BOE on Watch

Alongside the US elections and the FOMC, we also have the November BOE meeting on Thursday to focus on. The bank is widely expected to push ahead with a further .25% rate cut. Given that the move is widely priced in, the bigger focus will instead be on the forward guidance and projections given. This is particularly true on the back of the recent, controversial UK Autumn Budget. In light of the higher taxes, borrowing and spending outlined, traders have shifted their view are now expecting some shift in the BOE’s outlook.

BOE & UK Budget

If BOE governor Bailey is seen focusing on the budget and its implications, this is likely to be taken as a less-dovish signal, causing a lower repricing of rate cut cods beyond this month. However, if Bailey downplays the impact of the budget and focuses more on recent data, this should be taken as a sign that the BOE intends to pursue further easing as outlined previously. If we hear Bailey focusing on the recent drop in services inflation in particular, this should help lead GBP lower.

Volatility Risks from US

Developments in the US this week mean that we could see outsized moves in GBPUSD depending on the Dollar volatility we get. A Trump win and a dovish BOE should see GBPUSD sharply lower by Friday. However, a Harris win and a less dovish BOE meeting should see GBPUSD rise through the end of the week.

Technical Views

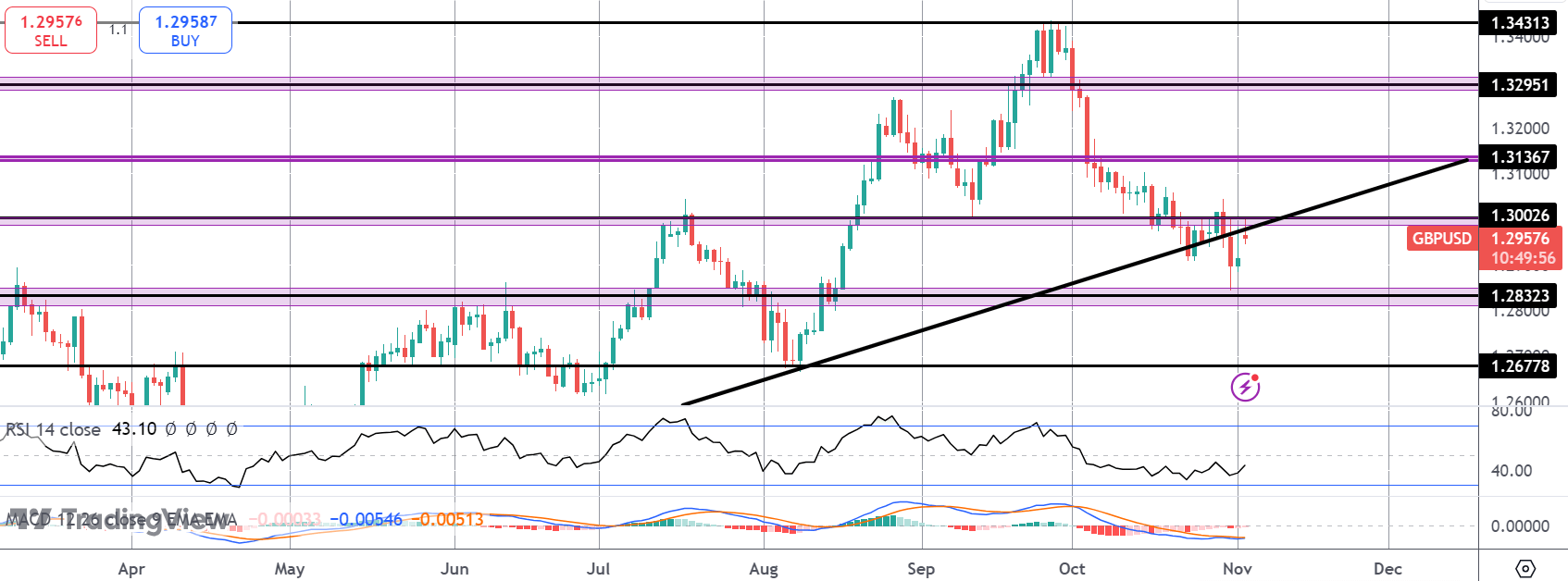

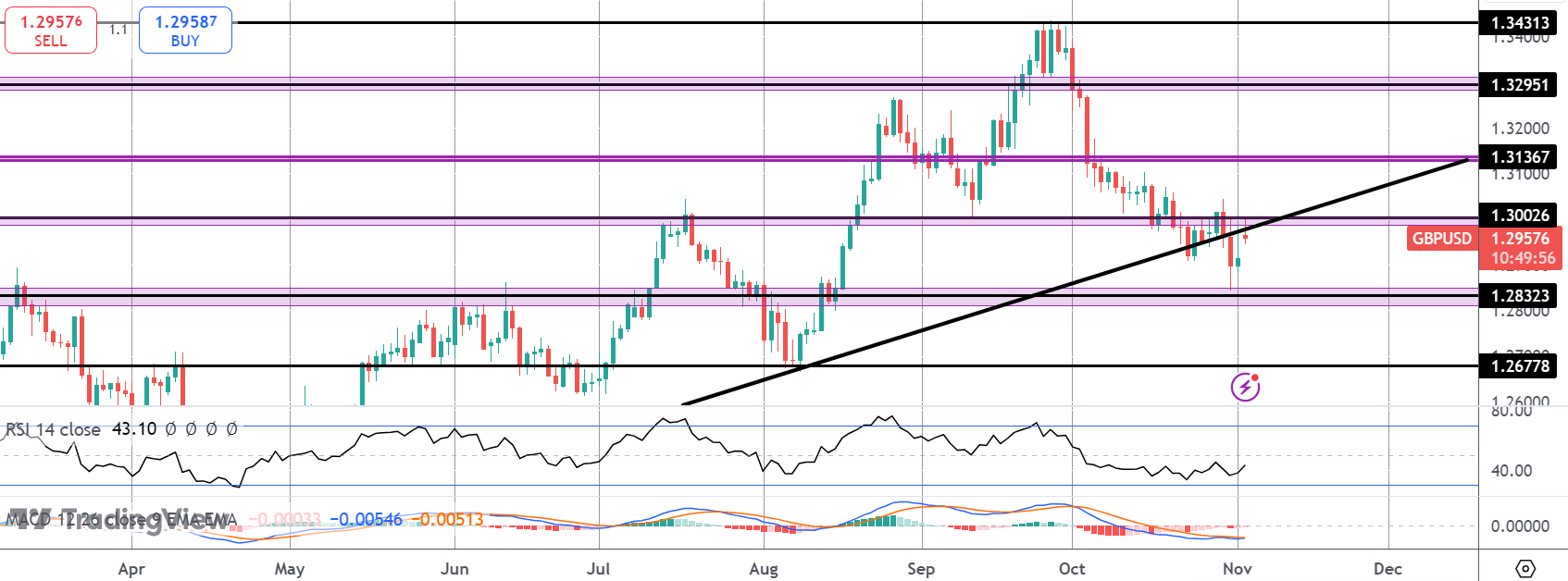

GBPUSD

The sell off in GBPUSD has stalled for now into the 1.2832 level with price now attempting to get back above the broken bull trend line and the 1.30 level. Above there, 1.3136 and 1.3295 will be next resistance levels to note. Downside, 1.2832 and 1.2677 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.