The FTSE Finish Line - November 11 - 2024

The FTSE Finish Line - November 11 - 2024

FTSE Snaps Four Day Losing Streak, Jobs Data Eyed

U.K. stocks opened the week on a positive note following declines in the previous four trading sessions. The benchmark FTSE 100 index rose 39 points, or 0.49%, after falling 0.8% on Friday. Since Republican Donald Trump was elected president of the United States last week, UK equities have been erratic, causing some to worry that a trade war would impact the expansion of the European economy. In the meantime, China's unsatisfactory stimulus plans have depressed commodity prices, which has a negative impact on mining equities. Market participants are eagerly awaiting U.S. inflation data on Wednesday, as well as UK labour market and September GDP data this week, to gauge how extensively and rapidly the Federal Reserve and the Bank of England will reduce interest rates this year and next.

Single Stock Stories:

Croda's shares rose 4.5%, leading the FTSE 100 index. The company reports Q3 group sales of £407 million, up 5% year-on-year. The results are in line with expectations, benefiting from more stable volume demand in key markets and ongoing cost control actions. The company reiterates its FY24 adjusted pre-tax profit forecast of £260 million to £280 million, with an expected currency translation impact of around £14 million. Croda's stock is down approximately 26% year-to-date.

Natwest's stock price rises up to 1.7%, being among the top percentage gainers on the FTSE 100 index. The lender buys back 1 billion pounds ($1.29 billion) worth of its own shares from the British government as it continues its exit from state ownership following its bailout during the 2008 financial crisis. As a result of the transaction, the government's ownership in NWG will fall from around 14% to around 11%. The stock is currently up 1%, taking its year-to-date gains to approximately 75%.

Kainos Group, an IT software provider, saw its shares rise 5.53% to 839 pence. The company reported a half-year adjusted pre-tax profit of 38.2 million pounds, compared to 37.9 million pounds a year earlier. The CEO, Russell Sloan, stated that the company continues to see substantial growth opportunities across its core markets in the medium and long term. Kainos also appointed Investec Bank to manage a 30 million pound share buyback program. The stock is rated "buy" on average, with a median price target of 1,030 pence, and had fallen around 25% year-to-date prior to the latest close.

