Market Spotlight: Fevetree Shares Tank On Fresh Profit Warning

Rising Costs Hurt Profits

Shares in UK beverage maker Fevertree are bouncing back today after a more than 15% plunge from yesterday’s closing price. The company, famous for making tonic mixers, issued a profit warning ahead of its upcoming earnings report in March. Fevertree warned that profits for 2023 would likely be lower as a result of rising material costs. It noted a sharp uptick in the cost of glass bottles as well as ingredients and packaging. Citing the impact of the Russia – Ukraine war, Fevertree warned that the cost of producing glass bottles would likely increase by around £20 million this year.

UK Cost of Living Crisis

Additionally, the company note the negative impact of the cost-of-living crisis in the UK as well as the recent increase in industrial action. In particular, the company noted the dampening impact the strikes across the UK had in the lead up to Christmas. Nevertheless, it still noted a 28% jump in demand year on year from pubs and restaurants though supermarket sales fell by around 2%.

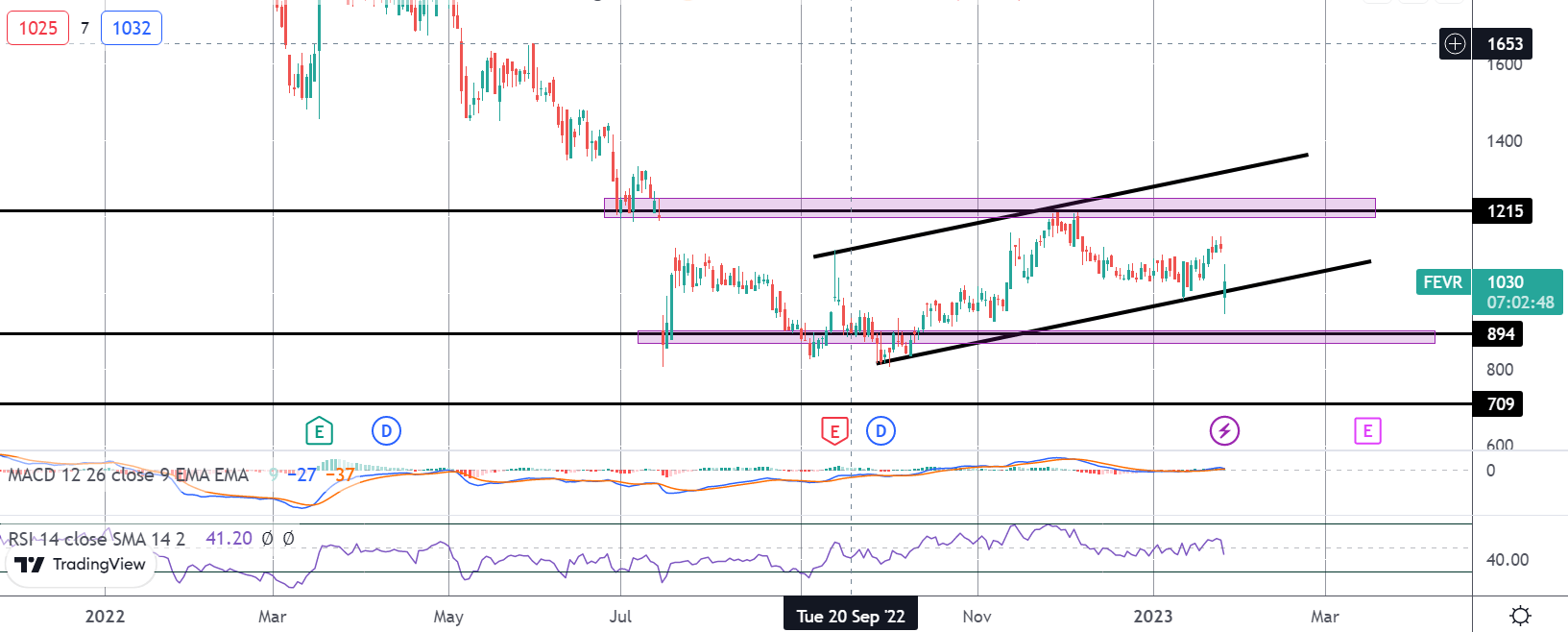

On the back of weak results posted in September, today’s profit warning is disappointing for investors. Shares are currently down around 66% from 2022 highs and are sitting around the initial pandemic lows, threatening to break lower.

Near-Term Outlook

Near-term, the downside risks for the company are well signalled. However, given the weak expectations, there are upside risks across the year should these conditions begin to resolve. A sharp cooling of inflation in the UK would help lift consumer demand. Furthermore, any shift lower in the cost of materials and ingredients will also help improve the outlook for Fevertree, helping increase profit margins. With this in mind, this is a good stock to keep an eye on over coming months should the UK picture start to improve.

Technical Views

Fevertree

The move off the 2022 lows has been framed by a shallow bullish channel. However, price is now testing the channel lows after gapping down today. Below here, 894 is the block of support to note (2020 lows) with a break below there opening the way for a move down to 709 next. To the topside, 1215 is the key hurdle for bulls, a break of which should help encourage fresh bullish momentum.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.