Institutional insights: Goldman Sachs - Flow of Funds Technical Update

GS Flow of Funds: Technical Update

FICC and Equities | 23 April 2025

We can take a deep breath, but it’s not over yet. The technical setup has shifted, and supply pressure from systematic strategies has eased. However, much like experiencing an 80-degree day in NYC in April, I wouldn’t dive into the pool just yet.

Current market dynamics (subject to rapid change):

a. Systematic pressure has finally subsided, and it appears we have found a temporary floor.

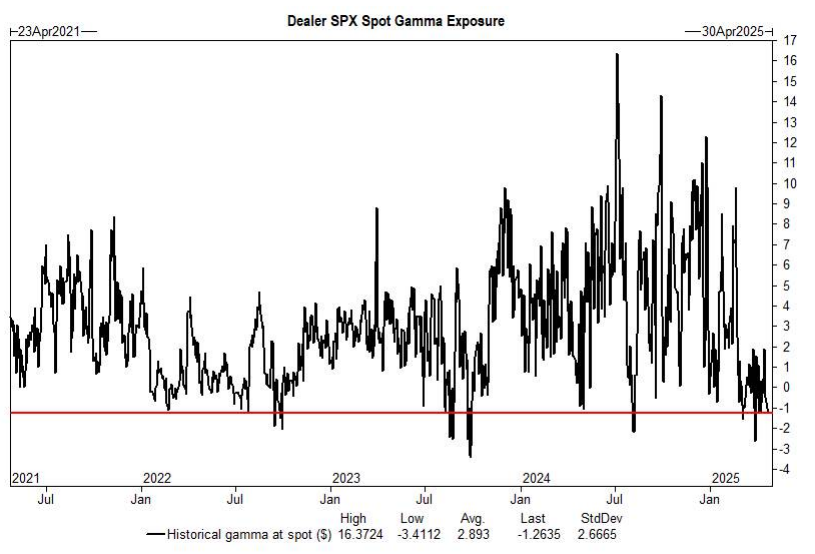

b. Dealers are short gamma, with low sentiment and liquidity, which is amplifying market movements in both directions.

