Better UK Data… Again

The British Pound continues to storm higher against the Dollar this week. Against a backdrop of elevated Fed easing expectations, further positive UK data is casting uncertainty over how the BOE is likely to proceed near term following its recent rate cut. The latest UK PMIs released today both came in above forecasts. Manufacturing came in at 52.5, up from 52.1 prior and above the 51.7 the market was looking for. Similarly, services was seen at 53.3, up from 52.5 prior and well above the 52.8 the market was looking for, marking a tenth consecutive month of expansion for the sector. GBPUSD reached a 13-month high on the back of the data,

BOE’s Bailey Up Next

Focus now turns to BOE governor Bailey who speaks at the Fed’s Jackson Hole Symposium tomorrow. With UK data strengthening recently, traders are struggling to get a read on whether the BOE will push ahead with further easing. Currently, market pricing is in favour of the bank holding in September and easing further in November. However, traders will be very sensitive to any signs tomorrow that the bank might look to hold rates through November while it monitors incoming data, particularly given the recent uptick in CPI (2.2% from 2% prior). In this scenario, GBPUSD could trade much higher near-term, especially if we get a firmly dovish view from Fed’s Powell tomorrow.

Technical Views

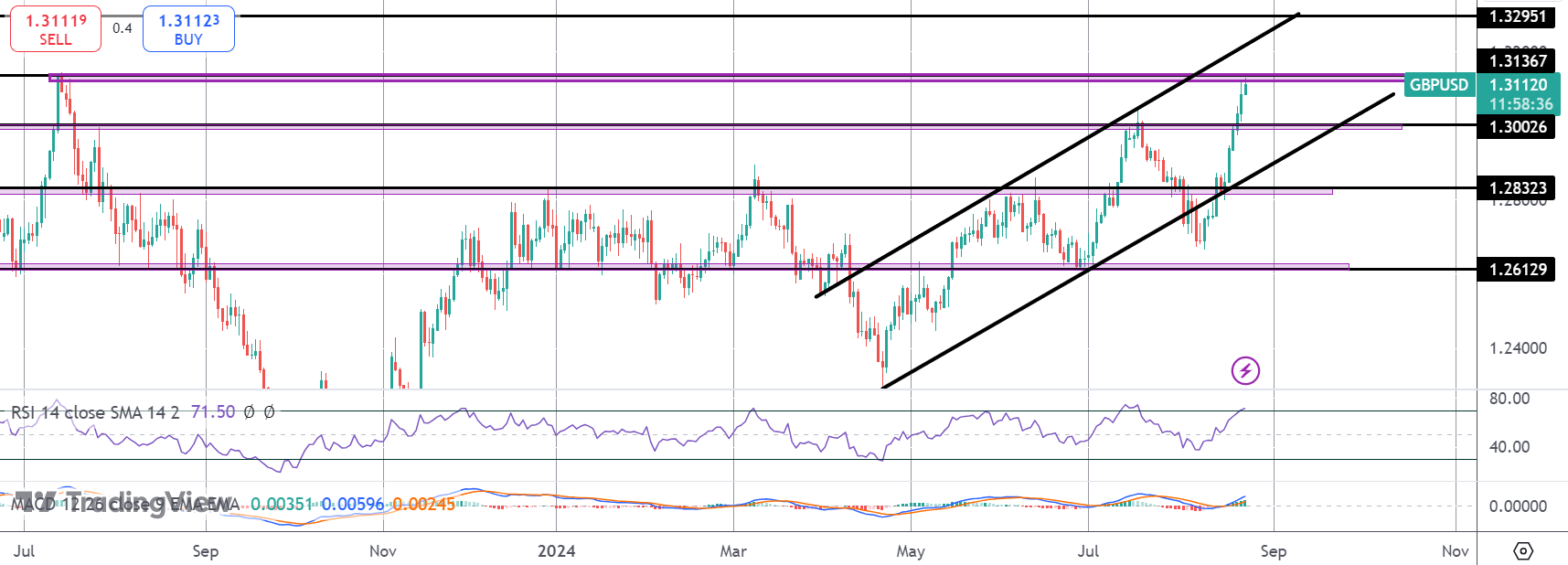

GBPUSD

The rally in GBPUSD has seen the market breaking above several resistance levels. Price is now testing the 1.3002 level and with momentum studies bullish, focus is on a fresh push higher. Above current resistance, 1.3297 and the channel highs will be the next objective for bulls. 1.3002 remains key support to note. In the Signal Centre today we have a buy limit at 1.3010, suggesting a preference to buy any pullbacks and stay long for fresh highs.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.

-1724317454.png)