Market Spotlight: ChatGPT Headlines Stall Microsoft Rally

Microsoft Holds Above Key Level

Shares in Microsoft have been stalled recently following the move in early Feb to fresh highs for the year. The company has been riding thick and fast waves around Chat GPT, the AI program it is heavily invested in. On any given day, depending on what you are reading, AI is either about to take over the world and cause mass joblessness or instead implode and fade away. ChatGPT is very much at the fore front of this situation.

ChatGPT & Bing

The free software which allows users to engage with an AI robot has been grabbing plenty of headlines recently, revolutionising the way people search on the internet. Having recently been integrated with Microsoft’s Bing search engine, there has been huge discourse around the potential for ChatGPT to help Bing unseat Google as the king of the search engines. However, in recent days there have been some discouraging headless suggesting that ChatGPT is not faring well within its new role. The Independent newspaper in the UK reported that the software has been glitching, insulting users, spreading misinformation and even questioning its own existence.

Still Some Wood to Chop

Clearly, there is still some way to go before ChatGPT can hand the same volume or search traffic required to unseat google. With Google’s own ChatGPT equivalent Bard suffering similar mishaps, it seems we are at the dawn of a new cold-war style AI arms race between tech companies. Given the massive spending going into AI and the huge cross-applications for the technology, whoever succeeds in getting this right stands to reap huge gains for shareholders.

Technical Views

Microsoft

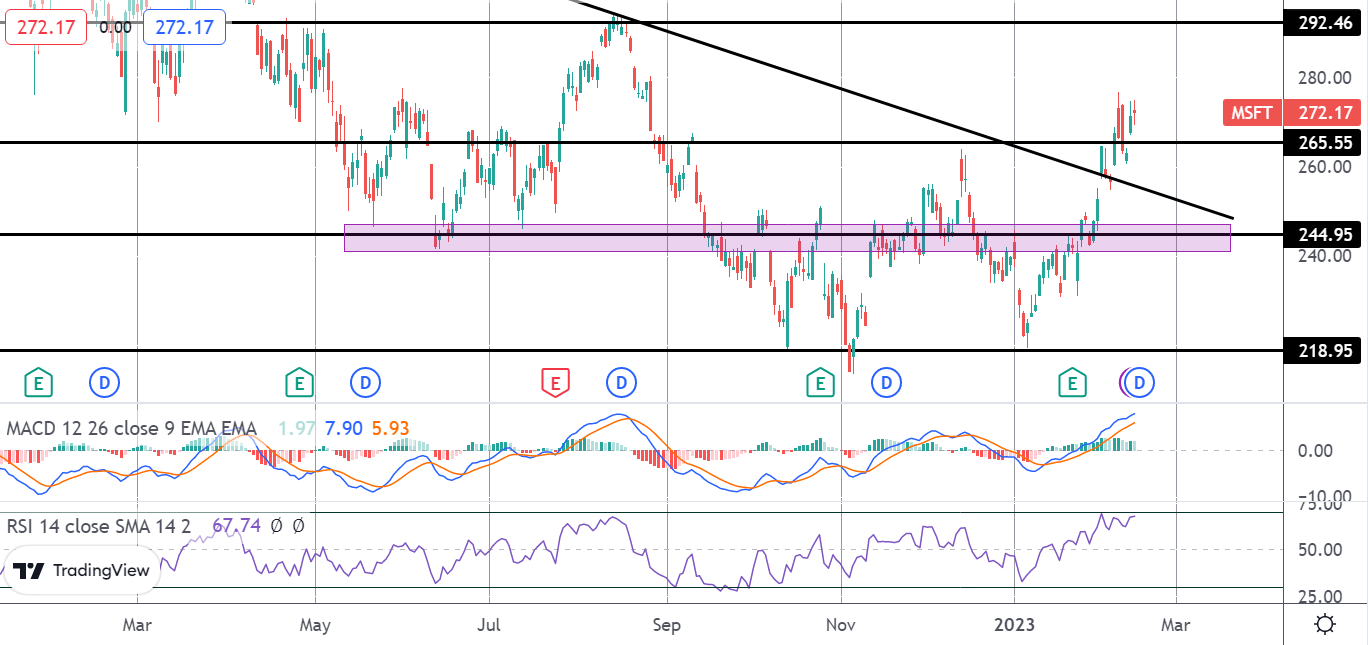

The rally in Microsoft shares of the 218.95 level has seen the stock breaking out above the bear trend line from highs and above the 265.55 level. With momentum studies turned bullish, the focus is on a continuation higher while the stock holds above the 265.55 level, keeping 292.46 in view as the next objective for bulls.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.