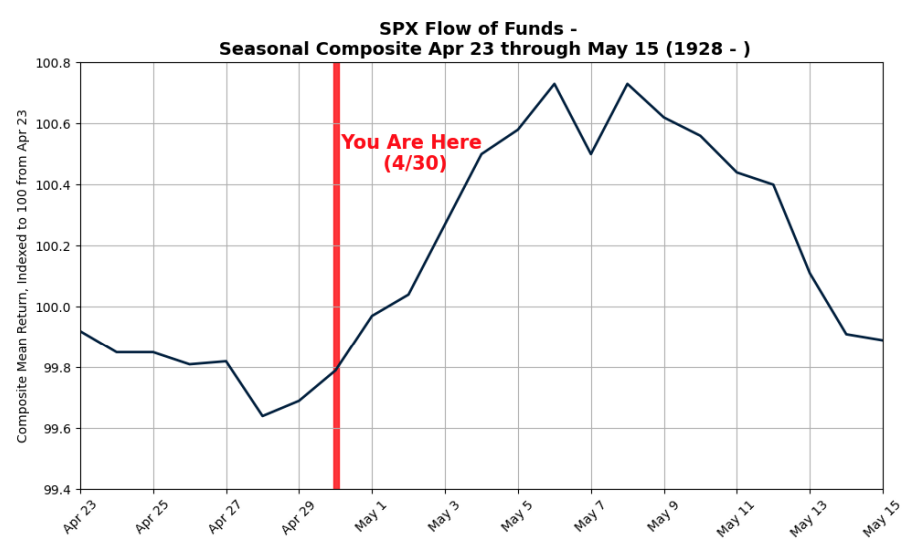

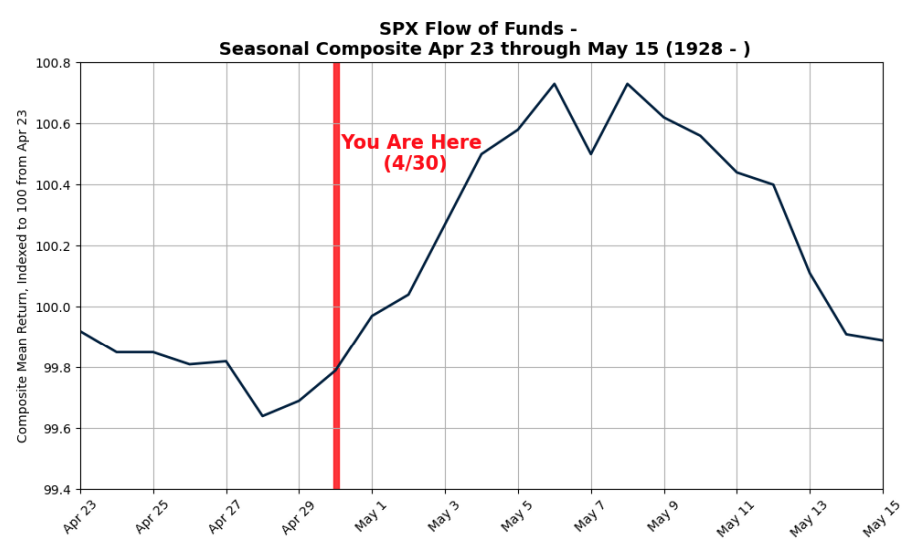

c. Historically, the first half of May is an unfavorable period for the market, with retail outflows throughout the month. So far, we have observed retail "dip-buying," but we should focus on any changes that could alter flows and market direction.

d. We estimate the blackout period will end around April 25, when approximately 30% of the S&P 500 will be in an open window, providing short-term market support.

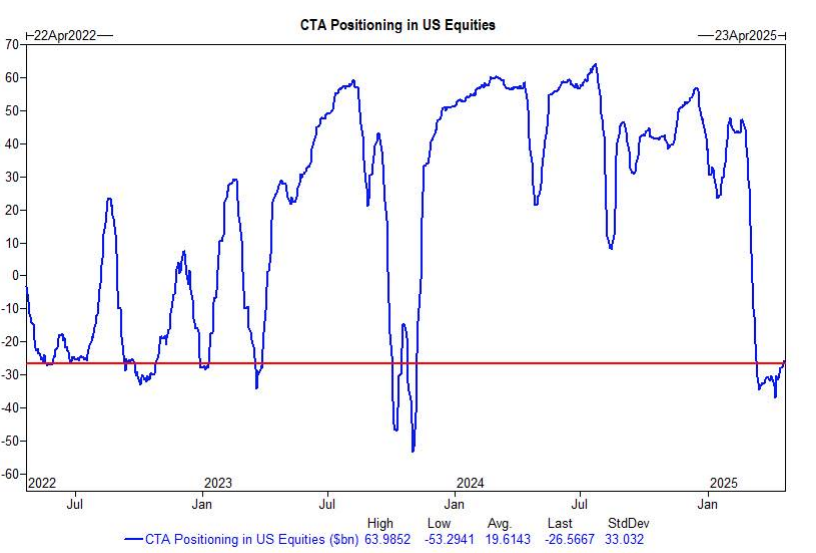

1. CTA Positioning

This supply has dictated the pressure on US equity markets this April—until now. Our model now estimates more than four consecutive trading days of a full GREEN sweep. From a systematic positioning standpoint, with a short position of $26 billion in US equities, we can say the worst is over for now.

