Market Movers: Coca Cola Earnings On Deck

Will KO Rally Continue?

US earnings season is back underway this week and ahead of the slew of big tech names due to report, attention today is on Coca Cola. KO stock has been one of the best performers over recent years, posting an almost 70% gain from the 2022 lows as the company’s post-pandemic recovery continues to gather steam. On the numbers front, the market is looking for Q1 EPS of $1.01 on revenues of $3.073 billion. If seen, this will mark a strong increase on the results posted a year earlier but a slight drop from the prior quarter.

With over a year of solid gains in its share price, further positive results today make KO shares a strong candidate for further longs. Given the return of demand in China as the peak of the country’s covid crisis passes, the demand outlook for KO remains strong. Risks of a global recession and a recession in the US are likely the key headwinds facing the company and traders will be keen to hear what KO has to say on this front and how it assesses the severity of downside risks.

Technical Views

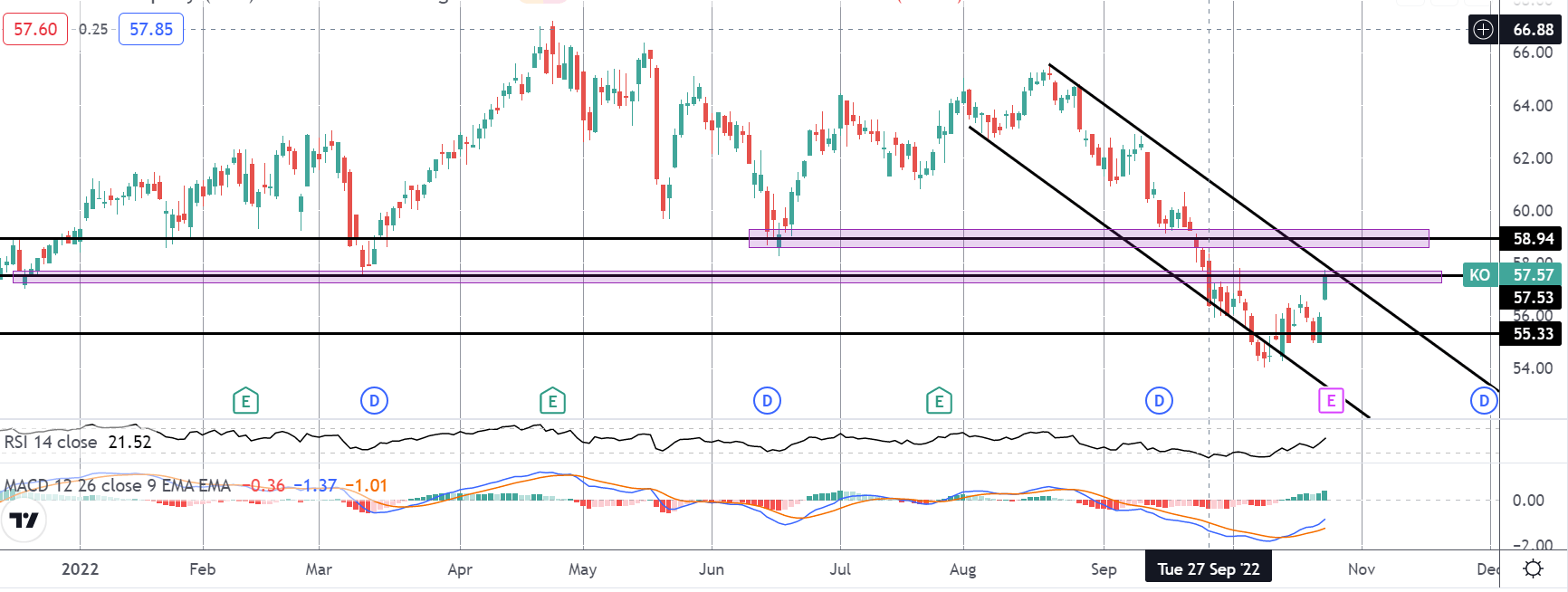

KO

Coca Cola shares have been rallying firmly this year, breaking out above the bear trend line from last year’s highs and now challenging the 64.05 level resistance. A breakout here will be firmly bullish, putting focus on a test of the 67.21 level highs next, in line with bullish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.