SP500 LDN TRADING UPDATE 18/03/25

SP500 LDN TRADING UPDATE 18/03/25

(PLEASE NOTE ALL LEVELS ARE NOW QUOTED IN THE JUNE CONTRACT M25 FOR US500 LEVELS SUBTRACT 54 POINTS.)

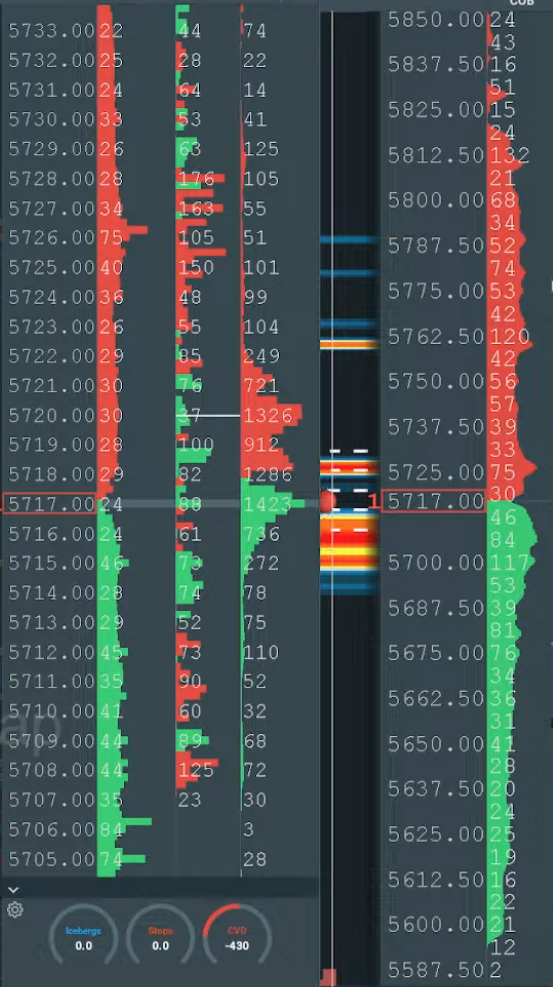

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5650/60

WEEKLY RANGE RES 5850 SUP 5550

DAILY BULL BEAR ZONE 5670/80

DAILY RANGE RES 5776 SUP 5688

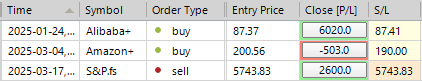

TODAY'S TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES>WEEKLY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE>DAILY RANGE SUP

LONG ON TEST/REJECT OF WEEKLY BULL BEAR ZONE TARGET DAILY RANGE RES>WEEKLY RANGE RES

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES: MUNDANE DAY

**FICC and Equities | March 17, 2025 |

- S&P 500: +64bps, closing at 5,572 with $200M MOC to sell.

- NASDAQ 100 (NDX): +55bps, closing at 19,812.

- Russell 2000 (R2K): +106bps, closing at 2,082.

- Dow Jones: +85bps, ending at 41,841.

Volume: 13.8B shares traded across U.S. equity exchanges, below the YTD daily average of 15.3B.

Volatility Index (VIX): -5.8%, closing at 20.51.

Commodities: Crude +45bps at $67.49; Gold +28bps at $3,009.

Rates: U.S. 10-Year Treasury -2bps at 4.29%.

Currency: DXY -31bps at 103.39.

Crypto: Bitcoin +1.3%, closing at $84,479.

### Market Dynamics: A Mixed Day

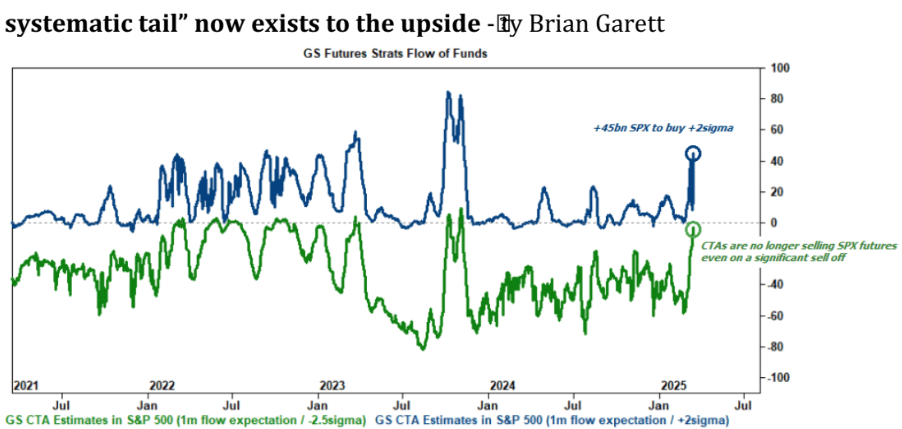

Today’s session had a somewhat defensive tone with pockets of short squeezes, yet it felt like the first “normal” trading day in over two weeks. Better-than-expected retail sales drove outperformance in cyclically-leveraged sectors, with the S&P Equal Weight index outperforming by ~70bps. Hedge funds (HFs) showed constructive, albeit muted, activity as volumes were down over 20%. HFs appear to be regaining confidence, while asset manager supply slowed, with some pair trades emerging instead of outright sales—a positive indicator. Non-fundamental activity is decelerating, with CTA supply at just $1B this week. CTAs are expected to step in as buyers during squeezes. The S&P 500 is now ~70 points away from reclaiming its 200-day moving average (5,742). Retail investors also returned to the market, with meme stocks surging +750bps over the past two sessions.

### Key Events to Watch

- NVIDIA GTC: Jensen Huang’s keynote at 1 PM.

- Investor Days: GLW and ADBE.

- Geopolitics: Trump and Putin expected to discuss Ukraine.

### Notable Weakness in Mega-Cap Tech

Mega-cap tech (“Mag 7”) showed weakness today, raising questions with no clear catalyst. Tesla fell 5%, and NVIDIA positioning ahead of GTC may have contributed. Investors are navigating quarter-end dynamics, questioning whether the global macro environment will support a positive EPS revision cycle for mega-cap tech after months of flat revisions. Lower prices may also reflect lowered expectations.

### Sector & Factor Trends Ahead of FOMC

As we approach Wednesday’s FOMC meeting, Goldman Sachs’ Long/Short Stagflation Pair Index (GSPUSTAG) is up +17% YTD. Stagflation-friendly sectors include Healthcare, Energy, Consumer Services (over Goods), and Value factors. Conversely, Industrials, Information Technology, Materials, and Communication Services are underperforming.

### Desk Activity Recap

- Overall Activity: Rated a 5/10.

- LOs: Finished -$2.7B net sellers, driven by broad supply in Tech, Industrials, and Consumer Discretionary.

- HFs: Ended +$1B net buyers, with demand in Tech, Industrials, Financials, and REITs.

Buybacks: Entering Day 1 of the blackout period, which lasts until April 25. Activity typically drops ~30% during this period. Limited 10b5-1 plans remain.

Quarter-End Pension Rebalancing: A mixed picture, with $29B in equities to buy versus $29B in bonds to sell.

### Derivatives Update

- CTA Positioning: Selling pressure has largely dissipated. CTAs are modeled as minor sellers across all scenarios for the next week.

- Gamma Exposure: Remains light, with dealers never long/short more than $2B of S&P within an 8% band.

- Flow Trends: Slower today, with sellers of volatility and demand for VIX downside via puts and put spreads (out to April). Desk supports these trades, expecting continued declines in volatility.

Weekly Straddle: Implied move of 1.88%, factoring in Wednesday’s FOMC decision.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!