Is GBPUSD Poised to Breakout This Week?

Cable Pushing Higher

GBPUSD is pushing firmly higher today with the pair bolstered by a combination of US pessimism, linked to the Moody’s downgrade, and UK optimism, linked to a potential UK/EU trade deal. GBPUSD has recovered above the 1.3264 level and is now fast approaching a fresh test of the YTD highs around 1.3427 with the market now looking poised for a fresh breakout.

Weakening US Sentiment

On the Dollar front, USD has been weakened by news of Moody’s cutting the US sovereign debt rating to AAB from AAA prior. Citing concerns over massive government debt and the prospect of a fresh increase under Trump, the move has underscored growing uncertainty over the US outlook. Combined with recent data weakness in key US readings, the news is keeping USD anchored lower on Monday with a further slide through the week likely unless we hear any positive US headlines. Thursday’s PMIs and weekly jobless claims will be the only key domestic data to watch and not expected to have much impact unless we see any meaningful surprises.

Rising UK Sentiment

On the GBP front, UK sentiment looks to be turning more positive again here. The recent US/UK trade deal and rising optimism now over a potential post-Brexit UK/EU trade deal mean that GBP could have more room to run higher here near-term. The two sides have reportedly made a major breakthrough in trade discussions ahead of a keenly awaited summit in London today. The deal reportedly includes an extension of EU access to UK fishing waters while UK citizens will be allowed to use EU passport gates again at airports. If the market reaction remains positive, we could see news highs in GBPUSD ahead of Wednesday’s UK CPI release.