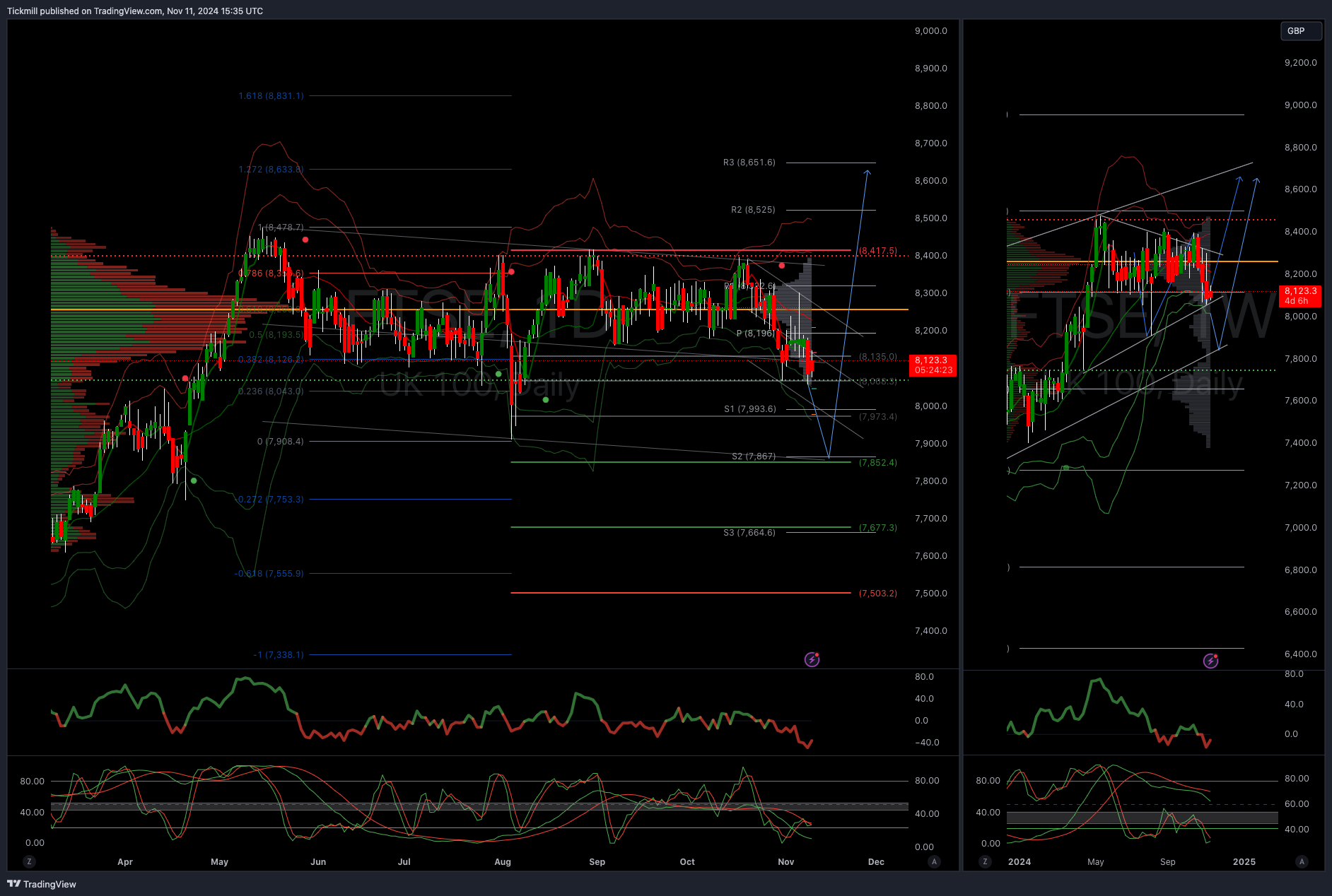

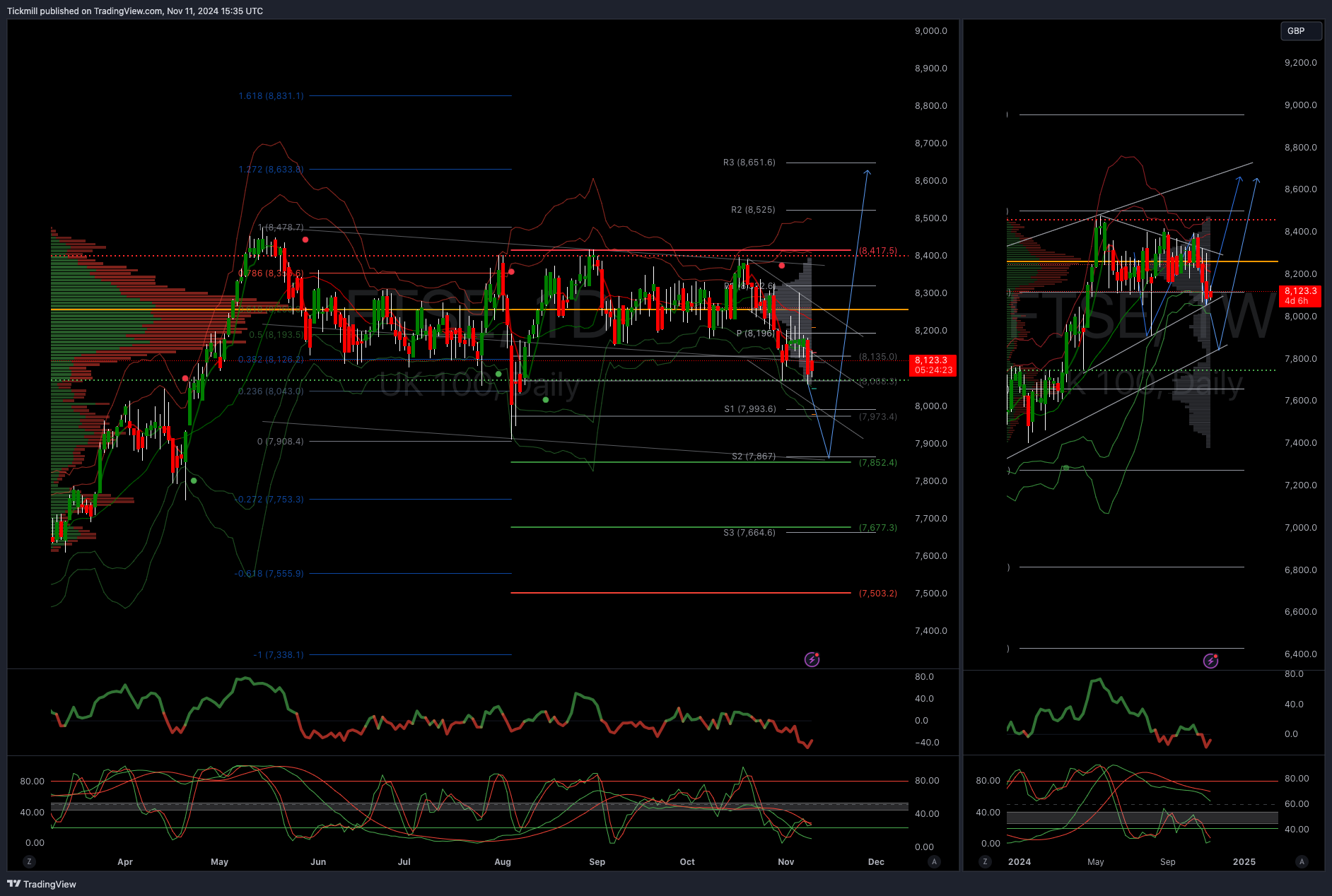

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!