REAL TIME NEWS

Loading...

Title USOUSD M30 | Bullish momentum buildingType Bullish bouncePreference The price is falling towards the pivot at 61, which is an overlap resistance that aligns with the 38.2% Fibonacci retracement. A bounce from this level could lead the price toward the 1st res...

Title USOUSD M30 | Bullish momentum buildingType Bullish bouncePreference The price is falling towards the pivot at 61, which is an overlap resistance

Daily Market Outlook, January 28, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The financial markets are certainly paying attention to Donald Trump. After a prolonged period of calm in the foreign exchange space, the curren...

Daily Market Outlook, January 28, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The financial markets are cer

Title EURGBP H4 | Bearish continuationType Bearish reversal Preference The price is rising towards the pivot at 0.8727, an overlap resistance. A reversal at this level could lead the price toward the 1st support at 0.8656, a multi-swing low support. Alternative Sce...

Title EURGBP H4 | Bearish continuationType Bearish reversal Preference The price is rising towards the pivot at 0.8727, an overlap resistance. A rever

SP500 LDN TRADING UPDATE 28/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6880/70WEEKLY RANGE RES 7065 SUP 6928FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ST...

SP500 LDN TRADING UPDATE 28/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

Title EURJPY H4 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling toward the pivot at 181.66, which is an overlap support that aligns with the 127.2% Fibonacci extension. A bounce from this level could lead the price toward ...

Title EURJPY H4 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling toward the pivot at 181.66, which is an ove

Title CHFJPY H4 | Bullish bounce off key support Type Bullish bounce Preference The price is falling towards the pivot at 198.82, an overlap support that aligns with the 38.2% Fibonacci retracement. A bounce from this level could lead the price toward the 1st resis...

Title CHFJPY H4 | Bullish bounce off key support Type Bullish bounce Preference The price is falling towards the pivot at 198.82, an overlap support t

USD Hanging On… For NowThe US Dollar is turning lower again today after stabilising yesterday on the back of Friday’s plunge lower. The drop on Friday, which extended into a gap lower yesterday, was fuelled by speculation of potential joint US/Japanese intervention...

USD Hanging On… For NowThe US Dollar is turning lower again today after stabilising yesterday on the back of Friday’s plunge lower. The drop on Friday

