SP500 LDN TRADING UPDATE 11/7/25

SP500 LDN TRADING UPDATE 11/7/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~40 POINTS***

WEEKLY BULL BEAR ZONE 6220/10

WEEKLY RANGE RES 6424 SUP 6224

DAILY BULL BEAR ZONE 6315/25

DAILY RANGE RES 6381 SUP 6261

2 SIGMA RES 6439 SUP 6201

GAP LEVELS 6147/6077/6018/5843/5741/5710

VIX BULL JULY CONTRACT BEAR ZONE 21.35 DAILY BULL BEAR ZONE 16.75

DAILY MARKET CONDITION - BALANCE - 6335/6238

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favoring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET 6271/61

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET 6336/57

SHORT ON TEST/REJECT 6357/67 TARGET 6336>6315

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MOMENTUM ROLL CONTINUES

FICC and Equities

10 July 2025 | 9:10 PM UTC

Market Highlights:

- S&P 500: +27bps, closing at 6,280, with a MOC of $4.2b to SELL.

- Nasdaq 100 (NDX): -16bps, ending at 22,829.

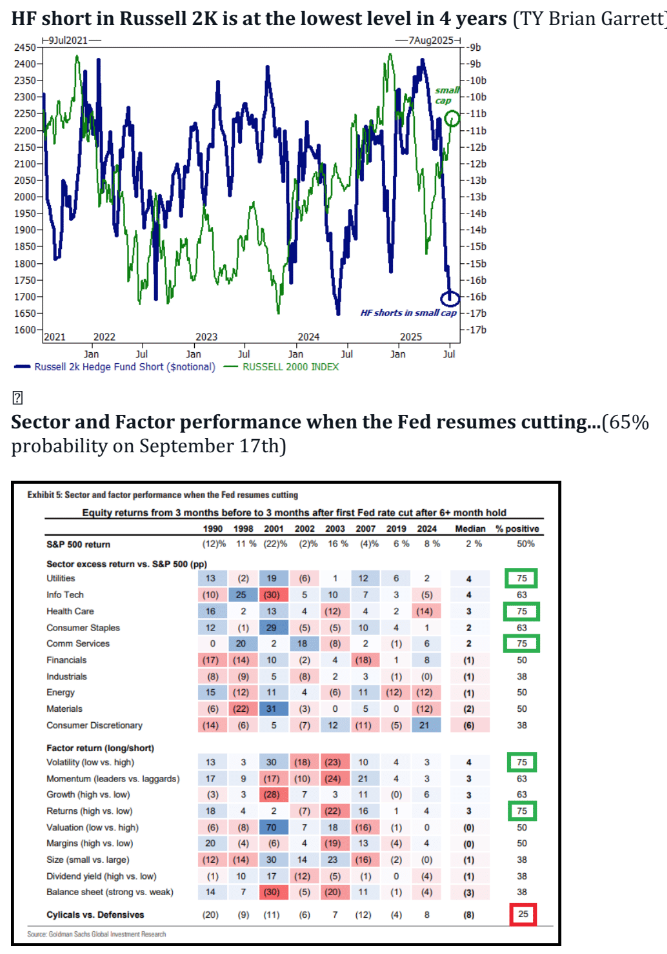

- Russell 2000 (R2K): +51bps, finishing at 2,280.

- Dow Jones Industrial Average: +43bps, closing at 44,650.

Trading Volume:

18.3 billion shares traded across all U.S. equity exchanges, surpassing the year-to-date daily average of 16.8 billion shares.

Key Indicators:

- VIX: +1%, closing at 15.78.

- Crude Oil: +221bps, settling at $66.87.

- U.S. 10-Year Yield: +1bps, now at 4.34%.

- Gold: +38bps, closing at $3,333.

- DXY (Dollar Index): +2bps, ending at 97.56.

- Bitcoin: +12bps, reaching $113,694.

Momentum Roll Observations:

Another quiet session marked by a momentum roll. The High Beta Momentum basket (GSPRHIMO) dropped -2.7%, driven by a -1% decline in the Long leg and a +1.7% rise in the Short leg. The GS MO Pair is down 12% for the month, marking its largest drawdown since February.

Sector Insights:

Airlines experienced a scramble to cover positions, with the group (GSIDLAIR) surging +10% (a 3.5 sigma move). This was fueled by Delta Airlines (DAL) rising +12% on better EPS and guidance, and United Airlines (UAL) climbing +14% following a balance sheet update and share repurchase announcement.

Within the Mag7 group, divergent price action stood out as TSLA and AAPL gained while NVDA, META, MSFT, GOOGL, and NFLX declined. Software stocks broadly traded down -2% to -6%, with no clear catalyst driving the selloff.

Floor Activity:

Activity levels were moderate, rated 5 on a 1-10 scale. The floor ended with +619bps for sale, compared to a 30-day average of -3bps. Asset managers were net buyers of $2.5b, focusing on macro products, tech, and discretionary sectors. Hedge funds finished flows flat, with supply in energy, tech, and financials balanced against demand in macro and discretionary sectors.

Earnings Season Kickoff:

Earnings season begins Tuesday with major financial institutions reporting pre-market, including JPM, WFC, C, BK, STT, and BLK. Key themes include positioning, sentiment, performance, and GIR sector previews.

Derivatives Market:

The volatility market remained subdued, with both skew and vol declining. Client activity included monetizing VIX downside, as the front-month VIX futures held a 16 handle. Airline names saw a notable volume spike, with LUV trading nearly 10x its 20-day average options volume (120k vs. 18k). Daily straddles remain at lows, with an implied move for tomorrow at 41bps.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!