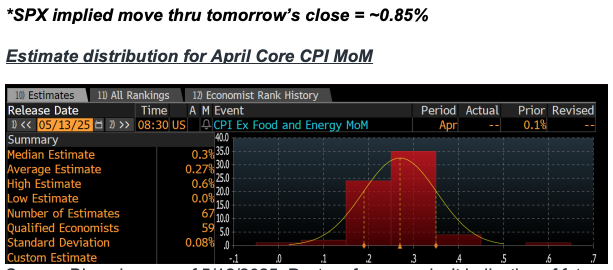

CPI Preview

From GS Research: We anticipate a 0.30% rise in April's core CPI, aligning with the consensus of +0.3%, leading to a year-over-year rate of 2.83%, slightly above the consensus of +2.8%.

- We predict a 0.31% increase in headline CPI, slightly above the +0.3% consensus, driven by higher food (+0.3%) and energy (+0.4%) prices. Our forecast aligns with a 0.39% increase in CPI core services excluding rent and owners’ equivalent rent, and a 0.20% rise in core PCE for April.

- Key component-level trends expected in this month's report include:

1. A 0.5% drop in used car prices due to declining auction prices, alongside a 0.1% rise in new car prices reflecting reduced incentives.

2. A significant 0.7% increase in car insurance premiums, based on our online dataset.

3. Modest upward pressure from tariffs on categories like apparel, recreation, and communication, contributing +0.06 percentage points to core inflation.

4. A decline in health insurance inflation as the BLS incorporates new data on insurance premiums.

- Looking ahead, tariffs will continue to hinder progress towards the 2% inflation target, with monthly core CPI inflation expected around 0.35% in the coming months. Our forecast indicates a sharp rise in most core goods categories, with minimal effect on core services inflation in the near term.

- Excluding tariff impacts, we expect underlying trend inflation to decrease further this year, due to reduced contributions from the auto, housing rental, and labor markets. We anticipate year-over-year core CPI inflation of +3.5% and core PCE inflation of +3.6% by December 2025.

Karen Fishman (Senior FX Strategist)

As we approach the CPI release, there's been a notable improvement in risk sentiment and an increase in real yields. Positive developments in US growth data and trade policy—specifically, a deal with the UK and reduced tariffs on China—have alleviated some of the pessimism surrounding the US economy and the Dollar. In the short term, there is potential for further Dollar strength if supportive news continues. However, we've consistently highlighted that the path to a weaker Dollar over time will not be straightforward. This may also limit the potential for Dollar weakness in the long run. Currently, the risk-reward of being overweight in Dollars is less attractive compared to recent years, with US yield risks still leaning downward and diminished "natural risk protection" as long as there are prolonged periods of positive correlation between SPX and USD, especially within G10.

There are two key questions regarding CPI: First, to what extent did higher tariffs affect April's figures? Second, will markets overlook an upside surprise now that tariffs are expected to be lower? It seems the policy shift has positively influenced how markets interpret incoming data, at least for now. A week ago, markets might have downplayed any upside surprise in macro data, viewing it as front-loading before an expected downturn. Now, there seems to be a tendency to discount any downside surprise, or higher CPI in this case, due to the retrospective nature of the data. A significant upside surprise in CPI could raise concerns that "too much damage has been done," but it seems the threshold is higher now and unlikely to reverse recent momentum on its own. Furthermore, a benign or expected outcome could further confirm that excessive risk premium has been added, allowing for a continuation of recent trends. I still believe it is prudent to hedge US equities in FX with long JPY. Tactically, being short AUD/JPY instead of short USD/JPY should slightly mitigate the impact of broad USD upswings. However, a lower threshold for equity upside suggests combining this with strategies anticipating fewer Fed cuts in upcoming meetings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)