The FTSE Finish Line - July 13 - 2023

The FTSE Finish Line - July 13 - 2023

FTSE & Sterling Shine As Miners Lead The Charge, Homebuilders Weigh

The FTSE recorded a second day of gains on Thursday heading into the close; the blue chip index was up 0.6%, driven by the positive performance of energy and mining stocks. The increase in commodity prices contributed to the upward movement, with Glencore leading the way by printing 2.8% in the green. AngloAmerican also continued its positive run, rising 2.45% during the day. In addition to the strong stock market performance, Sterling strengthened after official data revealed that Britain's economy contracted by a smaller-than-expected margin in May. This data suggests that the country may be able to avoid a recession in the near term. The positive economic news.

On the negative side of the ledger shares of Barratt Developments, the largest homebuilder in the UK, experienced a 4% decline to 399.1 pence in morning trade. The company issued a warning stating that it would construct significantly fewer homes in the current fiscal year due to a weak market affected by rising mortgage rates and persistent inflation, which have deterred potential buyers. Barratt Developments expects to build between 13,250 and 14,250 units in the year ending June 30, 2024, compared to 17,206 homes constructed in the previous year. This reduction in expected output reflects the challenging conditions in the housing market. Furthermore, the company reported a decline in the rate of weekly bookings per Barratt site for the fiscal year 2023, which stood at 0.55, representing a 32.1% year-on-year decrease.

Barratt's announcement had a ripple effect on its FTSE-100 peers, with Taylor Wimpey and Persimmon experiencing declines of 1.7% and 0.5%% respectively. Despite the recent drop, Barratt Developments had seen a 5.3% increase year-to-date as of the previous close. These developments underscore the impact of the weak market conditions on Barratt Developments and the broader homebuilding sector in the UK. Market participants closely monitor the performance of companies in the housing market as it can reflect the overall health of the economy and consumer sentiment.

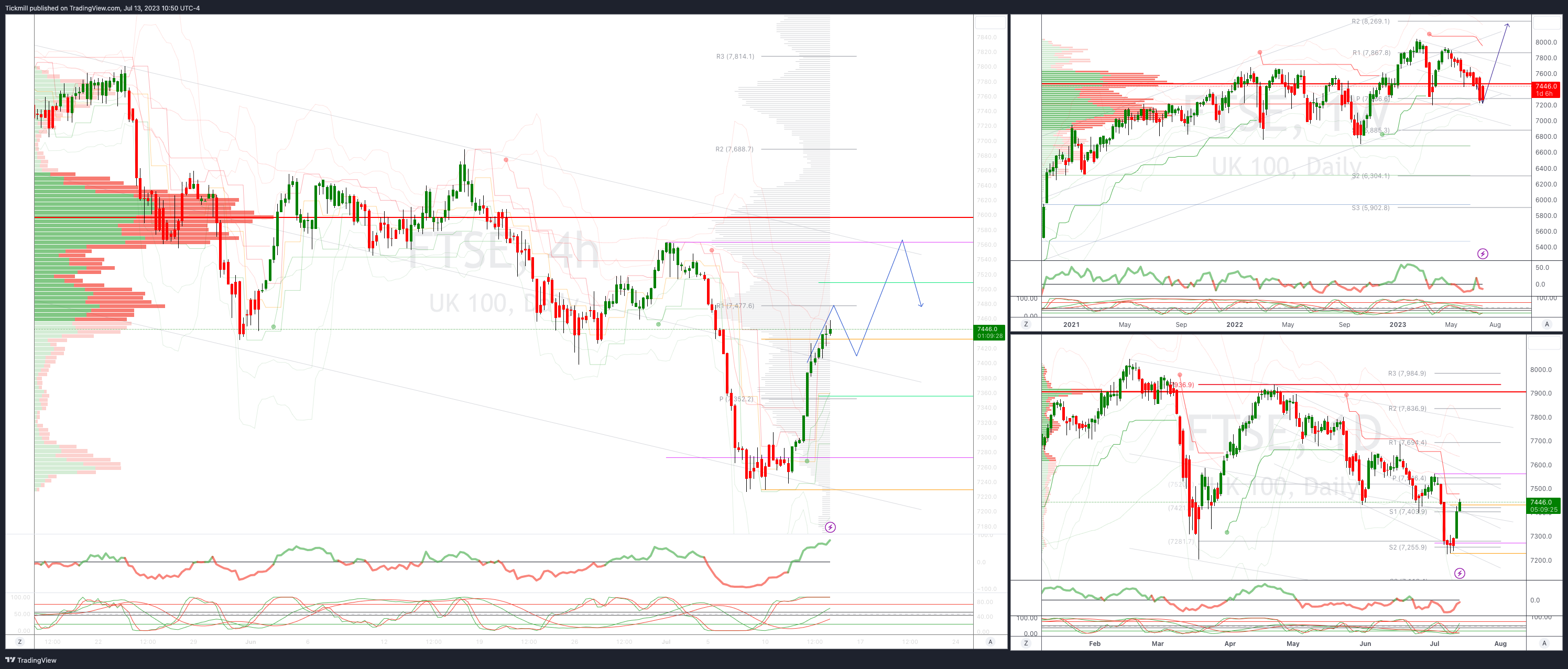

FTSE Intraday Bullish Above Bearish below 7400

Above 7550 opens 7660

Primary resistance is 7600

Primary objective 7193

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!