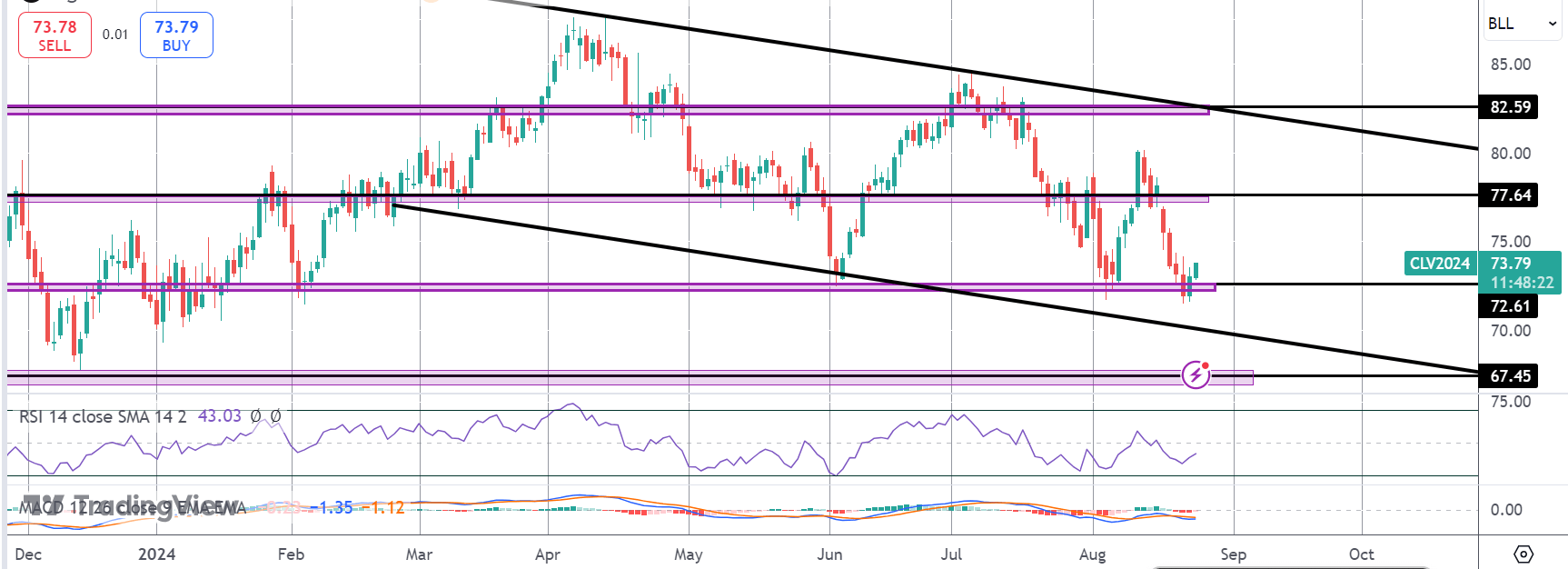

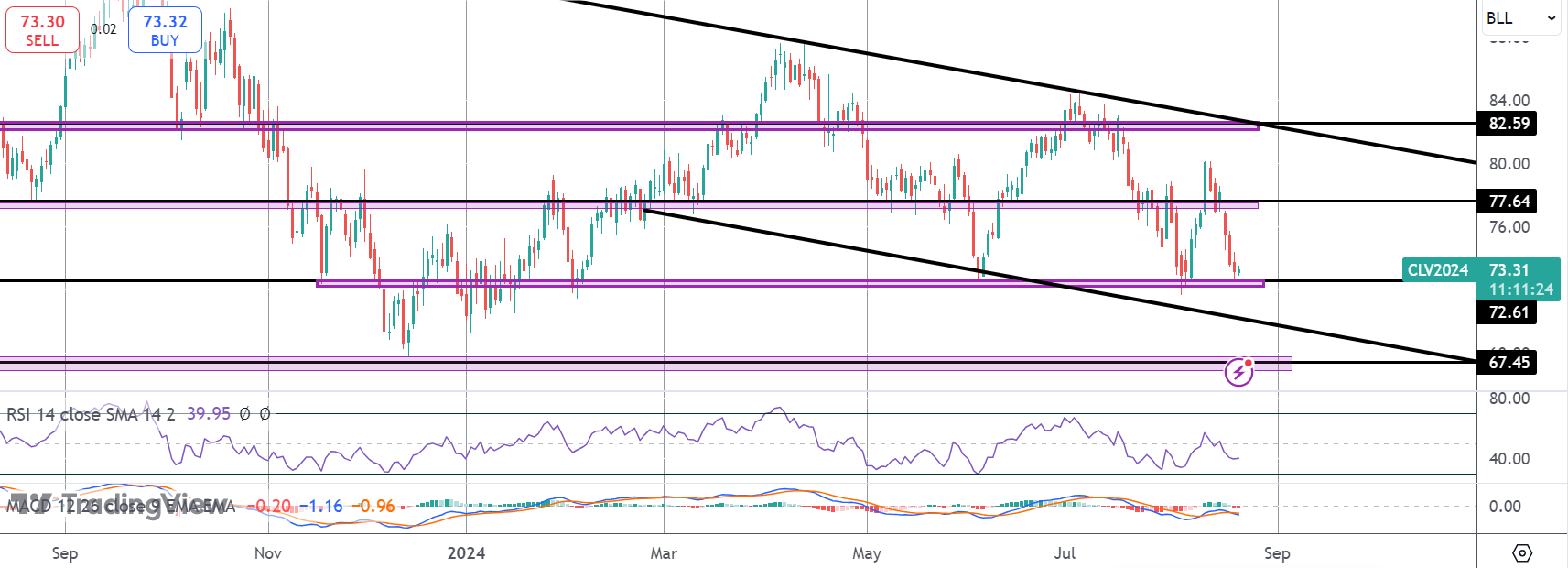

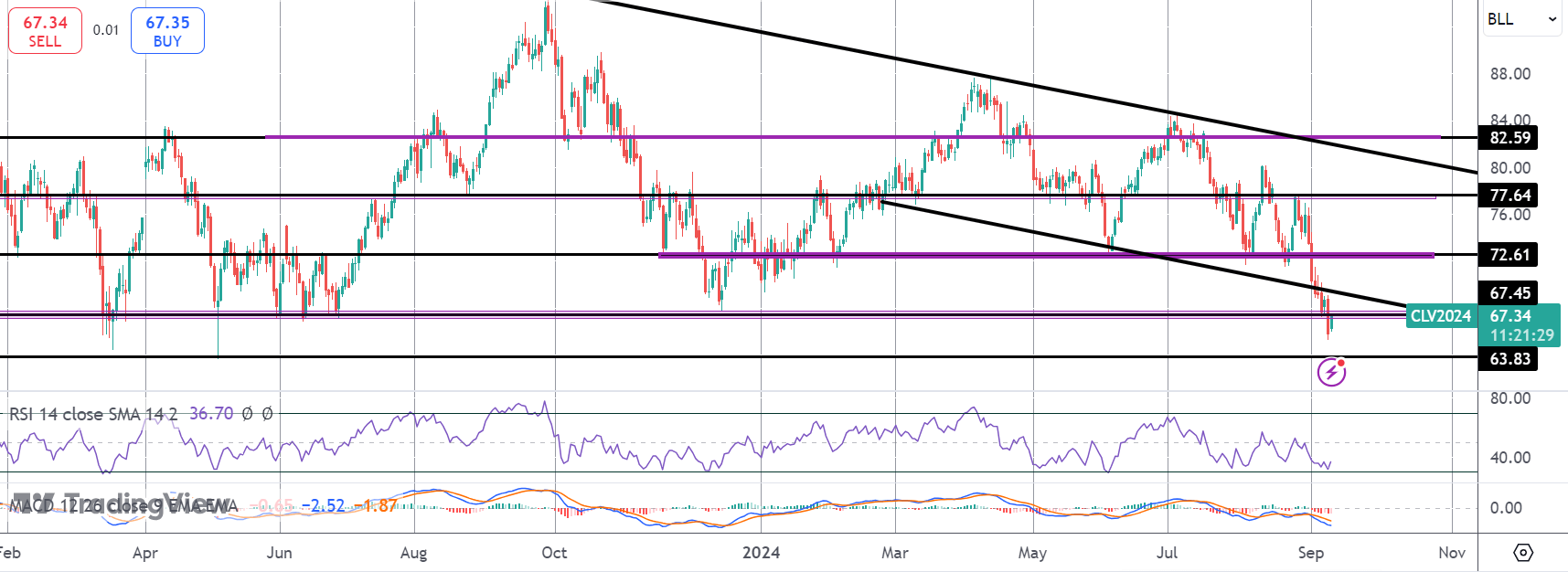

Crude Capped for NowCrude prices remain weak through early European trading on Tuesday. The market was pushing higher initially yesterday, benefiting from a weaker USD before reversing from the session highs. Over-supply concerns remain a key threat to the market w...

Crude Capped for NowCrude prices remain weak through early European trading on Tuesday. The market was pushing higher initially yesterday, benefiting

Buy NOK, SEK, AUD, JPY. Sell EUR, GBP, USD?The US and Japanese authorities intervened in the USD/JPY market on Friday evening, triggering heightened volatility. This resulted in a sharp appreciation of the JPY and KRW, alongside another surge in gold prices, now ex...

Buy NOK, SEK, AUD, JPY. Sell EUR, GBP, USD?The US and Japanese authorities intervened in the USD/JPY market on Friday evening, triggering heightened v

USD: Maintaining Short USD Bias, Monitoring Month-End RisksMarket and FX volatility is stabilising this morning following yesterday’s significant moves, marking our third-largest day on record for eFX volumes. Overall, most clients were eager to capitalise on the U...

USD: Maintaining Short USD Bias, Monitoring Month-End RisksMarket and FX volatility is stabilising this morning following yesterday’s significant move

.png)

.png)

.png)

-1727426479.png)

-1725532989.png)