Over the next week:

- Flat market: $30.50 billion in Global Equity Demand ($3.83 billion into the US)

- Rising market: $48.06 billion in Global Equity Demand ($7.38 billion into the US)

- Declining market: $18.24 billion in Global Equity Demand ($2.22 billion into the US)

Over the next month:

- Flat market: $49.61 billion in Global Equity Demand ($8.01 billion into the US)

- Rising market: $122.86 billion in Global Equity Demand ($25.55 billion into the US)

- Declining market: $19.10 billion in Global Equity Demand ($8.11 billion into the US)

We are 3% away from reaching any S&P trigger threshold levels.

- Short term: 5565

- Medium term: 5762

- Long term: 5480

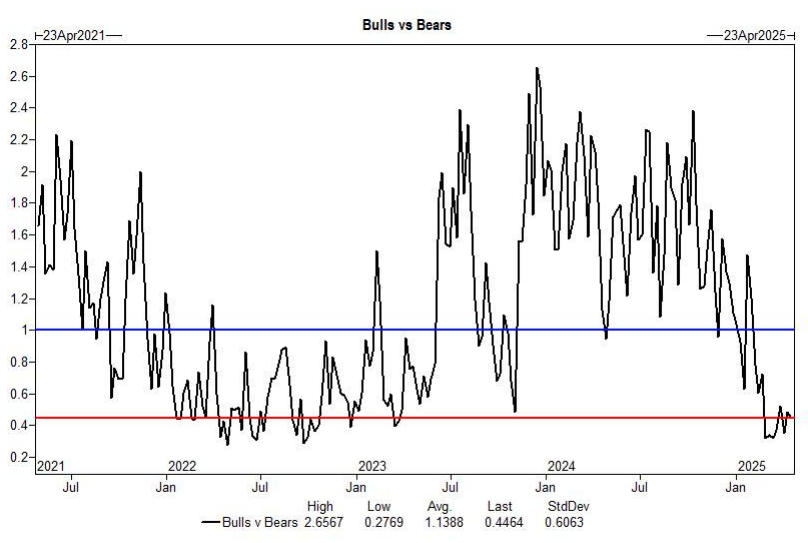

Sentiment

Recent weeks of apocalyptic sentiment have injected energy into rallies as investors eagerly pursue any signs of relief. While it's important to be cautious of the "hope trade," anticipate that it will generate "GIP Swing" scenarios given the current state of sentiment. The percentage of "bulls" in the AAII sentiment index has decreased by 60% since the beginning of the year. Although we are no longer at the year-to-date lows (which were also the lowest in a four-year period), the sentiment is not as bearish as it was before.

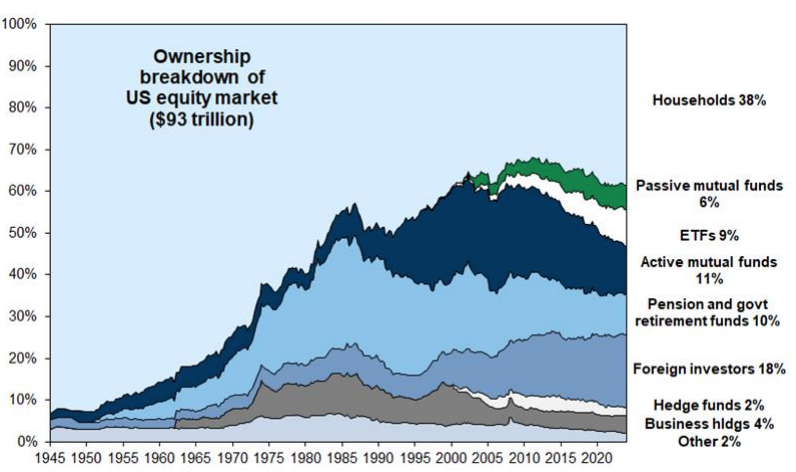

Market Construction

This is arguably the most crucial point. Households own over a third of the US equity market, which is significant. Retail investors are typically slower to react than automated trading systems. Although systematic pressure has eased, investors have come to expect that retail investors will step in to "buy the dip." So far, they have done so. We will be closely monitoring this group and will provide immediate updates if there is any change in the flow of investments.

