SP500 LDN TRADING UPDATE 6/05/25

SP500 LDN TRADING UPDATE 6/05/25

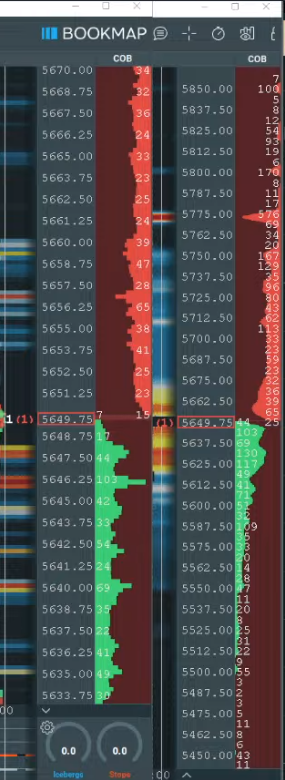

WEEKLY BULL BEAR ZONE 5640/30

WEEKLY RANGE RES 5580 SUP 5840

DAILY VWAP BULLISH 5641

WEEKLY VWAP BULLISH 5483

DAILY BALANCE 5724/5618

WEEKLY ONE TF UP 5455

MONTHLY ONE TF DOWN 5739

GAP FILL LEVELS 5339/5606

WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: S&P WINNING STREAK ENDS

FICC and Equities | 5 May 2025 | 8:29 PM UTC

Market Overview:

- S&P 500: -0.64%, closed at 5,565 with MOC buy orders worth $830M (after a 10-day winning streak).

- Nasdaq 100 (NDX): -0.67%, closed at 19,967.

- Russell 2000 (R2K): -0.85%, closed at 2,009.

- Dow Jones (DJIA): -0.24%, closed at 41,218.

- Volume: 13.9B shares traded across U.S. equity exchanges, below YTD daily average of 16.4B (-32% vs 20-day average).

- Volatility Index (VIX): +0.236 pts, closed at 23.64.

- Commodities: Crude oil -2.41% at $57.04; Gold +2.96% at $3,339.

- Treasuries: U.S. 10YR yield -3 bps at 4.34%.

- Currencies: DXY -0.24% at 99.78.

- Crypto: Bitcoin -1.57% at $94,228.

Summary:

U.S. equities pulled back by ~0.70% across the board, breaking the S&P 500’s longest winning streak in over 20 years. Trading volumes were muted, with major markets like the UK, Japan, China, and Korea closed. Beneath the surface, sector dispersion was notable:

- Gainers: Airlines rallied as crude prices dropped following an OPEC+ production hike. Retail saw strength, highlighted by SKX surging +25% on news of its acquisition by 3G Capital.

- Losers: Communication Services (NFLX, WBD -2% on proposed foreign media tariffs), Mega Cap Tech (Mag7, AAPL -3% amid Buffett retirement speculation), and MedTech (ZBH -12% on in-line earnings reflecting deal dilution and tariff concerns).

On the data front, ISM Services exceeded expectations, though prices paid hit their highest level since February 2023. Tariffs were a recurring theme, mentioned 13 times in April’s press release (compared to 13 in March and just 5 in January).

Market Activity:

- Activity levels on a scale of 1-10 were rated at 4, with institutional flows muted.

- Long-Onlys remained largely inactive, while Hedge Funds pressed shorts cautiously. Both groups ended as slight net sellers, with sector-level skews benign.

Post-Bell Earnings Highlights:

- PLTR: +5% (beat and raised guidance).

- LSCC: -2% (in-line quarter).

- NBIX: +11% (in-line with consensus, 2025 Ingrezza guidance reaffirmed).

- Ford: -3% (suspended FY forecast due to $1.5B tariff-related uncertainty).

Liquidity and Positioning:

- Top-of-book depth remains weak at $4M (vs historical average of $13M).

- CTAs reduced S&P 500 shorts to -$12.6B (down from -$21B two weeks ago) and are projected buyers under all scenarios this week.

- Buybacks: Estimated ~75% of companies are in open periods, increasing to ~85% by week’s end.

- L/S hedge funds are flat YTD, with gross leverage at the 100th percentile (3-year lookback) and net exposure at the 4th percentile.

Derivatives Update:

- Volatility ticked higher, with skew continuing to sell off from elevated levels.

- Notable trades included a buyer of the Aug 25 straddle (20K contracts) and Jul 26 calls (15K contracts). Interest in IWM calls suggests positioning for a short squeeze.

- Gamma positioning remains balanced, with dealers flat but leaning shorter on both upside and downside risks.

- Weekly straddle pricing at 1.80%, factoring in Wednesday’s FOMC meeting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!