Gold Soaring on US Data Weakness

Gold Pushing Higher

Gold prices are soaring on Monday with the futures market up around 2% on the day already. The move higher comes on the back of the consolidation we’ve seen over the last two weeks following the correction lower from YTD highs. With demand now kicking in again, the focus is on a return to highs and a resumption of the record bull trend we’ve seen this year.

Weak US Data & Fed Easing Expectations

The driver behind the move looks to be a renewed focus on Fed easing expectations following some weaker-than-forecast US data last week. The challenger job cuts data last week revealed a surge in layoffs, which hit 20-year highs last month, saw USD coming under fresh selling pressure. With traders now pricing in a roughly 65% chance of a rate cut in December, gold prices look likely to remain supported for now. Data last week also showed a sharp drop in consumer sentiment which hit its lowest level on record over November. Given the lack of data amidst the ongoing US govt shutdown, these data points have hit harder than usual with gold prices rallying accordingly.

Shutdown Talks

Looking ahead this week, traders will be watching to see if there are any positive headlines from the shutdown talks between congress over the weekend. A group of democrats have been pushing support for a compromise bill aimed at restoring Fed funding ahead of Thanksgiving. If successful, this should help fuel a surge in risk appetite ultimately capping gold gains for now. If the bill fails, however, gold prices could move firmly higher.

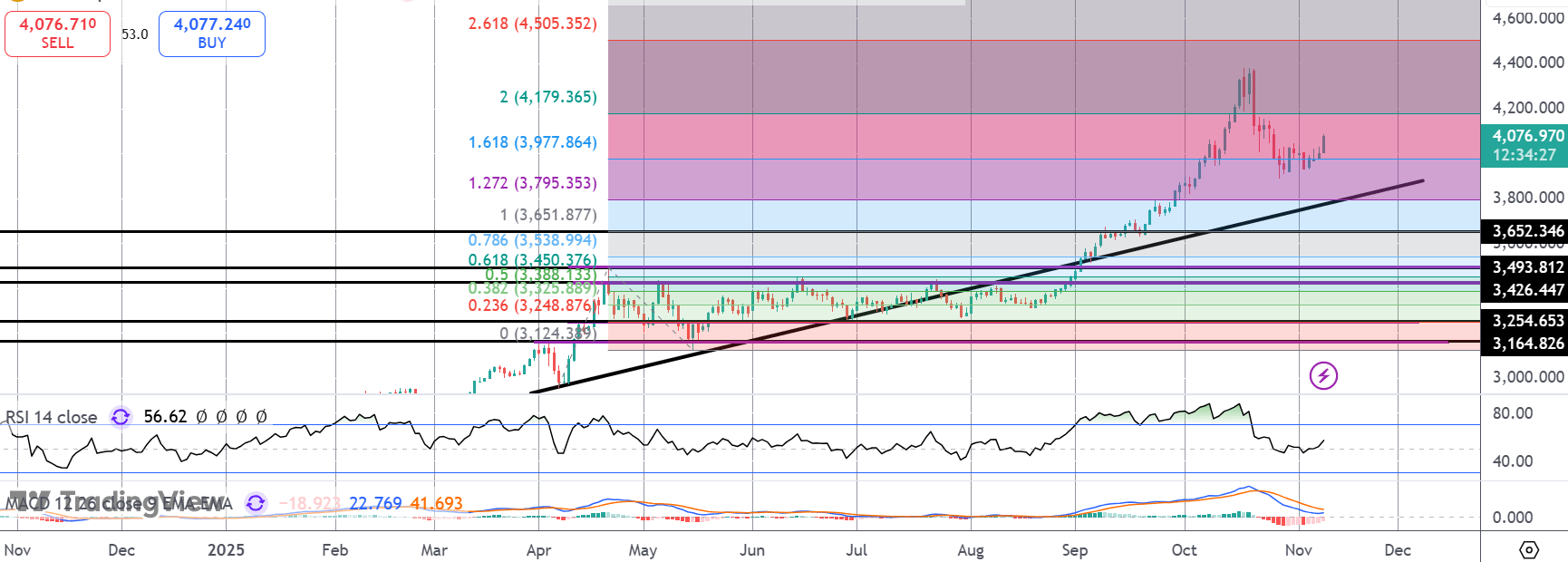

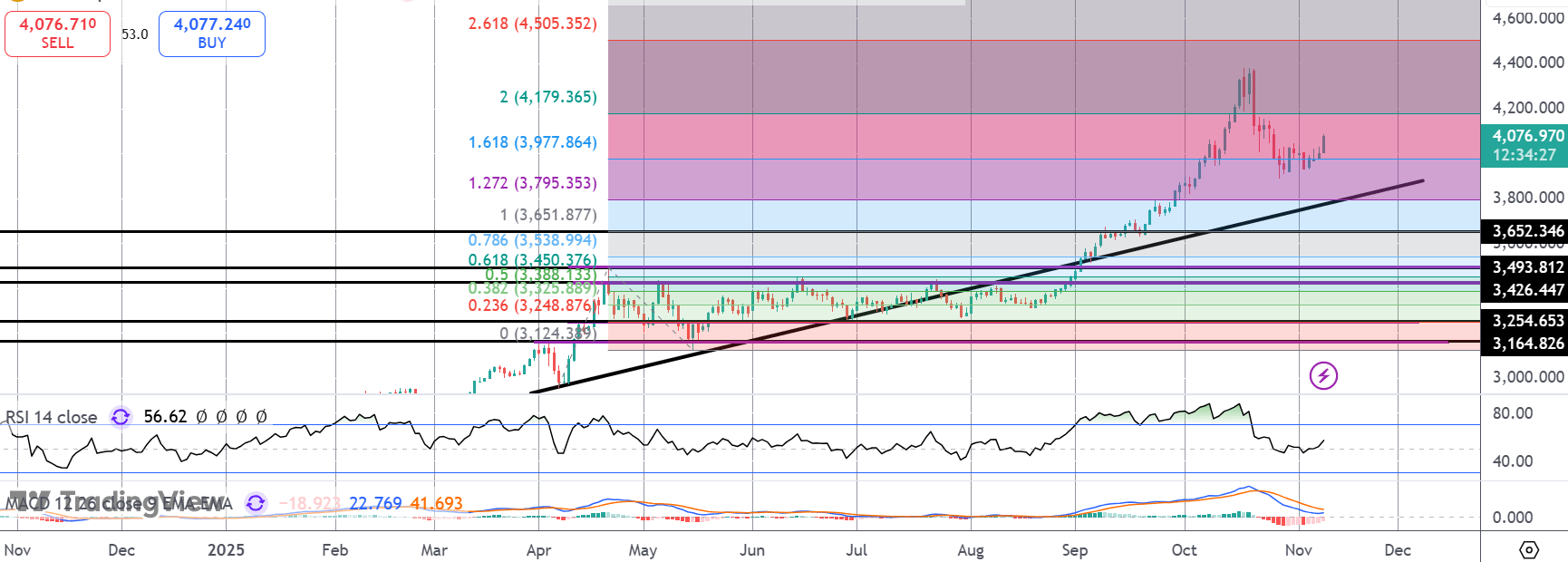

Technical Views

Gold

The correction lower has found fresh support into a retest of the broken 1.61% Fib level. While this area holds, the focus is on a return to highs, supported by momentum studies which are reversing higher now also. 4,200 will be the first hurdle for bulls ahead of the YTD highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.