Market Spotlight: Etsy Earnings in Focus Today

Etsy Up Next

US earnings season continues today and among the key names reporting, iconic e-commerce Etsy will be one of the key focus points for traders. On the back of a Q3 earnings miss, traders will be looking to see whether the company’s performance rebounded in Q4 or worsened. On the numbers front, Wall Street is looking for EPS of $0.08 on revenues of $755.41 million. This would be a solid rebound from Q3, if seen, and should help shore up the company’s stock price which has been sliding over recent weeks, now down around 16% from highs.

Negative Citron Research Report

Along with the weaker-than-forecast Q3 earnings report, Etsy shares have also bene hit recently by a report from Citron Research claiming that the company isn’t taking a strong enough stance on counterfeit goods being sold on its website. Looking at the bullish forecasts for Q4 its clear that the company is expecting holiday demand to have driven sales higher ahead of year-end. With decent retail activity seen elsewhere, this is a reasonable forecast. The company has seen several bullish analyst revisions recently, suggesting upside risks into the release today.

Technical Views

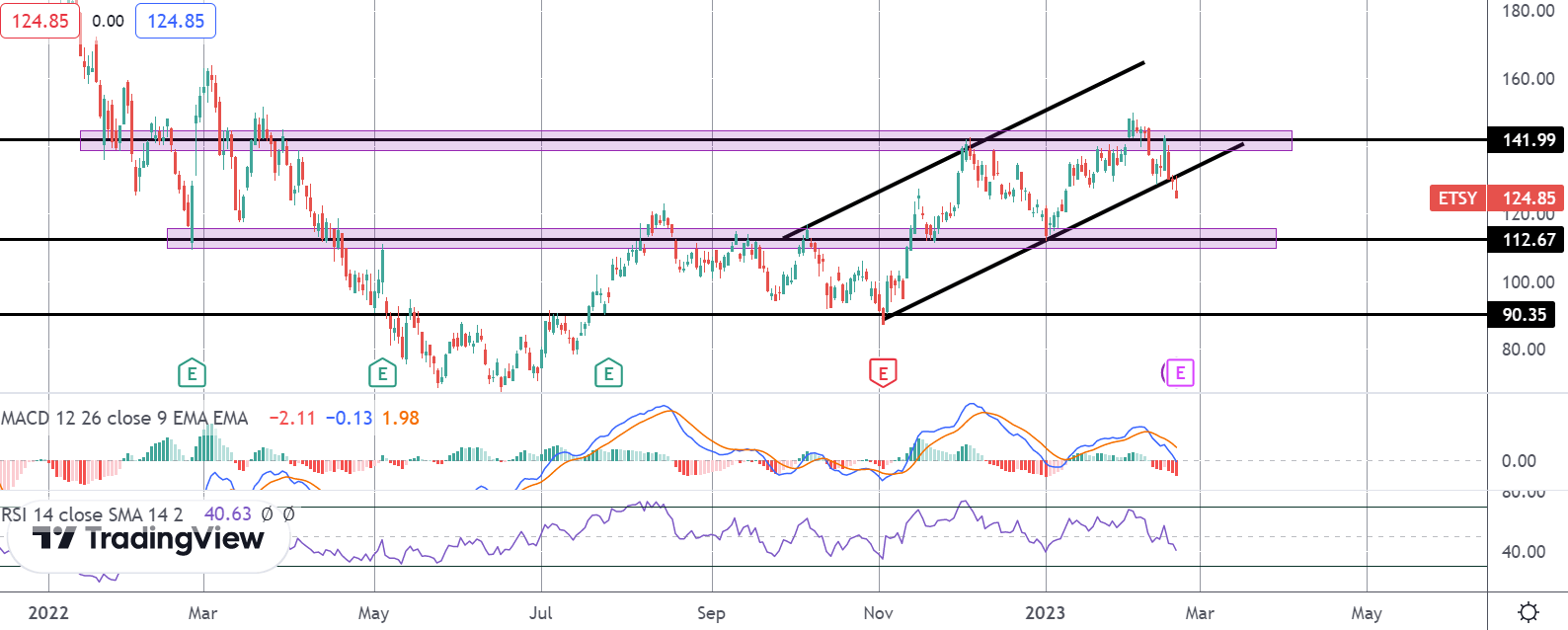

Etsy

The reversal lower from the recent highs above 141.99 has seen Etsy stock breaking down out of the bull channel as the correction deepens. With momentum studies flipped bearish now, the focus is on a further push lower towards 112.67 level which will be the big test for the stock. Bulls need to defend this level to maintain the broader upside focus.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.