Dow Pushing Higher

Following an impressive rally over much of Q4, the Dow has seemingly lost in mojo in recent months. The 21% Rally off October’s lows, fizzled out into December, seeing a partial correction from which point the Dow has been stuck in a consolidation pattern. However, conditions now look to be shifting in favour of a fresh breakout.

Powell Refrains from Fresh Hawkishness

Friday’s bumper US jobs report was seen as something of a bogeyman by traders given the expectations (or rather the fear) that the Fed would take a more hawkish view on rates consequently. However, Fed chairman Powell’s speech yesterday was notably short of any fresh hawkish impetus. While Powell reaffirmed his view that the Fed would need to stick with rate hikes until next year, his comments around the disinflation process once again served to temper any hawkish expectations from the market. On the back of Powell’s speech, USD was firmly lower leading to equities gains across the board, including the Dow.

Key Takeaway

The takeaway from yesterday’s comments is that if one of the strongest jobs reports in years (unemployment rate also seen falling to 1969 lows) doesn’t provoke fresh hawkish, then the Fed is clearly set on continuing its pivot. Furthermore, the Fed is also clearly confident in its view that inflation will continue to come down under current monetary policy conditions. With this in mind, traders have been given a clear signal here and the Dow looks set to advance further near-term.

Technical Views

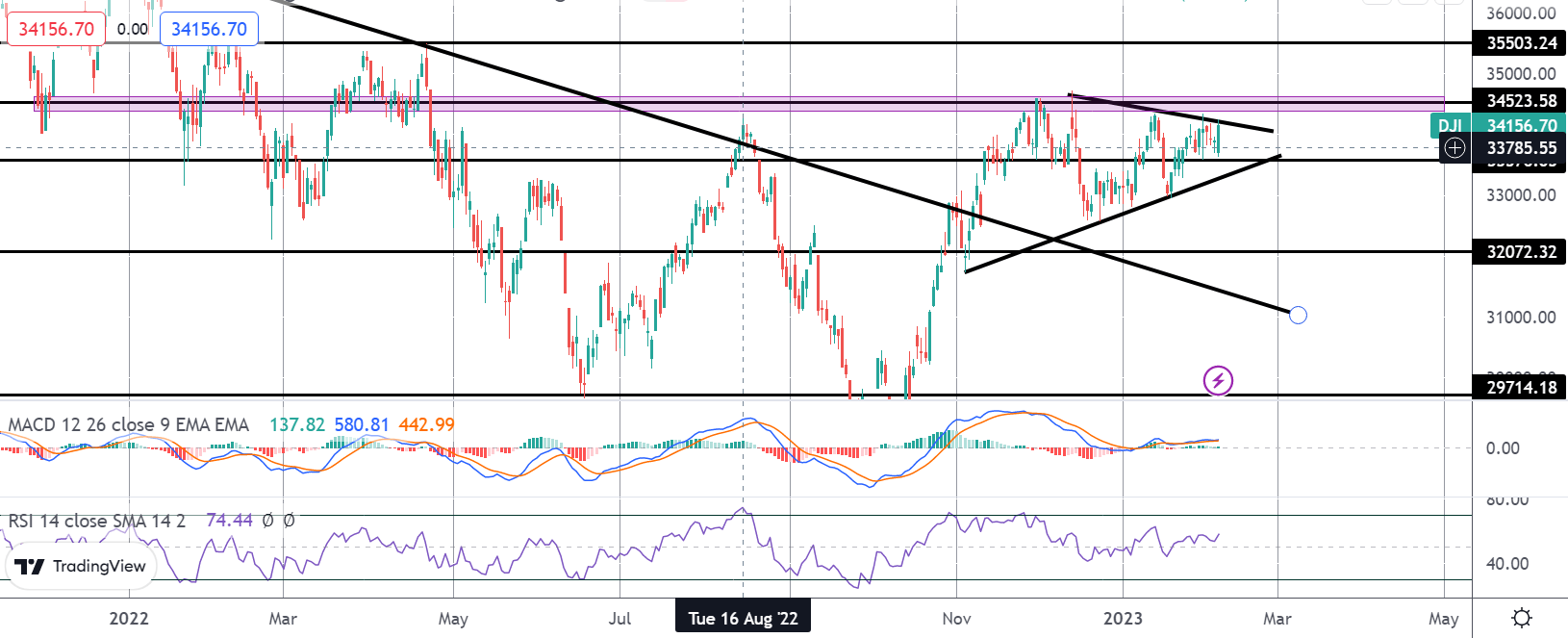

Dow Jones

Following the breakout above the bear trend line from last year’s highs, the Dow has settled into a triangle pattern, capped by resistance at the 34523.58 level. Price is now testing the triangle top and with momentum studies bullish, the focus is on a break higher. Above 34523.58, the key level to note Is the 35503.24 level resistance next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.