Nasdaq Soaring on Dovish Fed Bets

Stocks Gaining Ground Again

US stocks are roaring ahead this week s traders brace for the September FOMC meeting on Wednesday. Traders are now widely expecting the Fed to push ahead with a deeper .5% rate cut on the back of the recent continued fall in jobs and inflation. While a few weeks ago, stock sentiment had weakened on ballooning economic fears and the prospect of aggressive Fed easing, those same expectations are now supporting the market. Traders now sense that hard landing risks aren’t s severe as initially thought, with the focus instead on the easier financial conditions to come as the Fed begins easing.

Market Scenarios for Wednesday

Looking ahead to Wednesday, the Nasdaq stands to gain firmly if the Fed cuts by a larger .5% and gives a clear signal that further easing is coming, which would be the most bullish scenario for stocks. The recent correction lower in the market has created plenty of room for fresh bullish momentum as risk capital re-enters. Given the built-up level of dovish expectations, however, there are bearish risks for stocks. If the Fed cuts by a smaller .25% this could be met with disappointment and a short-covering rally in USD which hampers upside in stocks. Additionally, if the Fed refrains from giving a clear signal on further easing beyond this month, that could also frustrate stock bulls, tempering the upside reaction from a rate cut this week.

Technical Views

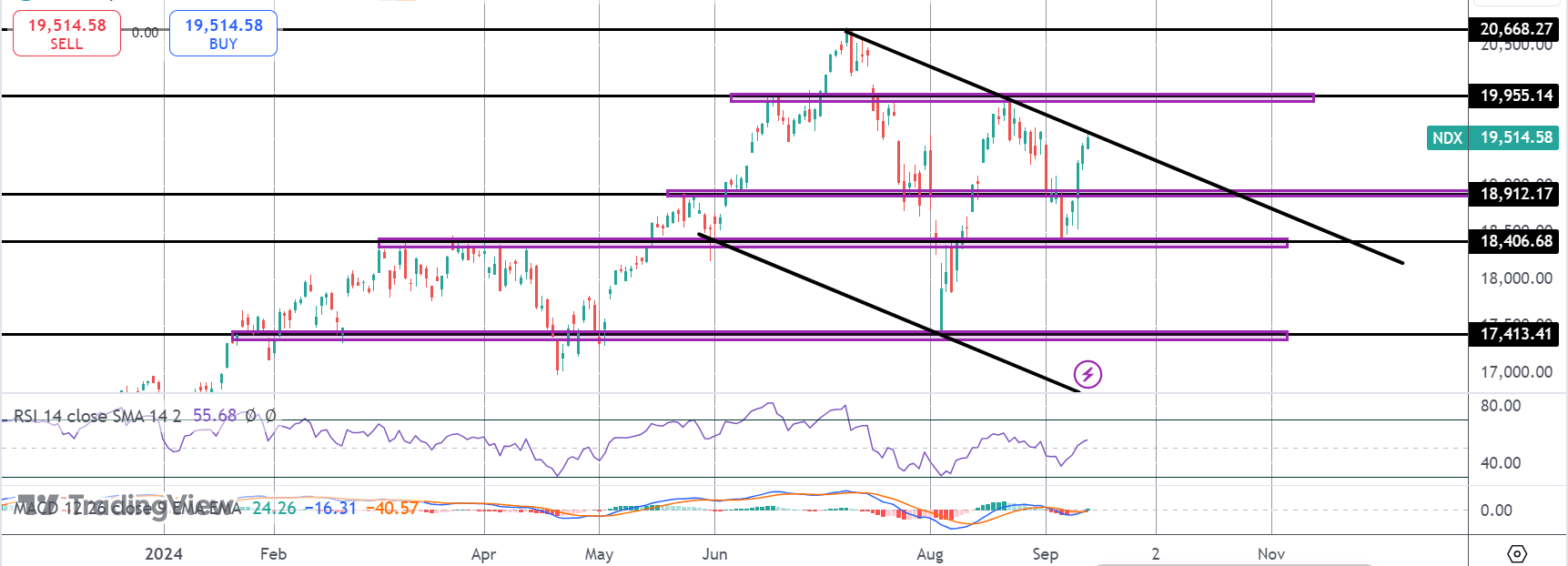

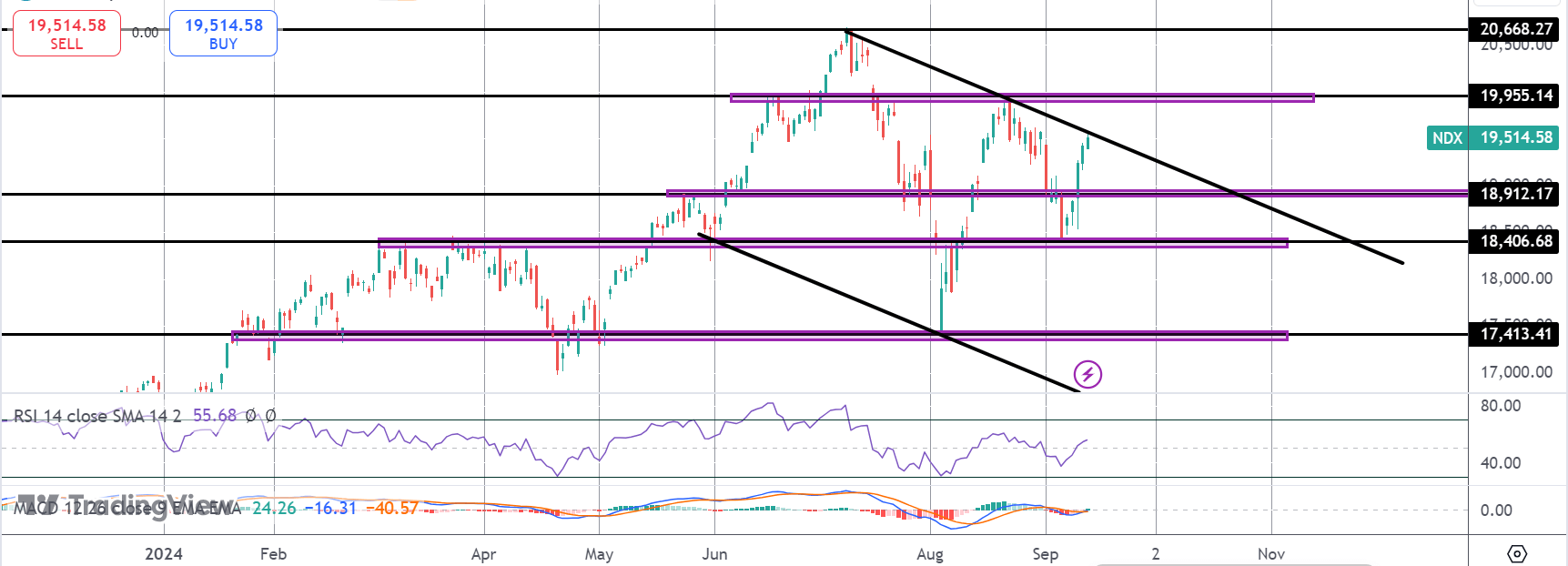

Nasdaq

The rally off the 18,406.68 level has seen the market breaking back above 18,912.17 with price now testing the bear channel highs once again. The current structure can be viewed as a corrective bull flag pattern, putting focus on a fresh break higher. 19,955.14 will be the key level to watch with a move above here signalling a continuation of the bull trend towards 20,668.27 and above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.