SP500 LDN TRADING UPDATE 15/04/25

SP500 LDN TRADING UPDATE 15/04/25

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5300/5290

WEEKLY RANGE RES 5640 SUP 5140

DAILY BULL BEAR ZONE 5370/60

DAILY RANGE RES 5491 SUP 5373

2 SIGMA RES 5756 SUP 5108

5610 GAP FILL

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – 30 POINTS)

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 5509>5520

SHORT ON TEST/REJECT GAP FILL/WEEKLY RANGE RES TARGET WEEKLY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: CALM

Date: 14 April 2025 | Time: 8:31 PM UTC

Market Overview:

- S&P 500: Up 79 bps, closing at 5,405 with a Market-on-Close (MOC) sell order of $600 million.

- NASDAQ (NDX): Up 57 bps, closing at 18,796.

- Russell 2000 (R2K): Up 114 bps, closing at 1,890.

- Dow Jones Industrial Average: Up 78 bps, closing at 40,524.

- Trading Volume: 17.8 billion shares traded across all U.S. equity exchanges, compared to the year-to-date daily average of 16.5 billion shares.

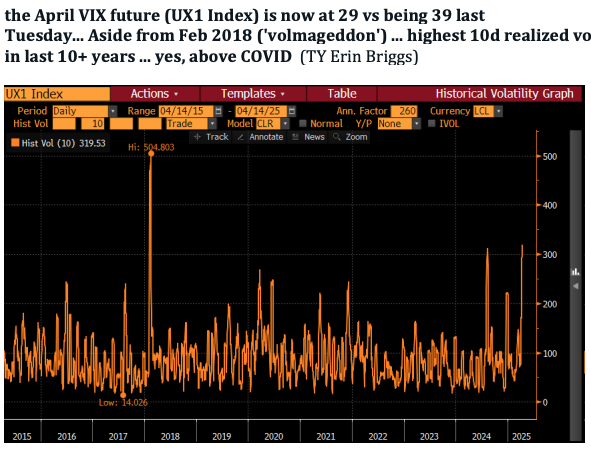

- Volatility Index (VIX): Down 18%, closing at 30.97.

- Crude Oil: Up 20 bps, priced at $61.61.

- U.S. 10-Year Treasury Yield: Down 11 bps, at 4.38%.

- Gold: Down 53 bps, priced at $3,227.

- U.S. Dollar Index (DXY): Down 44 bps, at 99.66.

- Bitcoin: Up 160 bps, valued at $84,783.

Market Sentiment:

The week began calmly with positive news flow. President Trump announced a pause on import duties for consumer electronics, benefiting Apple (+4%), which sources over 80% of its iPhones from China. Additionally, there are reports of potential tariff exemptions for parts of the auto industry, boosting Ford and GM by 4%. Federal Reserve Governor Waller indicated a preference for rate cuts if recession risks increase, leading to a 13 bps drop in the U.S. 10-Year yield to 4.36%. Despite some intraday fluctuations, the market remains focused on the weakening USD, with the DXY chart hitting three-year lows. Defensive sectors like REITs, Utilities, and Staples outperformed, while S&P cash volumes were muted, down 39% compared to the 5-day moving average. Liquidity challenges persist, with the S&P top of book at $1.8 million.

Trader Insights:

According to TMT trader Peter Bartlett, recent market flows have shown covering of macro products alongside ongoing supply from asset managers. While there have been sporadic buying activities from long-only investors, many are waiting for more stability and visibility before increasing market exposure. The trading floor activity was rated a 4 out of 10, with overall activity levels subdued. Long-only investors ended as net sellers by $1.5 billion, with supply spread across various sectors. Hedge funds remained balanced, with tech and macro product covers offset by minor supply in utilities and industrials.

Derivatives Market:

The volatility space experienced a relatively quiet session as clients adopted a wait-and-see approach until the spot market breaks its current trading range. The main theme was volatility reversion, with the VIX down approximately 6.75 points and SPX 1-month ATM volatility down over 4 points. There was interest in VIX downside expressions, with a purchase of 40,000 VIX June 16 Puts for 12 cents. For bullish exposure, owning calls in QQQ is recommended, as the upcoming earnings season is expected to keep volatility elevated. The gamma story remains unchanged, with dealers maintaining small short positions without flipping long. The straddle for the shortened week is priced at 2.55%..

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!