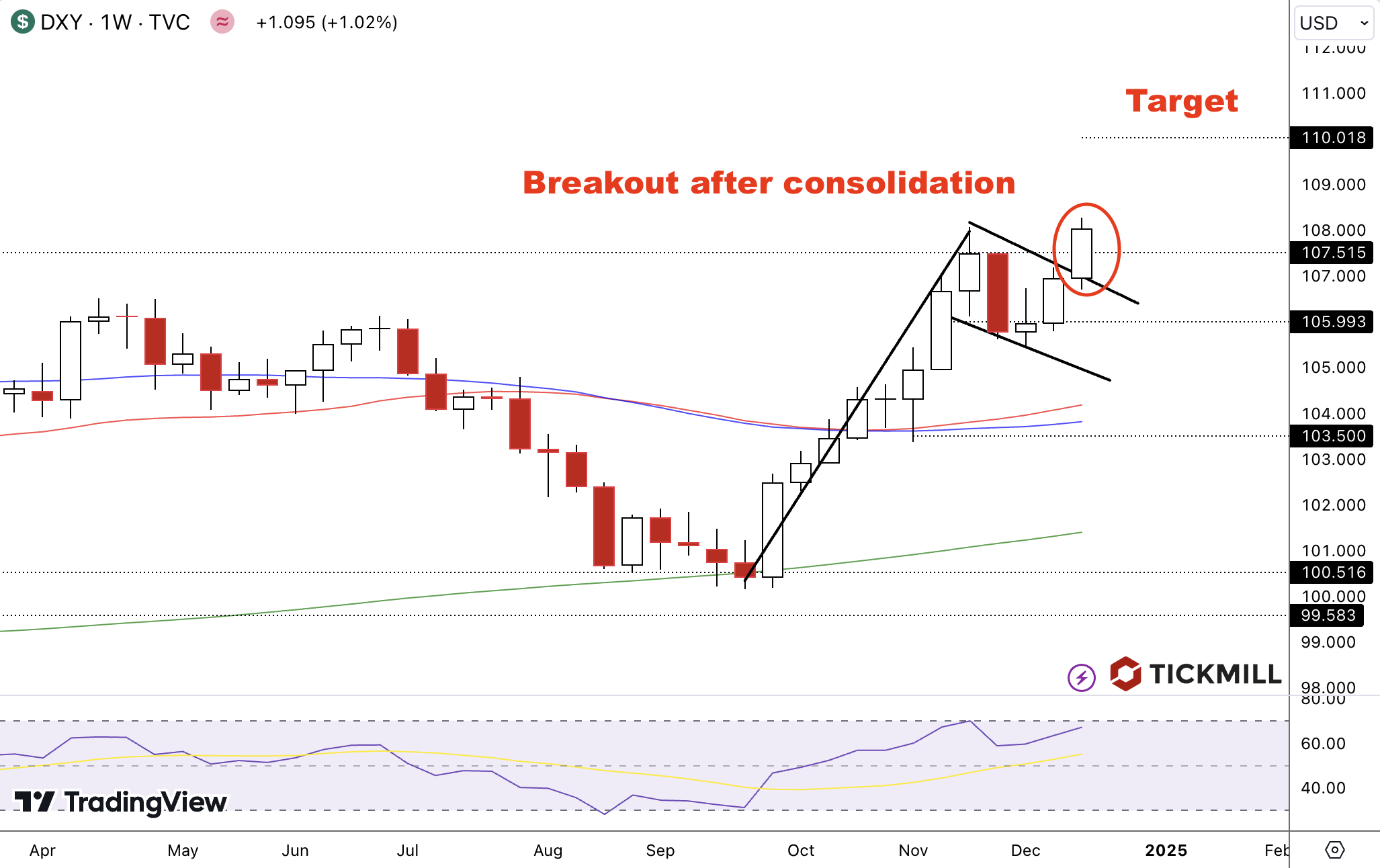

Hawkish Fed Rate Cut Spurs Medium-term Dollar Strength, Bulls Eye 110 on DXY

On Thursday, the US Dollar stepped back slightly after its strong post-Fed decision rally. The DXY Index currently hovers near 108.00, as some traders lock in profits following Wednesday’s notable upward move. The Federal Reserve’s quarter-point rate cut, which lowered the policy band to 4.50%-4.75%, had been almost fully factored into market expectations. However, what truly rattled investors was the Fed’s updated interest rate outlook for 2025: policymakers now anticipate only two rate cuts rather than the previously projected four. This shift dampened expectations for a more accommodative environment and indirectly supported a stronger Dollar in the longer run:

The FOMC appears uneasy about the long-term trajectory of inflation. Despite the year’s progress in easing price pressures, the cautious tone suggests the central bank sees risks to the disinflationary trend. The specter of looming policy changes by incoming President-elect Donald Trump—regarding immigration, tariffs, and taxation—lingers in the Fed’s collective thinking. Although Powell and colleagues have not offered explicit forecasts on these political developments, their cautious stance implies that a less predictable policymaking environment could tighten the rate differential between the US and other economies, favoring the Dollar over time.

Fed Chair Jerome Powell underscored the uncertainty surrounding future inflation paths, a decrease in downside risks to employment, and strong growth in the second half of the year. He noted that monetary policy is now closer to the neutral rate, thereby reducing the scope for further aggressive cuts. To underline the Fed’s concerns, the projection for the 2025 core PCE (Fed’s preferred inflation metrics) was revised upward from 2.2% to 2.5%. This adjustment suggests that controlling inflation remains a priority, overshadowing other factors that might have warranted faster rate reductions.

On the labor front, the latest data offered positive news for the Dollar. Initial Jobless Claims dropped to 220K for the week ending December 14, exceeding consensus forecasts of 230K. This improvement indicates resilience in the US labor market, which could reinforce the Fed’s position that a stable or slightly restrictive monetary environment is justified.

The Euro is strengthening against the Dollar what appears to be a purely technical bounce. The ECB, which has embraced a more accommodative stance by reducing the Deposit Facility rate by 100 basis points to 3%, seems poised to continue policy easing into 2025. ECB official Pierre Wunsch anticipates four additional cuts, partly to counteract the impact of US tariffs and potentially bring the Euro closer to parity with the USD—an intentional strategy to buffer Eurozone competitiveness. Such a currency move could mitigate some trade-related headwinds, although it also reflects the region’s vulnerability to external policy shifts:

Turning to the UK, the GBPUSD pair failed to rise despite that the BoE maintained its key interest rate at 4.75%. The decision to stand pat, however, was less united beneath the surface; the vote split at 6-3 against rate reductions rather than the widely expected 8-1. Sterling’s response has been negative, as increased support for easing tends to erode a currency’s yield appeal. Looking ahead, the UK Retail Sales release on Friday will offer a fresh data point. Economists predict a 0.5% monthly rise for November following October’s 0.7% decline, and a strong number might somewhat stabilize sentiment around the Pound.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.