SP500 LDN TRADING UPDATE 04/04/25

SP500 LDN TRADING UPDATE 04/04/25

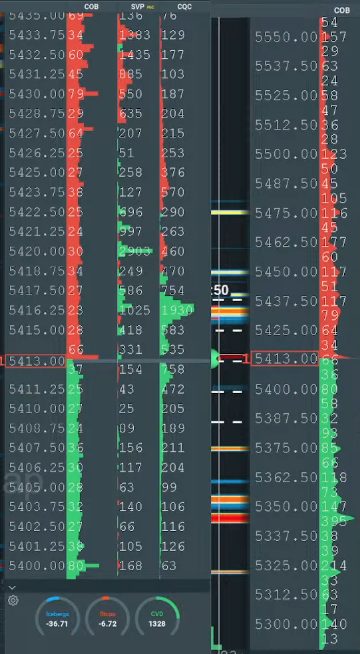

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5050/60

WEEKLY RANGE RES 5746 SUP 5458

DAILY BULL BEAR ZONE 5455/65

DAILY RANGE RES 5464 SUP 5378

2 SIGMA RES 5563 SUP 5279

5345 WEEKLY NVPOC

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – -40 POINTS)

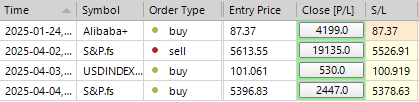

TRADES & TARGETS

LONG ON ACCEPTANCE ABOVE DAILY BB ZONE TARGET 5532

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP > 5345

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MARKET MELTDOWN

FICC and Equities | April 3, 2025

Market Summary:

The U.S. equity market experienced a significant decline today:

- S&P 500 closed down 484bps at 5,396, with a Market-On-Close (MOC) imbalance of $900m to BUY.

- NASDAQ 100 dropped 541bps to 18,521.

- Russell 2000 fell 659bps to 1,910.

- Dow Jones slid 398bps to 40,545.

A staggering 20.8 billion shares traded across all U.S. equity exchanges, far exceeding the year-to-date daily average of 15.4 billion shares. The VIX surged +39.5% to 30.02, while crude oil declined -7% to $66.67. The U.S. 10-year Treasury yield fell 10bps to 4.03%. Other notable moves: gold rose 118bps to $3,129, the dollar index (DXY) dropped 163bps to 102.11, and Bitcoin fell -4.5% to $81,858.

Key Observations:

- S&P 500 closed 4.8% lower, while the NASDAQ 100 was down 5.4%.

- Today marked the busiest day on the HT cash desk since "Deep Seek Monday" (January 27). The orderly flows suggest no panic, with hedge funds (HFs) reducing net positions ahead of the session and large defensive rotations from long-only (LO) investors over the past month.

Sector Performance:

Selling was concentrated in sectors impacted by tariff fears, particularly technology (TMT), semiconductors, and financials. Apparel, footwear, and home furnishings were hit hard, with declines exceeding 15%. Our retail basket (GSX1RETL) dropped 11%, an 8-sigma move.

Conversely, Healthcare (+6% buy skew) and Consumer Staples (+13% buy skew) saw meaningful buying activity. Staples outperformed Discretionary in one of the largest divergences in the past 20 years. Managed Care and Pharma also saw strong demand, benefiting from exclusion from reciprocal tariffs disclosed last night.

Market Flows:

- Total activity levels on the trading floor were ranked 9/10.

- LO investors ended the day with $3 billion for sale, totaling $3.5 billion for sale this week. Hedge funds finished $1.5 billion for sale, balanced for the week, with shorts outpacing long sales.

Fund Performance:

- Fundamental Long/Short (LS) managers were down 2.1%, primarily driven by market beta, and are now down 1.9% YTD.

- Systematic LS managers declined 0.2%, but remain up 11.0% YTD.

Derivatives Activity:

The session saw strong client activity at the open, heavily tilted toward downside protection, particularly in SPX and NDX. Customers rolled down put spreads and bought significant volume in the 25-delta put area. Despite the sharp market decline, volatility flows were relatively muted in the afternoon.

The VIX climbed to ~30, its highest level since the August 5 volatility event. While VIX spot rose 8v and SPX fell nearly 5%, VVIX (volatility of VIX) remained essentially unchanged, highlighting this as a "real-world story" rather than a volatility-driven event.

Economic Data:

The ISM miss added further pressure, with payroll data due tomorrow (GS forecast: +150k; consensus: +140k). A colleague noted that it is rare for the VIX to remain below 30 while the S&P falls more than 4% in a day—this has only occurred once before, on September 13, 2022, when the S&P fell 9% over the following month before bottoming.

End-of-Day Summary:

Today’s trading activity was exceptionally high, with broad market weakness concentrated in tariff-sensitive sectors. Defensive rotations and selective buying in Healthcare and Staples provided some counterbalance. While volatility rose, flows remained orderly, and the market avoided panic-driven capitulation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!