes now turn to the BOE today with traders keen to see whether the UK central bank will announce a similar pause or push further with tightening. The heavy drop in August inflation, which allowed the bank to pause in September, stalled last month with CPI sticking at 6.7%. On the back of this reading, expectations have grown a little more mixed. The BOE had expressed a desire to move away from further tightening, however, with the deflationary trend pausing, might we see the BOE hike one last time?

Base Case Scenario

The main issue facing the BOE here is that UK economic conditions (and forecasts) are rapidly deteriorating. With growth forecasts sinking and recession risks looming, the BOE risks pushing the UK outlook lower still if it hikes again. With this in mind, the central scenario today is for the BOE to hold rates steady again, signalling the potential for further tightening if needed, while it awaits the October inflation results.

Inflation Outlook

If CPI remains at prior levels or is seen rising we can then expect a further hike from the BOE before year end, which should keep GBP supported on the back of the meeting. However, if the BOE refrains from signalling any further potential tightening, this would likely see GBP sharply lower near-term, especially against higher yielding currencies which are benefiting from fresh USD weakness.

Technical Views

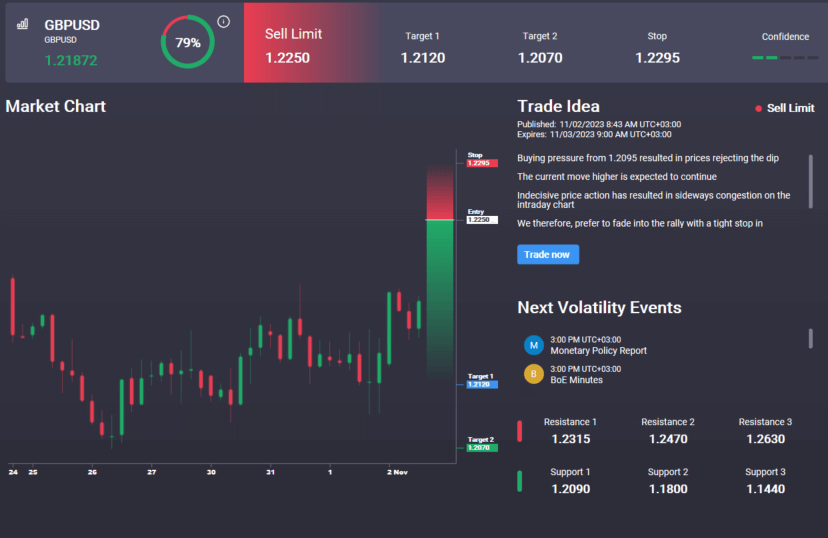

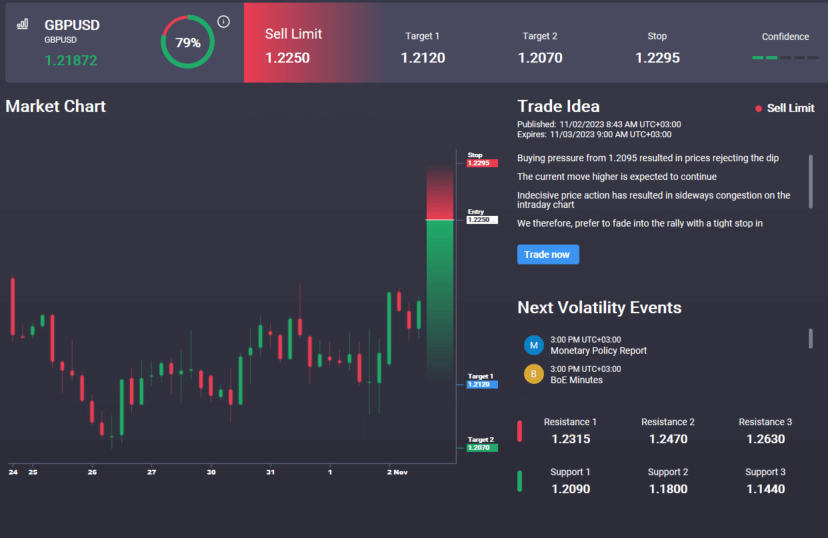

GBPUSD

The pair has been consolidating over recent weeks, oscillating around the 1.2171 level. Price is now starting to test above it and the bear channel. Given the bullish divergence we’ve seen in momentum studies recently, risks of a bullish reversal are growing with 1.2437 the first objective for bulls on any break higher. Interestingly, we have a sell signal in the Signal Centre today set at 1.2250, suggesting a preference to fade any move higher here.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.