The FTSE Finish Line: June 17 - 2025

The FTSE Finish Line: June 17 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

British equities opened lower on Tuesday, as escalating hostilities between Iran and Israel dampened market sentiment and prompted investors to shift toward safe-haven assets. However, by the close, the FTSE 100 managed to recover, trading back towards flat on the session. The Israel-Iran conflict entered its fifth day, coinciding with U.S. President Donald Trump’s early departure from the Group of Seven summit in Canada. During the summit, Trump signed a trade agreement with British Prime Minister Keir Starmer, which eliminated tariffs on aerospace products while preserving quotas and tariff rates for British cars. Nonetheless, unresolved issues regarding steel and aluminium imports remain.

Meanwhile, the Oil, Gas, and Coal index climbed 1.5%, driven by rising oil prices amid heightened Middle Eastern tensions. BP and Shell led the gains among blue-chip stocks, each advancing over 1%. Investors’ attention this week will turn to central bank meetings, with both the Bank of England and the U.S. Federal Reserve expected to hold interest rates steady. Market participants will closely monitor any signals of potential rate hikes, especially after the Bank of England’s quarter-point rate cut in May. Additionally, trade-related announcements are set to draw interest as Trump’s early July tariff deadline approaches.

Single Stock Stories & Broker Updates:

Shares of British insurance firm Legal & General have fallen by 1.7% to 252p, making it one of the biggest decliners on the FTSE 100 index, which is down 0.7%. The company anticipates that its core operating earnings per share will increase between 6% and 9% by 2025, consistent with its three-year objectives. It also reaffirms its targets for 2028, aiming to generate between 500 million pounds and 600 million pounds ($678.10 million-$813.72 million) in operating profit. JPM analysts note, "Some may find this disappointing," while the brokerage had expected the profit forecast to exceed 600 million pounds by 2028. The company plans to reveal its strategy for its asset management division later on Tuesday, focusing on becoming a more capital-efficient business. Including current losses, the stock has decreased by 9.8% so far this year.

Shares of British investment holding firm OceanWilsons Holdings rose as much as 6.8% to an all-time high of 1,575 pence. The stock is among the top performers on the FTSE mid-cap index. Hansa Investment Company is potentially looking to acquire OceanWilsons in an all-share deal. According to the terms, OCN shareholders will receive both voting and non-voting shares in Hansa. Peel Hunt analysts comment that "the merger could enhance scale and liquidity, reduce fees, and facilitate an on-market share buyback of 2-4% of share capital annually." The company also plans to return up to 123 million pounds ($166.8 million) to shareholders through a tender offer. With the gains from this session, OCN has increased by approximately 19% year-to-date.

Shares of ASOS rose by 2.6% to 321p. The UK fashion company has appointed Aaron Izzard as its new CFO, replacing the current finance head, Dave Murray. Murray will resign on June 30 to explore other opportunities. Year-to-date, the stock is down approximately 28%, despite today's gains.

Shares of Morgan Sindall rise 14.5% to a record-high of 4,390p, making it the top gainer on the FTSE mid-cap index and set for its best day since October 2024. The company expects FY25 profit before tax to significantly exceed previous expectations, with its Fit Out unit seeing strong trading activity and annual profit expectations raised. The construction segment's FY25 operating margin is expected to be in the 3.0%-3.5% target range, with revenues anticipated to surpass prior estimates. MGNS has risen ~13% YTD, including session gains.

Technical & Trade View

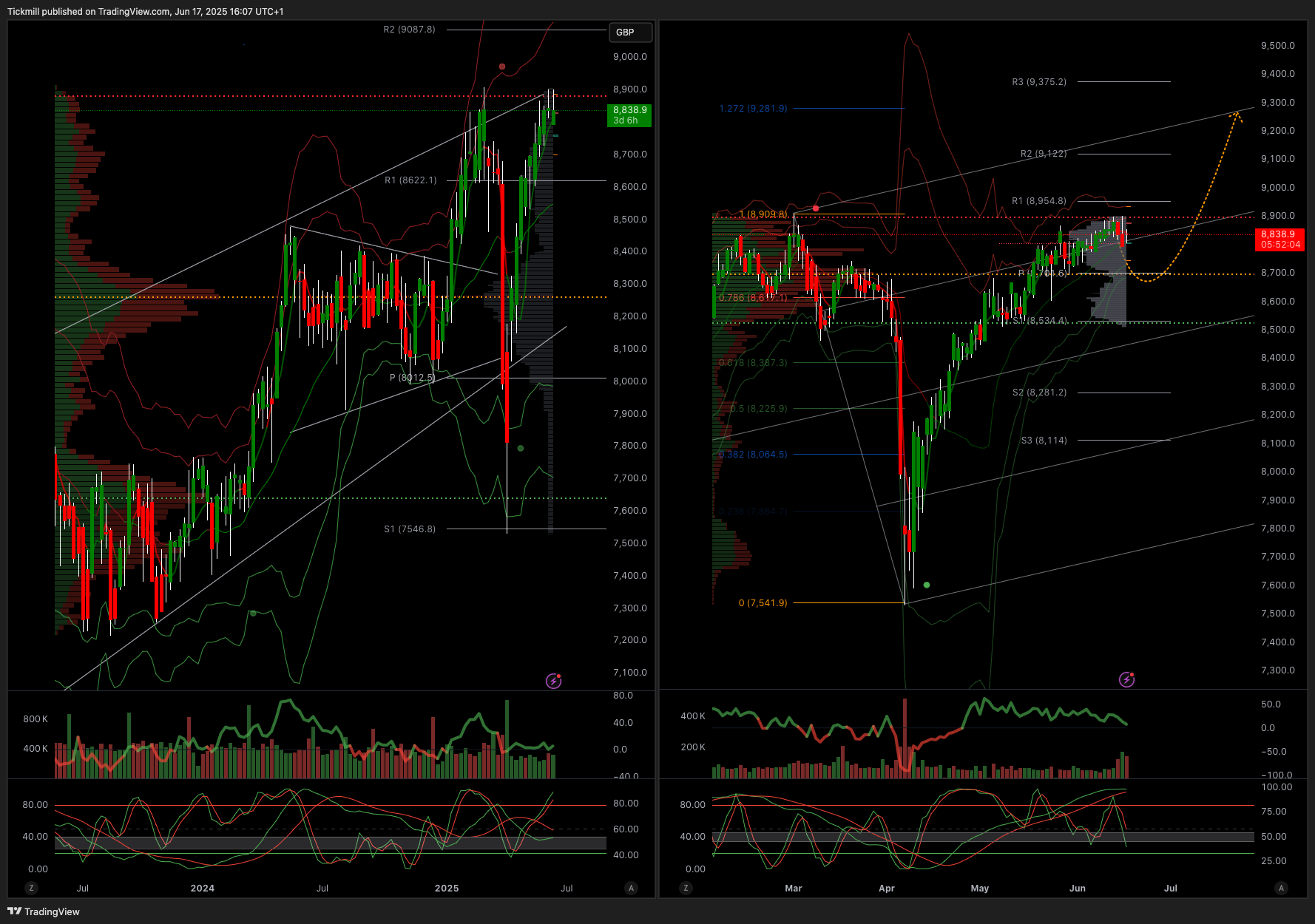

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8500

Below 8500 opens 8250

Primary objective 8900

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!