Markets Digest: Fed’s Emergency Cut, Key Takeaways of WHO Wuhan Report

One of the rumored outcomes of the Federal Reserve’s response to evolving risk associated with coronavirus was an emergency rate cut of 50 basis points, which, in fact, were done yesterday. Clearly it was also an attempt to create a positive shock in expectations, but the official statement and Powell press-conference remarks brought to a naught the desired effect: US stocks surged but then suddenly went into decline closing with 3% loss on Wednesday.

Both the statement and Powell message to markets contained infamous wording of “act as appropriate” which spooked equity investors. Historically, this phrase was a harbinger of Fed's capitulation which was followed by either an interest rate cut or QE.

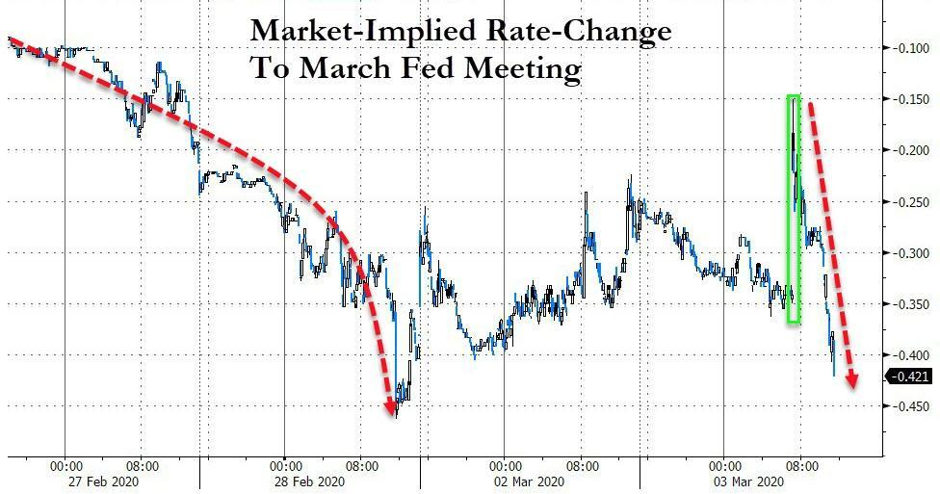

As a result, markets have concluded that it is not an end to the new easing cycle and after a brief ease in expectations continued to price in more cuts (by 40 bp):

Source: Zero Hedge

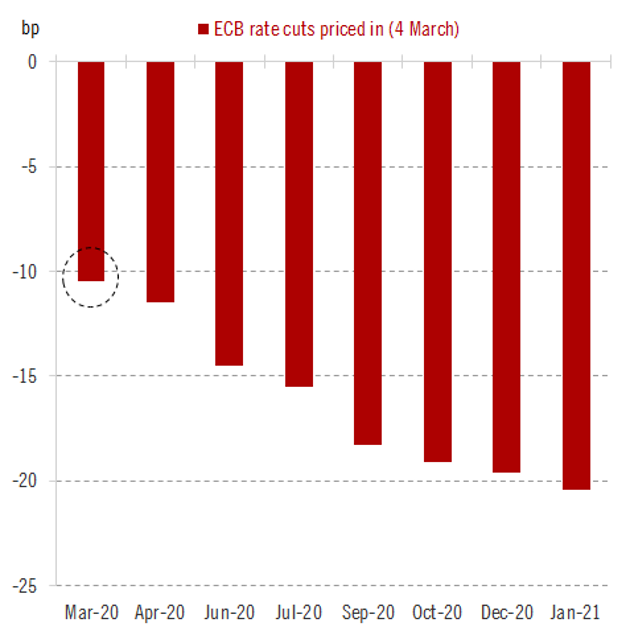

The Fed’s bold and aggressive move has changed expectations regarding the ECB March meeting from “no change” to 10 bp interest rate cut:

Source: Frederic Ducrozet

It follows that if the ECB continues to insist on rise of government spending as a primary response to the challenge (as the ECB’s Vice President De Guindos recently indicated), this will definitely cause a strong strengthening of the euro against the dollar, since the markets are now essentially pricing in a coordinated response of central banks.

While the mainstream media continues to scare us with the monster, molded from rumors and facts about the coronavirus, I would like to draw your attention to the WHO report with probably the first more or less reliable data. WHO experts team were finally allowed into Wuhan and gathered the findings based on fairly representative sample – about 60000 cases. Yesterday, WHO held a conference, released the report (available here), I will give the summary:

- Considering the cluster of infected, in 78-85% of cases, the way of transmission were airborne droplets during the close contact;

- In 5% of cases, treatment required ICU; in 15% of cases, respiration with highly concentrated oxygen were required. With a mild course of the disease, the average time to recovery is 2 weeks, in severe and critical 3-6 weeks;

- Most infected people develop symptoms within a few days. Asymptomatic cases are rare;

- The most common symptoms: fever (88%), dry cough (68%), exhaustion (38%), sputum production when coughing (33%), shortness of breath (18%), headache (14%), muscle pain (14%), sore throat (14%). "Running nose" is not a symptom of coronavirus.

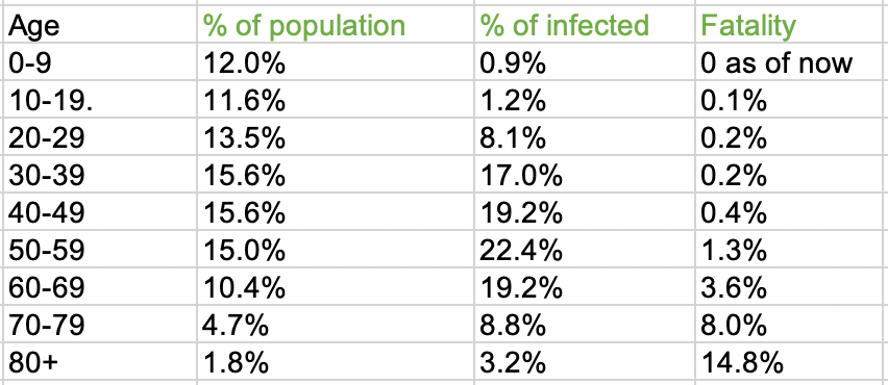

- Mortality based on a sample of 44,672 people was 3.4%. Mortality is highly dependent on age, gender, concurrent illnesses and immune response. Data is relevant on February 17th.

- 20% of patients need outpatient treatment for several weeks;

And finally, the most valuable, in my opinion, information: the relative proportion of infected and victims, depending on age:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.