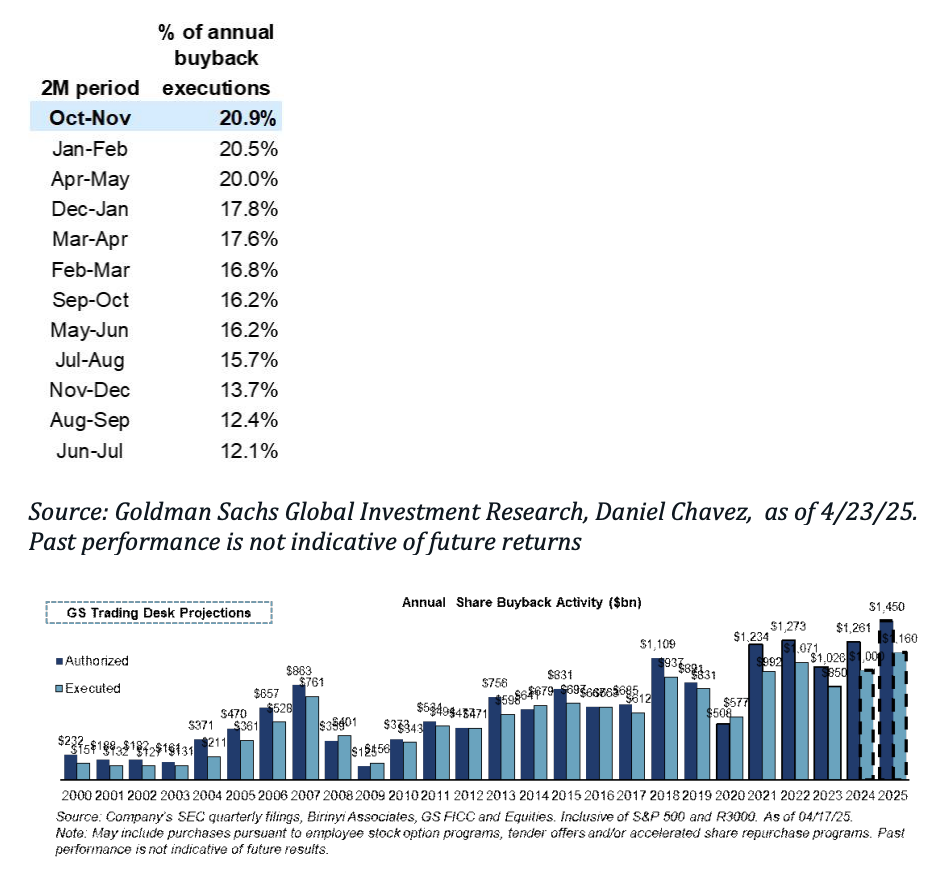

Buybacks

Here's some positive news...

We anticipate the blackout period to conclude around April 25th, at which point approximately 30% of the S&P 500 companies will be in an open window for buybacks. Regarding authorizations, 2025 year-to-date figures stand at $377.1 billion. Historically, the corporate repurchase window from April to May is particularly strong, being the third-best period of the year, accounting for 20% of executions. The Goldman Sachs buyback desk estimates $1.45 trillion in authorizations and $1.16 billion in executions. This activity is expected to provide market support as we enter the peak of earnings season.

Gamma

Dealers are not holding long gamma positions, which typically act as a market buffer. Currently, gamma is intensifying market fluctuations in both directions. According to GS Futures strategies, dealers are short gamma and tend to increase their short positions during market rallies of up to 3%, while they become longer during sell-offs down to 4%. It's important to note that dealers consistently remain short gamma across our profile.

Seasonality is expected to be unfavorable in the coming weeks. While there will be opportunities due to the technical setup, overall, retail pressure is likely to dominate. Currently, this impact is minimal, but it could change.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!