NZDJPY On Watch

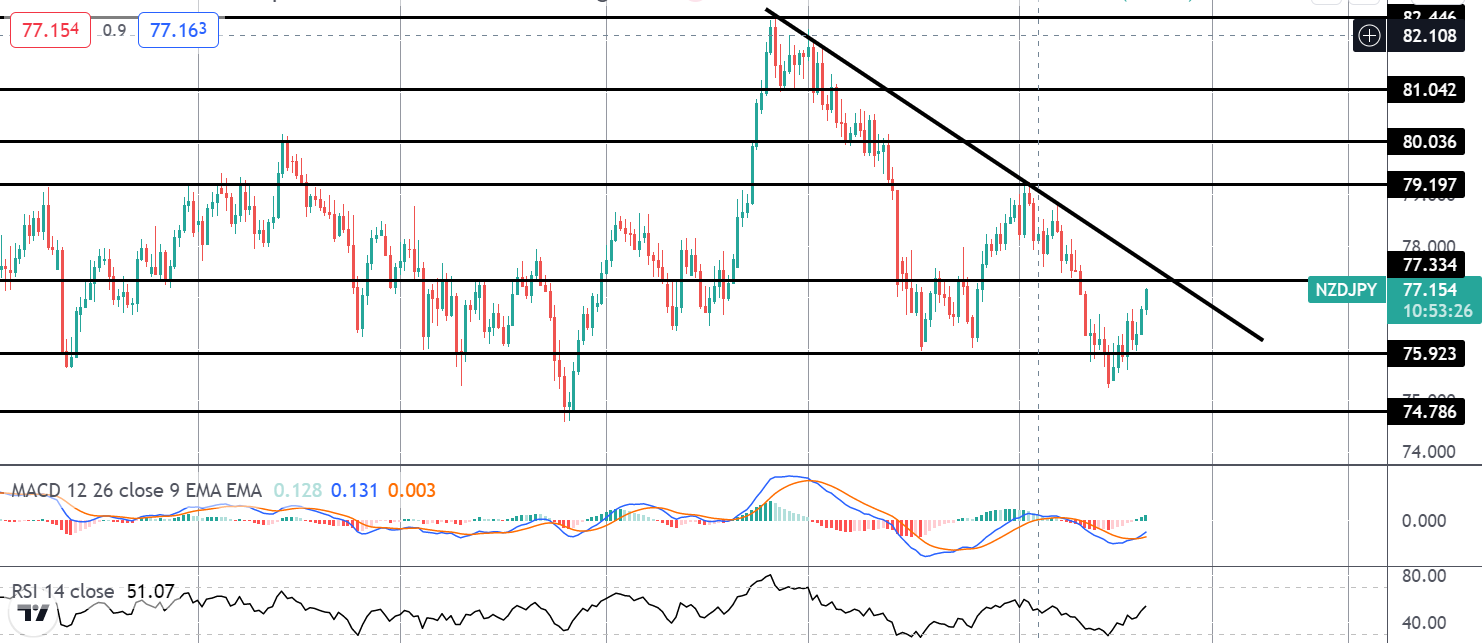

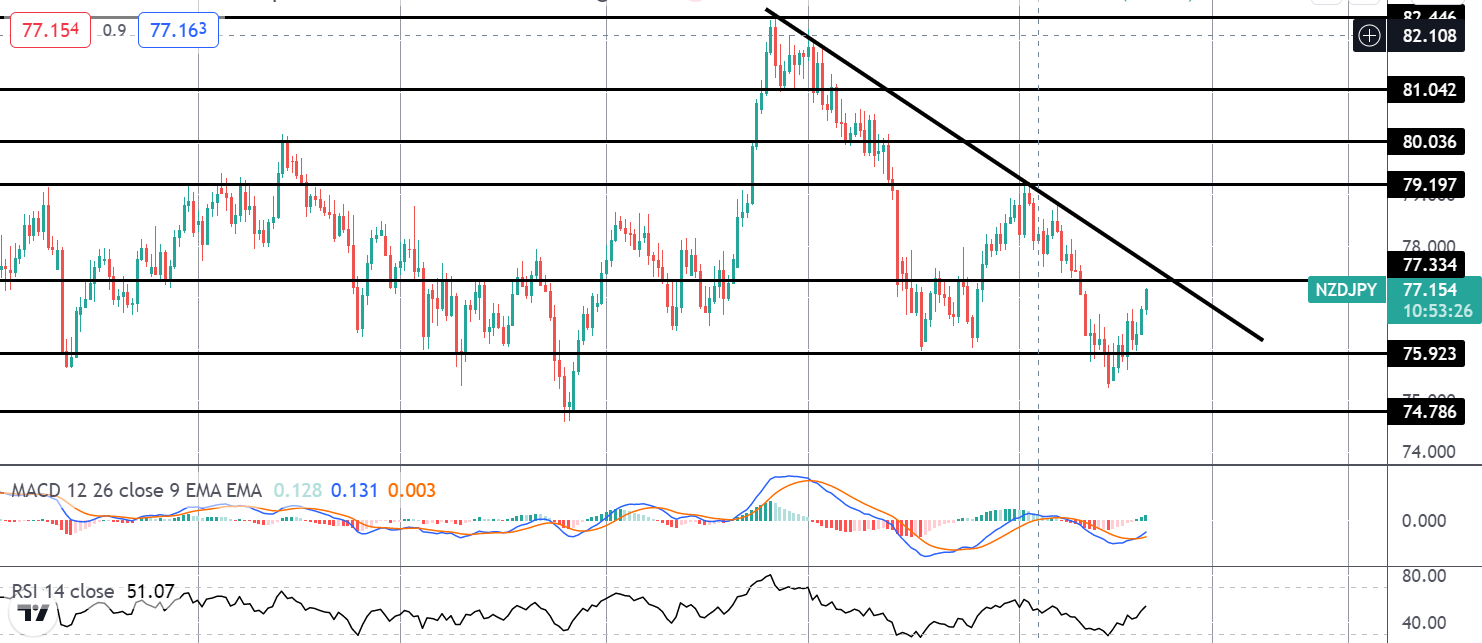

NZDJPY is worth keeping an eye on here. The reversal off the move sub 75.92 is starting to gather momentum and price is fast approaching the bear trend line from 2021 highs and the 77.34 level resistance. With the retail market heavily short the pair and RBNZ rate-hike expectations surging in the face of rising inflation and falling unemployment, there is room for a breakout here. Bulls can look to trade a closing breach of the 77.34 level, targeting 79.19 initially and 80.03 above.

With risk assets remaining supported, NZD has seen better demand over recent sessions. Rising commodities prices have created decent support for the antipodean currency while at the same time, JPY has seen outflows linked to diminished safe haven demand, a theme which looks set to continue near-term.

Keep An Eye On

USD flows across the rest of the week look set to be the biggest driver. With NZD benefiting from the current weakness in USD, bulls need to see a continuation of the this dynamic in order for a breakout to work. With this in mind, keep an eye on Thursday’s US inflation reading and Friday’s jobs report. Any unexpected weakness will likely fuel a further rally whereas any consequent USD strength will likely curtail the current NZDJPY rally.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.