Technical Views

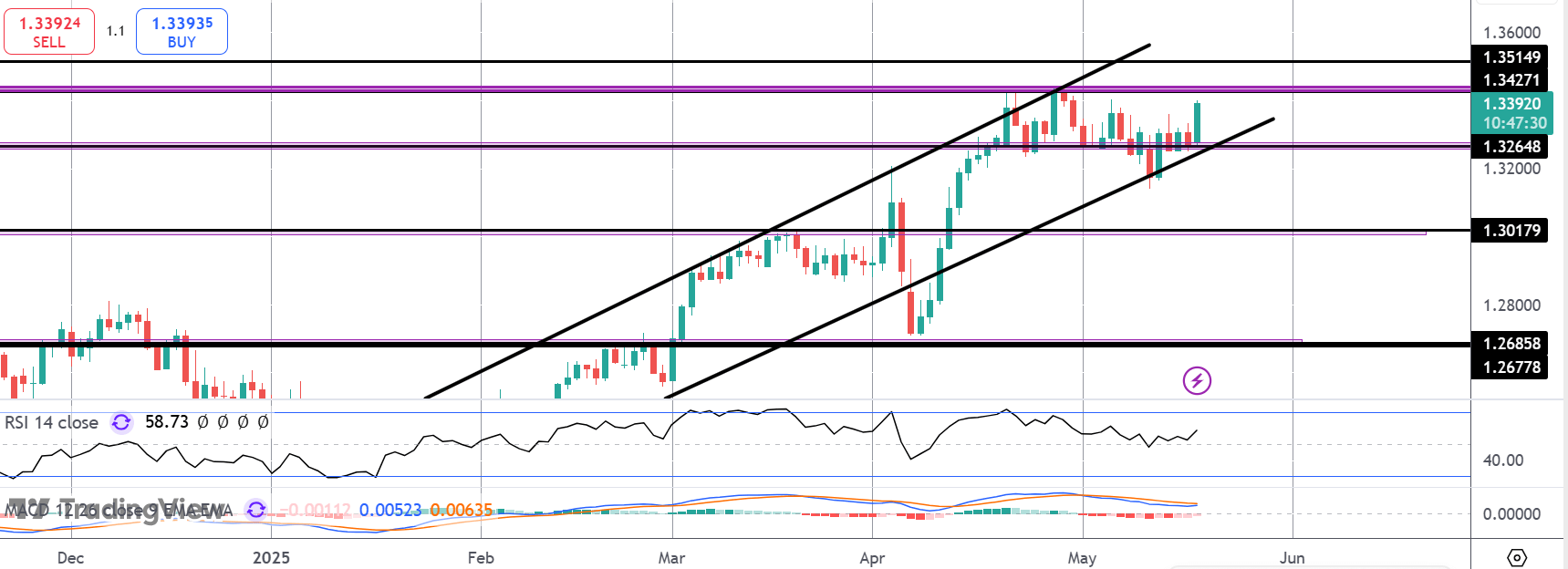

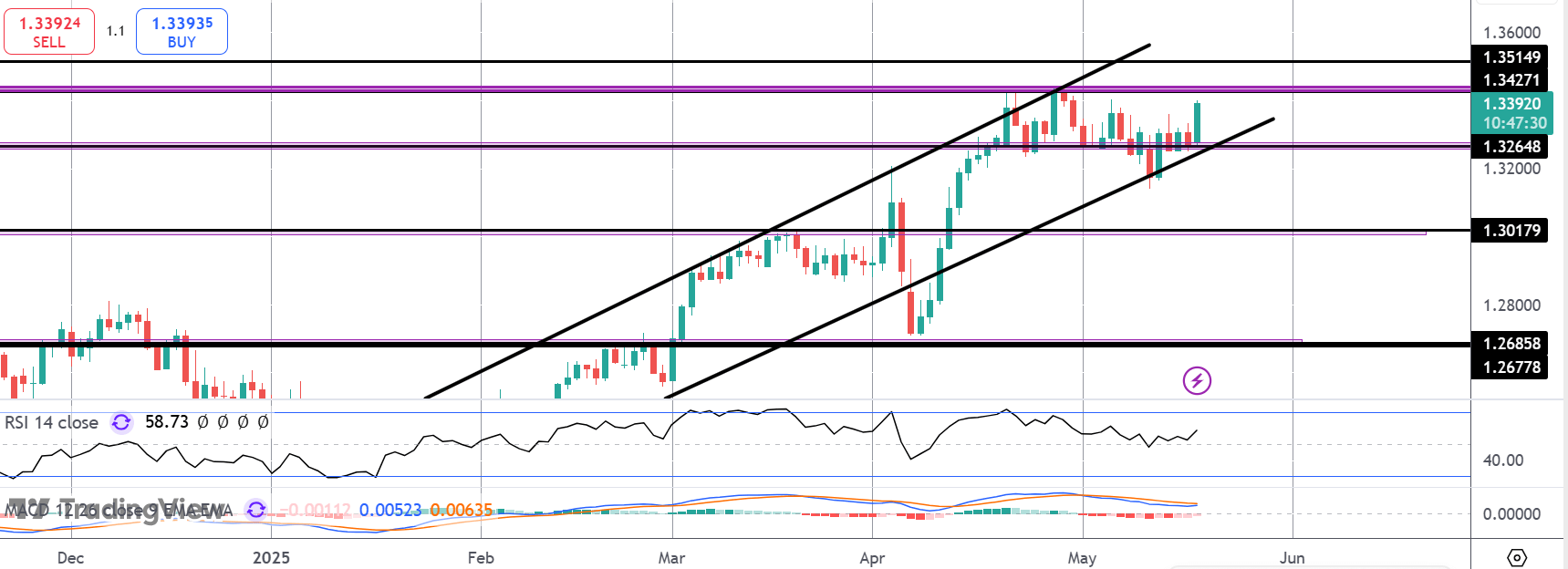

GBPUSD

The rally in GBPUSD off the bull channel lows and the 1.3264 level is now fast approaching a test of the 1.3427 level highs. With momentum studies turning higher from bearish levels, there is plenty of room for a fresh breakout higher here with 1.3514 the next target for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.