SP500 LDN TRADING UPDATE 08/04/25

SP500 LDN TRADING UPDATE 08/04/25

WEEKLY & DAILY LEVELS

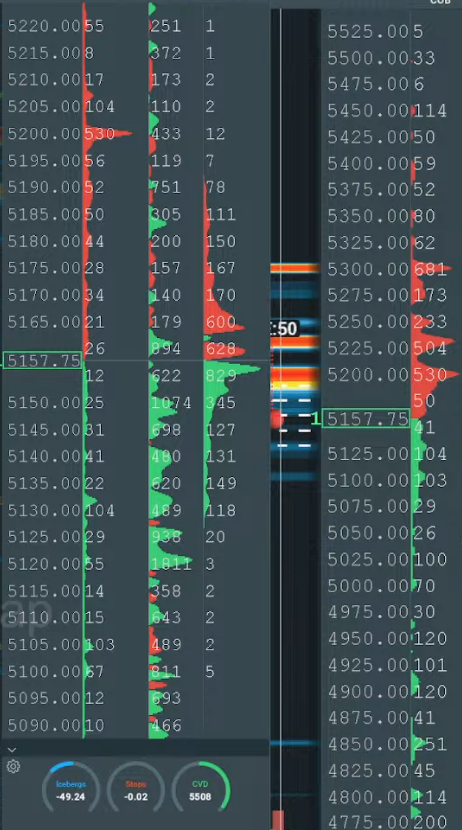

WEEKLY BULL BEAR ZONE 5050/60

WEEKLY RANGE RES 5443 SUP 4749

DAILY BULL BEAR ZONE 5050/70

DAILY RANGE RES 5167 SUP 5068

2 SIGMA RES 5268 SUP 5002

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – -40 POINTS)

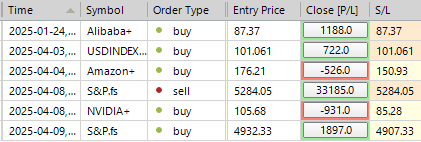

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT 5268 TARGET 5167

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: WHIPLASH

FICC and Equities | April 7, 2025

Market Overview:

- S&P 500: Closed down 23bps at 5,062 with $5B MOC to sell.

- Nasdaq (NDX): Up 19bps at 17,430.

- Russell 2000 (R2K): Down 19bps at 1,835.

- Dow Jones: Dropped 91bps to 37,965.

- Trading Volume: 28.7 billion shares traded across all U.S. equity exchanges, significantly above the YTD daily average of 15.4 billion shares.

- Volatility Index (VIX): Rose 359bps to 46.98.

- Other Markets:

- Crude Oil: Down 168bps at $64.49.

- U.S. 10-Year Yield: Up 21bps at 4.20%.

- Gold: Declined 127bps to $2,997.

- DXY (Dollar Index): Up 48bps at 103.51.

- Bitcoin: Down 35bps at $78,531.

Key Highlights:

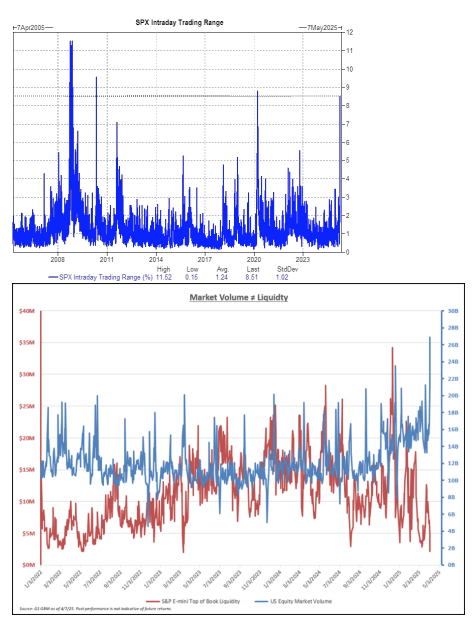

1. Record Trading Volumes: Back-to-back record volume days for U.S. equities, with 28.7 billion shares traded today versus 26.6 billion on Friday. Market liquidity remains strained, as evidenced by the S&P E-mini top-of-book depth dropping to $2 million—the widest gap between volume and liquidity in our dataset.

2. Investor Sentiment: Activity levels on the trading floor were rated an 8 out of 10, with investors largely frozen. Desk flows were less chaotic compared to Thursday and Friday, showing signs of stabilization.

- Asset Managers and Hedge Funds (HFs) were net buyers (~$1.5 billion) across the floor, marking the highest buy skew for HFs since January and placing in the 96th percentile on a 52-week lookback. - Heavy limit order (LO) supply has eased, with renewed interest in high-quality tech stocks and China ADRs.

3. Cover Demand: Strong cover demand emerged in lower-quality, highly shorted names and ETFs following the S&P’s sharp 800bps reversal between 9:45 AM and 10:00 AM due to false news about a "90-day pause in tariffs." This demonstrated how volatile coiled spring covers can be in the current market environment. - Buy skews were concentrated in Financials, Technology, and Consumer Discretionary sectors. - Thursday and Friday saw the largest two-day notional short selling in macro products in our dataset’s history.

Hedge Fund Performance:

- Fundamental Long/Short (LS) Managers: Estimated returns down 1.4% today, now down 5.9% YTD.

- Systematic LS Managers: Returns declined 0.9%, primarily due to unwinding in crowded stocks (~2.5 SD adverse moves). Despite today’s pain, systematic LS managers remain up 10% YTD.

Economic Forecast Adjustments:

Jan Hatzius and team have revised the 2025 Q4/Q4 GDP growth forecast down to 0.5% (from 1%) and the annual average GDP growth forecast to 1.3% (from 1.5%). The 12-month recession probability has been raised from 35% to 45%.

Derivatives Market Insights:

- Intraday trading range reached 8.51%, comparable to levels seen during COVID and the Global Financial Crisis (GFC).

- SPX volatility and skew were heavily bid, particularly in the front end, where the term structure is fully inverted.

- Dealer positioning remains flat/short gamma across the board, with flows focused on monetization and rolling of existing hedges.

- Limited directional buying was observed, though some clients purchased weekly calls on the "Mag7" stocks to capitalize on potential rebounds.

- The ATM straddle for the remainder of the week implies a 5.75% move, highlighting heightened volatility.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!